Most honest traders will testify to the fact that losing their hard-won, open bitcoin gains is a painful, humbling experience. It’s even more of an emotional shakedown once they realize that many of those profit ‘give-backs’ were completely unnecessary. The most successful traders know when it’s time to begin taking […]

Author: Don Pendergast

Bitcoin Traders: How to Use the Relative Strength Index (RSI) for Profit

Are you one of the thousands of bitcoin traders looking for the ‘perfect’ technical indicator? Your search will never end, for there are no ‘guaranteed-gains’ indicators…anywhere. However, if you’re willing to spend a little time learning how to use the Relative Strength Index (RSI), you may find yourself in accord […]

Bitcoin Trading: What Is a Trailing Stop and How Does It Work?

Perhaps it’s already happened to you. Your big winning bitcoin or altcoin trade suddenly reversed lower overnight, decimating thousands of dollars in open profits. Profits that could have – and should have -been yours to enjoy. If this describes your bitcoin trading history, it’s high time you learned how to […]

Bitcoin Trading Styles: Swing vs. Trend, Explained

Are you confused regarding what kind of bitcoin system to trade? Why not check out the time-tested bitcoin trading styles of swing trading and trend following. What Is Bitcoin Swing Trading? Here’s Investopedia’s definition of swing trading: Swing trading is a style of trading that attempts to capture gains in a […]

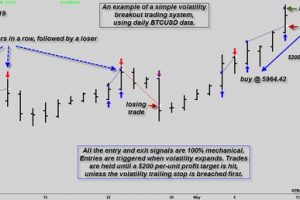

How to Build Your Bitcoin Trading System (+2 Trading Strategies)

Long-time traders are all too familiar with the old saw that says: “Trading systems are a dime a dozen.” Unfortunately, the sad truth is that many trading systems cost hundreds, if not thousands of dollars to lease or buy. However, even with such steep price tags, not one of them […]

Bitcoin Technical Indicators: How Support and Resistance Work

The big question for every bitcoin trader is: “What is the best bitcoin technical indicator?” Well, why not take a look at the simple truths depicted via market support (demand) and resistance (supply) levels? These can be among the most powerful, and predictive, of all the high-tech market tools within […]