With the launch of bitcoin spot ETFs, we’re seeing renewed interest in bringing crypto into the mainstream. One of the ways that ordinary investors can buy into this new asset class is through a cryptocurrency ETF.

Crypto ETFs come in all flavors, from funds that hold only bitcoin, to funds that hold diverse baskets of blockchain- and crypto-related companies.

Investors have compelling reasons to consider adding a crypto ETF to their portfolios. As an indicator of the sector’s potential, bitcoin continues to outperform gold, the S&P 500, the NASDAQ Composite, and many other asset classes over the long term.

Crypto ETFs provide investors with easy exposure to the crypto ecosystem, without having to set up and manage your own crypto wallets.

In this article, our editors have rated and reviewed the top cryptocurrency ETFs as an alternative investment opportunity in 2024.

The List of Crypto Futures ETFs

Several crypto-focused funds can be purchased using online brokerage accounts. Currently, available cryptocurrency ETFs focusing on stocks related to blockchain and cryptocurrency index funds include:

Blackrock iShares Bitcoin Trust (IBIT)

Blackrock iShares Bitcoin Trust (IBIT)

BMJ Score: 3.0

2024 saw the listing of the first spot bitcoin ETFs on U.S. exchanges. Though the Grayscale Bitcoin Trust continues to account for over 90% of the market, BlackRock’s IBIT has been the prominent alternative for investors exiting GBTC.

As of January 21, 2024, the spot bitcoin ETF holds more than $1 billion in bitcoin, making it the second spot bitcoin ETF to achieve this milestone. The rapid inflow in funds could be attributed to IBIT’s low expense ratio and BlackRock’s history as a proven and reliable asset manager.

The fund enables investors to access bitcoin with a traditional brokerage account, removing the operational and security concerns of holding bitcoin directly.

As of December 2023, BlackRock is the world’s largest ETF manager by AUM. The company’s history of innovation has catapulted it to the forefront

- Assets under management: $1.1 billion

- Expense ratio: 0.12%

- Returns (1 year): 1.97%

- Returns since inception (2024): 1.97%

- Investing Strategy: Bitcoin holdings

Fidelity Wise Origin Bitcoin Fund (FBTC)

Fidelity Wise Origin Bitcoin Fund (FBTC)

BMJ Score: 2.0

The Fidelity Wise Origin Bitcoin Fund is an index fund launched in 2024 by Fidelity Digital Assets. The company has over 70 years of experience in the securities market and is looking to expand its market presence in the digital assets sector.

The underlying asset of this fund is bitcoin, which is held in custody by Fidelity Digital Assets. Unlike other funds, FBTC only has one holding: bitcoin. Other ETFs on the market may include other securities such as USD, CAD, or stocks. FBTC also does not invest in any derivatives or other cryptocurrencies. The fund was meant to reflect the performance of bitcoin as measured by the Fidelity Bitcoin Reference Rate.

It’s important to note that until August 1, 2024, the expense ratio of 25 basis points to invest in FBTC will be waived. This was implemented by Fidelity to gain market traction for their ETF.

- Assets under management: $20 million

- Expense ratio: 0.25%

- Returns (1 year): -10.74%

- Returns since inception (2024): -10.74%

- Investing Strategy: Bitcoin holdings

Grayscale Bitcoin Investment Trust (GBTC)

Grayscale Bitcoin Investment Trust (GBTC)

BMJ Score: 4.5

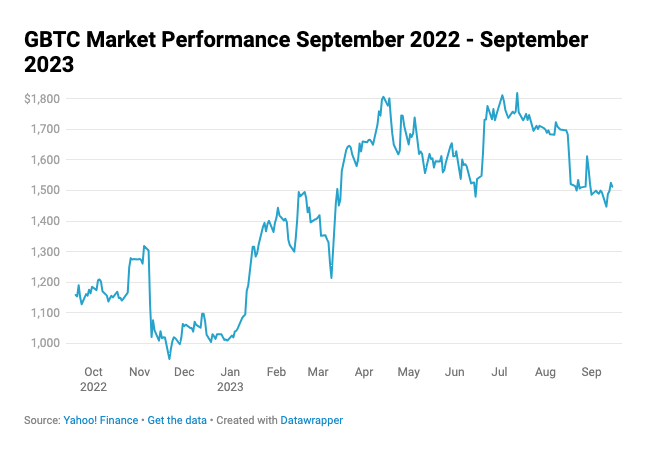

An early mover in the cryptocurrency space, GBTC is an index fund that exposes investors to changes in bitcoin prices without buying the digital currency themselves.

Launched in 2013, GBTC holds bitcoin directly, enabling investors to gain exposure to price movements in the digital currency without opening a digital wallet to store bitcoin. GBTC has an expense ratio of 1.5%, higher than is typically the case with ETFs.

As of 2023, Grayscale remains the crypto investment industry's most traded trust product, boasting 74% of the total trading volumes.

- Assets under management: $24.47 billion

- Expense ratio: 1.5%

- Returns (1 year): 348.30% (NAV as of December 2023)

- Returns since inception (2013): 8799.81%

- Investing Strategy: Bitcoin holdings

Bitwise 10 Crypto Index Fund (BITW)

Bitwise 10 Crypto Index Fund (BITW)

BMJ Score: 3.0

BITW is an index fund that exposes bitcoin and other major cryptocurrencies. The fund attempts to match the return of an index of the ten most highly valued cryptocurrencies.

The selected cryptocurrencies are screened and monitored for specific risks and weighted using market capitalization. As a result, the selected digital currencies rebalance monthly.

During the peak of the crypto bull run, BITW grew over ten times in assets under management. From an initial position of $120 million in assets, it rapidly grew to $1.2 billion by the end of 2021.

As of December 2023, the crypto index fund had assets worth $697 million AUM and is available for public trade.

- Assets under management: $697 million

- Expense ratio: 2.50%

- Returns (1 year): 59.17% (as of December 2023)

- Returns since inception (2017): 251.80%%

- Investing strategy: Major cryptocurrencies

Grayscale Digital Large Cap Fund (GDLC)

Grayscale Digital Large Cap Fund (GDLC)

BMJ Score: 3.5

GDLC, an index fund that debuted in February 2018, offers investors exposure to various digital currencies. The fund offers investors the opportunity to gain exposure to the price movement of a basket of large-cap digital assets in a mutual fund vehicle, saving them the effort of buying and storing the assets themselves.

Initially, the fund’s assets were distributed between the following four major cryptocurrencies on a market-cap-weighted basis: Bitcoin, Ether, Bitcoin Cash, and Litecoin.

As of 2023, Bitcoin Cash and Litecoin are no longer part of the fund components. They were replaced by the following altcoins that gained a significant market cap after 2020 – Solana, Polygon, and Cardano.

However, the lion’s share of the fund allocation is still in bitcoin (67.25%), followed by Ethereum (24.59%). The fund made modest gains in 2023 after a tumultuous 2021-22.

- Assets under management: $224.365 million

- Expense ratio: 2.5%

- Returns (1 year): 380.42% (as of December 2023)

- Returns since Inception (2018): 206.67%

- Investing Strategy: Major cryptocurrencies

Blockchain ETFs

These ETFs do not invest directly in cryptocurrencies per se but rather in blockchain technologies (for more information, see our guide to Best Blockchain ETFs.)

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

BMJ Score: 3.0

LEGR endeavors to track the performance of companies that use, invest in, develop, or have products expected to benefit from blockchain technology. It also invests in companies that stand to realize increased efficiency from the blockchain’s ability to improve the efficiency of various business processes.

While the majority of the holdings are located in the US (41%), the fund also has exposure to securities based in China (10%), India (7.6%), France (7.4%), and Germany (4.8%).

As of 2023, the top holdings of LEGR include NVIDIA Corp, Amazon, Oracle, Intel, Microsoft, AMD, Salesforce, and Accenture. The holdings are spread across finance, IT, industrial, utilities, healthcare, energy, and consumer staples.

- Assets under management: $103 million

- Expense ratio: 0.65%

- Returns (1 year): 19.45% (December 2023)

- Returns since inception (2018): 28.17%

- Investing Strategy: Blockchain-related company equities

Amplify Transformational Data Sharing ETF (BLOK)

Amplify Transformational Data Sharing ETF (BLOK)

BMJ Score: 4.0

The BLOK ETF offers exposure to blockchain and digital sharing companies. The fund invests globally, with at least 80% of its holdings dedicated to the equity securities of companies actively involved in developing and utilizing transformational data-sharing technologies.

The fund holdings are spread across major crypto exchanges, IT firms, payment providers, bitcoin mining firms, and other financial service providers. As of 2023, they include Coinbase Global, Riot Platforms, SBI Group, Paypal, and Accenture.

- Assets under management: $1.16 billion

- Expense ratio: 0.75%

- Returns (1 year): 98.09% (as of December 2023)

- Returns since inception (2018): 81.96%

Investing Strategy: Blockchain-related company equities

Siren NexGen Economy ETF (BLCN)

Siren NexGen Economy ETF (BLCN)

BMJ Score: 2.5

The BLCN ETF, on the other hand, looks to achieve long-term growth by tracking the investment returns of an index linked to the blockchain economy. The linked index is the Siren Nasdaq Nexgen Economy Index.

The index is built to gain returns from companies focused on directing resources to developing, researching, supporting, innovating, or utilizing blockchain technology for their proprietary use.

BLCN results from a partnership between Siren and Nasdaq and involves collaboration in research, analysis, and investigation.

As of 2023, the top 10 holdings of the fund are spread across Coinbase, Microsoft, Mastercard, Paypal, AMD, IBM, and Overstock, to name a few.

- Assets under management: $74.8 million

- Expense ratio: 0.68%

- Returns (1 year): 14.68% (December 2023)

- Returns since inception (2018): -4.63%

- Investing Strategy: Blockchain-related company equities

Bitcoin Futures ETFs

Instead of holding a crypto ETF, you could opt to hold a bitcoin futures ETF, which tracks the future price of bitcoin, through the convenience of an exchange-traded fund.

ProShares Bitcoin Strategy ETF (BITO)

ProShares Bitcoin Strategy ETF (BITO)

BMJ Score: 3.0

BITO launched on Oct 19, 2021, as a game-changer in the crypto ETF segment. It was the first ETF in the US to gain the SEC's approval to trade on a major US exchange. BITO does not directly invest in bitcoin; the fund invests in futures contracts.

Fundamentally, BITO exposes investors to bitcoin without owning the digital asset themselves. The Commodity Futures Trading Commission regulates the future contracts held by BITO.

In its first year of operation, BITO took the market by storm, amassing $ 1.4 billion in assets in mere days and months. However, the ETF has suffered devaluation since then due to the broader market volatility.

- Assets under management: $880.4 million

- Expense ratio: 0.95%

- Returns (1 year): 96.45% (December 2023)

- Returns since inception (2021): -45.81%

- Investing Strategy: Bitcoin futures

Valkyrie Bitcoin Strategy ETF (BTF)

Valkyrie Bitcoin Strategy ETF (BTF)

BMJ Score: 2.0

Valkyrie Bitcoin Strategy ETF launched three days after BITO went public. Like BITO, BTF does not invest directly in bitcoin. Similarly, the Commodity Futures Trading Commission regulates trades.

BTF investors don’t have to file K-1 forms with the IRS as the investments are made through a Cayman Islands subsidiary. Like the BITO, the Valkyrie fund also has an expense ratio of 0.95%.

While BITO instantly hit the ground running, BTF had a reasonably slow start in 2021. And two years later, BTF remains a fairly undersubscribed ETF compared to BITO.

- Assets under management: $34.51 million

- Expense ratio: 0.95%

- Returns (1 year): 102.42% (as of December 2023)

- Returns since inception (2021): -44.44%

- Investing Strategy: Bitcoin futures

Global X Blockchain & Bitcoin Strategy ETF (BITS)

Global X Blockchain & Bitcoin Strategy ETF (BITS)

BMJ Score: 2.5

Global X Blockchain & Bitcoin Strategy ETF was launched on November 16th, 2021, as the ETF’s provider’s second blockchain-related ETF. The first is the Global X Blockchain ETF (BKCH). Similar to the bitcoin ETFs mentioned above, BITS is a fund that invests in bitcoin futures.

However, BITS invests in blockchain-related equities found on Global X Blockchain ETF. As of 2023, the main holdings are BKCH ETF (46.19%), CME Bitcoin FUT BTCU3 (32.12%), and CME Bitcoin FUT BTCV3 (21.51%).

The total AUM of BITS has remained relatively stable despite the turmoil in the markets in 2022. From $10.6 million in 2021, the AUM hasn’t strayed north of $12.15 million as of Q3 2023.

- Assets under management: $15.410 million

- Expense ratio: 0.65%

- Returns (1 year): 175.29% (December 2023)

- Returns since inception (2021): -51.87%

- Investing Strategy: Bitcoin futures, other blockchain ETFs

What Are Cryptocurrency ETFs?

An exchange-traded fund is a security that tracks an index, a commodity, or a basket of assets. Unlike a mutual fund, shares in the ETF are tradable like stock. The best ETFs regularly outperform mutual funds because of their diversity or a focus on reliable assets, making these attractive options in the traditional market.

The idea of digital ETFs (ETFs comprised of digital assets like crypto) has been a focal point for investors who see them as reliable and mature forms of investment in a new market. These ETFs solve several problems blocking cryptocurrency’s mass adoption and seem the next step in expanding this market.

That said, getting overwhelmed as a new crypto investor is relatively easy. Thousands of digital tokens populate the market, not to mention hundreds of DeFi apps, complex trading pairs, and novel processes like staking and yield farming.

Cryptocurrency ETFs can help simplify investments by providing an easily digestible alternative. Investors can gain exposure to the lucrative blockchain ecosystem without directly entering an alien landscape. And since managed assets spread the investments across a broad range of handpicked tokens, the volatility is also somewhat dampened.

The rise of crypto ETFs is also vital for the continued growth and evolution of the broader ecosystems. The global ETF market holds nearly $10 trillion in AUM. Developing new ETFs based on digital assets will allow blockchain projects to tap into the capital available in traditional ETF markets.

What Are Crypto Futures ETFs?

Crypto futures ETFs function like crypto ETFs, only backed by crypto futures contracts rather than physical crypto.

Like conventional futures, bitcoin futures are contracts allowing two parties to agree on buying or selling bitcoin at a predetermined price and date. This means their value fluctuates based on market expectations of bitcoin's future price, not necessarily its current worth.

In contrast, crypto spot ETFs track the actual price of the crypto itself. The idea behind a spot ETF is to allow more investors to get exposure to crypto without having them buy the actual asset, using a simple ETF they can add to their investing portfolio.

What Are Spot Crypto ETFs?

A spot crypto ETF is a fund that directly tracks the price of an asset. So, rather than buying crypto, investors can easily purchase shares in a fund that buys and holds the crypto for them.

Note that the share prices of these ETFs can be all over the map, depending on how they carve up their shares. But the price of the underlying crypto asset (e.g., bitcoin) should be the same between funds.

While spot ETFs are much easier than buying crypto directly, note that you’ll pay fees for that convenience – and the fees can potentially cut into your long-term gains.

How to Invest in Crypto ETFs

Investing in a crypto ETF is similar to regular ETFs. You must start with a brokerage platform, such as E*TRADE or RobinHood.

The next steps are to fund your brokerage account and browse the crypto ETFs on the interface. Pick one that fits your investment objectives and risk preferences, enter the number of shares you want, and buy.

Many crypto ETFs also target multiple assets and securities besides actual cryptocurrencies/crypto futures. For instance, blockchain ETFs target corporations with exposure to blockchain technology.

The potential volatility and risk exposure from such ETFs can vary from funds based on assets or securities on the blockchain. You should only invest what you can afford to lose in crypto ETFs.

As with any volatile asset class, in-depth market research and fundamental analysis is essential before investing in a crypto ETF. Do your homework.

Investor Takeaways

- Crypto ETFs are easier than buying and holding crypto yourself. But you’ll pay for the convenience with additional fees..

- More crypto ETFs may be on the way. Now that spot bitcoin ETFs have been approved, many investors are anticipating spot Ethereum ETFs to follow.

- Like any other tech ETF, risks are higher, but so are potential rewards. But these new frontiers in crypto investing are bringing crypto into the mainstream.

Are you looking to make the best decision regarding cryptocurrency ETFs and investments? Subscribe to Bitcoin Market Journal, where you’ll always get a balanced take on your crypto investing strategy.