If you’re looking to earn interest on your crypto – like earning interest in the bank – you’ll likely want to do it through a crypto lending platform. Here are the best rates as of June 2024:

| BTC | WBTC | ETH | USDT | DAI | USDC | |

| Nexo | 7.00% | – | 8.00% | 16.00% | 14.00% | 14.00% |

| Crypto.com | 5.00% | – | 5.50% | 6.50% | 6.50% | – |

| Coinloan | 6.00% | 6.00% | 7.00% | 9.20% | 9.20% | 9.20% |

| Binance Savings | 0.27% | – | 1.50% | 6.03% | 3.90% | 4.43% |

| Youhodler | 9.00% | – | 9.00% | 18.00% | 18.00% | 18.00% |

| Aave | – | 0.09% | 2.08% | 4.55% | 3.86% | 13.66% |

| Compound | – | – | – | – | – | – |

| Mango | – | – | – | – | – | – |

What is Crypto Lending?

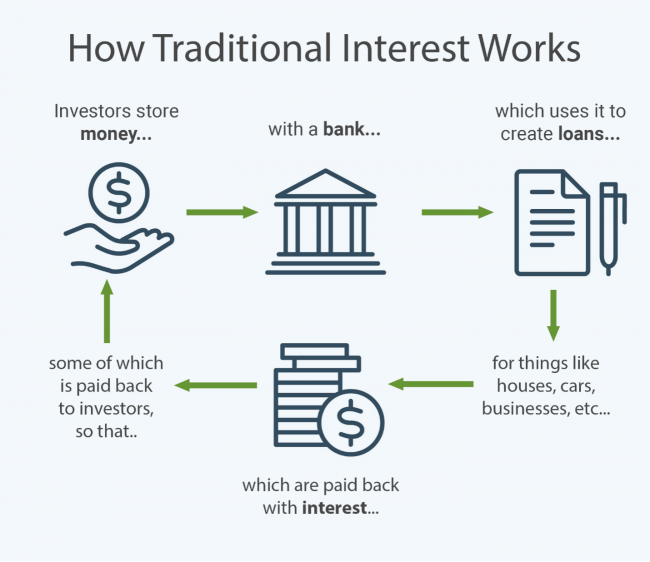

In the traditional banking system, you keep your money in a savings account, and the bank uses your money to make loans. As the loans are paid back (with interest), some of that interest is passed along to you:

Crypto lending platforms work the same way, except you’re storing your crypto in a “lending platform” rather than a “savings account.”

The difference is that banks pay an average of .06% interest, where crypto platforms can pay 6% or more. That’s a 100x improvement over banks.

Finding the crypto lending platform, then, can help your wealth work for you – but in the rapidly changing world of crypto, it’s tricky to trust. That’s why we’ve pulled together the best crypto lending rates for you.

Types of Cryptocurrency Lending Platforms

There are two main types of crypto lending platforms: centralized finance (CeFi) platforms and decentralized finance (DeFi) platforms. Think of CeFi like a traditional bank: there’s a company behind the platform, so while they are not regulated like a bank, they are still responsible for your funds. DeFi platforms are more like the Internet itself: rather than one company being in charge, it’s a distributed network of lenders and borrowers, with blockchain-based smart contracts handling all the money.

CeFi Platforms

If you choose CeFi lending platforms like Coinbase or Binance, you entrust your crypto to a central entity or company. Most CeFi platforms implement KYC (Know Your Customer) and AML (Anti Money Laundering) practices, and thus require clients to share personal information. CeFi platforms operate similarly to online banks or traditional lending services.

Despite the more rigorous rules compared with DeFi platforms, many choose CeFi services due to convenience and generally higher interest rates. CeFi services provide the security that “someone is in charge,” and are also easier to use. Also, some CeFi platforms enable users to borrow fiat against their cryptocurrency, with the fiat money being sent directly to their banking accounts.

DeFi Platforms

DeFi platforms are websites that handle the lending and borrowing automatically, using smart contract-based algorithms. Typically you install a Web3 wallet like MetaMask, then connect it directly into a DeFi website like Uniswap. (Watch our DeFi Hands-On Workshop for step-by-step walkthroughs.)

Lenders and borrowers go to DeFi platforms because they don’t require KYC verification, enabling users to maintain more privacy. However, DeFi users entrust their crypto funds to algorithms, which connect directly to their crypto wallets. There’s no “complaint line” if things go wrong.

Best CeFi Lending Rates

Nexo

Nexo

Nexo is one of the largest crypto lending platforms in the market. Founded in 2017, it boasts over $12 billion in assets under management, and over 3 million users worldwide. If you have never used a crypto lending platform, Nexo may be the best place to start, due to its easy-to-use interface.

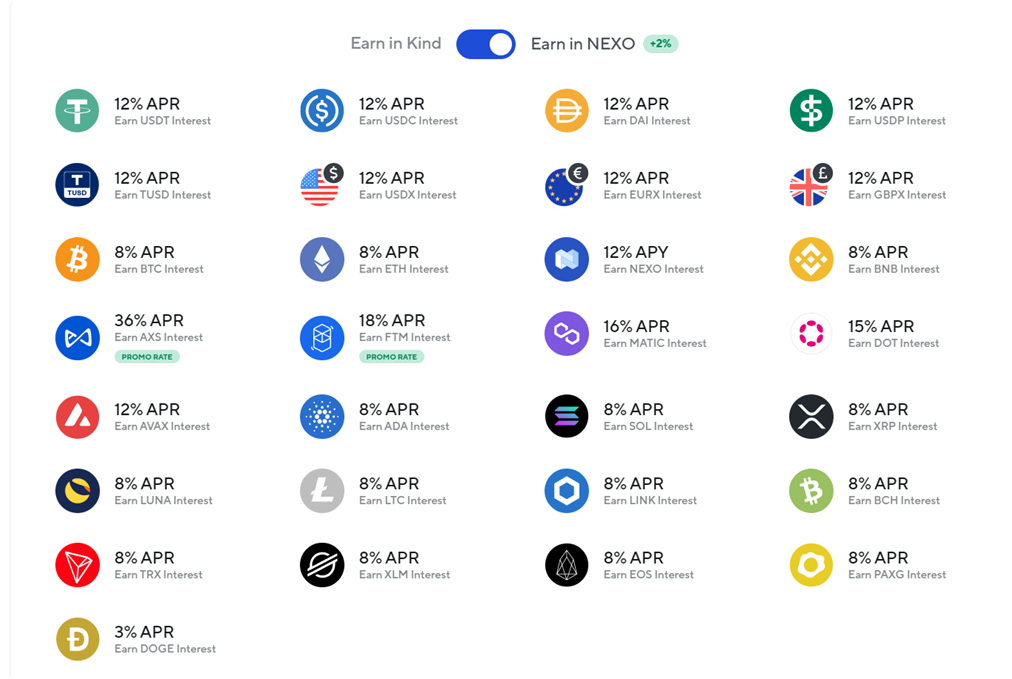

The APY on Nexo can reach up to 18% on various digital assets. Today, the platform supports 29 cryptocurrencies, including BTC, ETH, BNB, ADA, LINK, DAI, DOGE, LTC, USDT, and USDC. The interest rate on stablecoins is sometimes above 10%, far higher than traditional savings accounts.

U.S. customers are no longer accepted.

Users can also earn interest on fiat currencies – like a traditional bank – and borrow fiat against crypto. Nexo supports USD, EUR, GBP, and several other currencies.

Many investors choose Nexo because it offers compound daily payouts, flexible earnings, and $375 million insurance on all custodial assets.

Users who choose to use NEXO – the platform’s native token – have additional privileges, such as better interest rates and more free crypto withdrawals.

Crypto.com

Crypto.com

Crypto.com was founded in 2016 and has become one of the largest cryptocurrency services. It provides exchange, non-fungible tokens (NFTs), payment, and lending services to over 10 million users worldwide. In addition, its assets are backed by $750 million in insurance. The fact that it was picked by Visa to settle transactions on the fintech giant’s payment network tells a lot about Crypto.com’s potential.

The platform’s Crypto Earn product has offered an APY of over 10%. In total, about 40 digital assets are supported, including the native token Crypto.com Coin, which makes users eligible for additional rewards. If you stake more of the Crypto.com coin, you can receive a higher interest rate.

CoinLoan

CoinLoan

CoinLoan is a specialized crypto lending platform launched in 2017. The platform enables users to earn daily interest with their funds never being locked. At the time of writing, CoinLoan supports over 20 assets, including:

Stablecoins like USDC, USDT, TUSD, BUSD;

Cryptocurrencies like bitcoin, Ethereum, Ripple, Stellar, and Monero;

Fiat currencies, including the pound and the euro.

The annual interest rate for popular coins like bitcoin and Ethereum is 7.2%, and it goes as high as 12.3% for stablecoins.

CoinLoan relies on a series of security measures to keep the funds safe, including insured custody, vulnerability scans, 2FA (two-factor authentication), security alerts, and cold crypto storage, among others.

Binance Savings

Binance Savings

Binance Savings is the crypto lending offering from the largest crypto exchange in the world by trading volume.

Binance offers two options for its users: flexible savings and locked savings. The former allows investors to simply deposit their crypto assets and redeem the funds at any time. Locked savings are suitable for those who are ready to deposit their crypto funds for longer periods. The great thing about locked savings is that they come with higher interest rates on most occasions.

It’s worth noting that Binance provides high interest rates on its proprietary stablecoin – BUSD, which is pegged to the US dollar. Depositors should expect an APY of 10% on BUSD with flexible savings. The interest rate on USDC is only 0.5%, as Binance regards Circle’s dollar-pegged stablecoin as a competitor.

Youhodler

Youhodler

Youhodler is a Swiss-based fintech platform focused on crypto lending and exchange services.

Users can earn interest on deposits in BTC, USDC, TUSD, PAX, and more. The interest is paid weekly, and the APY figure has rated from 5% for BTC and ETH, to over 12% for stablecoins. The minimum deposit amount is $100 worth of crypto.

The Crypto Loans service enables users to borrow BTC, stablecoins, or fiat currencies against 50 supported cryptocurrencies. Youhodler offers loans with 90% LTV for 30 days, 70% LTV for 61 days, and 50% LTV for 180 days.

Best DeFi Lending Rates

Aave

Aave

Aave is one of the major players in the world of DeFi. It allows users to borrow and lend money without intermediaries. As mentioned, no KYC or AML verification is required, which is true for all DeFi platforms listed here: just connect your Web3 wallet and go.

Aave enables users to lend and borrow in about 30 cryptocurrencies, including ETH, USDC, DAI, and USDT. The protocol is fueled by the native token called AAVE.

Here are the interest rates for lenders and borrowers:

Compound

Compound

Like Aave, Compound is one of the most popular and influential DeFi lending platforms; it sparked the initial DeFi craze back in 2020. Compound is extremely user-friendly, and easier for new users to navigate. The platform supports over 20 cryptocurrencies for lending and borrowing.

Additionally, Compound allows its users to earn its native token, COMP, which gives holders the right to participate in the governance process (like shareholder voting in a traditional company).

Alchemix

Alchemix

Alchemix is an interesting DeFi lending protocol, as it offers self-paying loans. For example, a borrower deposits DAI to take a loan with up to 50% LTV, which is disbursed in the form of alUSD, Alchemix’s native USD-backed stablecoin. The 50% LTV loan is eventually paid off over time automatically using the net returns from staking the initial DAI principal, which is staked by the protocol into one of the pools operated by Yearn.

Thus, Alchemix is designed for borrowers rather than lenders. In a way, it lets users borrow from themselves, as the loans are paid from the interest generated by the principal.

Mango

Mango

Mango is a decentralized cryptocurrency exchange that includes a DeFi lending service. The latter is used to provide liquidity on the Mango market.

Users can easily borrow multiple cryptocurrencies, including the native MNGO token, and pay low annual interest rates. Lending is also possible; however, the rates offered on most cryptocurrencies aren’t too competitive.

Mango Markets protocol is currently not working (since October 2022), but a v4 upgrade is expected to bring the platform back online in the first half of 2023.

How to Select the Best Crypto Lending Platforms

Selecting the right crypto lending platform is not an easy task, considering the speed with which the industry moves. Nevertheless, there are several factors that can help:

- Longevity: Look for platforms that have been around for at least two years, with a growing user base. If they have reached this level of “critical mass,” even if things go wrong, they’ll generally try to make it right.

- Costs and fees: CeFi platforms may charge fees for withdrawals, accessing loans, and other operations, so check all commissions and fees. Don’t forget Ethereum gas fees, which can eat away your profits. (See our guide on How to Avoid Crypto Fees.)

- Platform risks: CeFi platforms are run by centralized entities, so you should ensure they are trusted and legal to use in your country. In the case of DeFi platforms, make sure they have a solid reputation over at least two years.

- Collateral Amount: Note how much borrowers are required to put into the system as collateral, as this can be used to protect lenders in the case of market crashes. Look for collateralization of at least 100% of what they are borrowing.

- Minimum Deposit: Note how much you need to “buy in” to the platform. Use our Crypto Interest Calculator to figure out what your real interest rate will be, after taxes and fees.

What is Crypto Lending?

Crypto lending is a type of Decentralized Finance that acts as a bridge to allow investors to lend money to borrowers in exchange for interest on the original amount. A crypto lending platform is, therefore, the channel that connects the two parties.

How Does Crypto Lending Work?

Like we have just seen, there are three major players in the crypto lending framework: lenders, borrowers, and a platform that connects the two.

- Lenders – These are investors who want to earn passive income on their digital assets. They lend their digital assets to crypto lending platforms in order to earn interest.

- Borrowers – Borrowers need funds and use their digital assets as collateral to get a loan.

- Platforms – These are third-party platforms that could be either decentralized or centralized. They connect the borrowers to lenders and handle the transactions.

DeFi vs. CeFi Lending: What’s the Difference?

Even though both DeFi and CeFi lending involves exchanging various digital assets, the platforms that facilitate them have different underlying infrastructure that determines whether the platform is centralized or decentralized.

DeFi Lending

In DeFi lending, transactions are not handled by people but rather by smart contract codes. Additionally, DeFi platforms are non-custodial, meaning that only the user can touch or control their own funds.

Moreover, many DeFi platforms do not adhere to KYC (Know Your Customer) or AML (Anti-Money Laundering) regulations, thus helping their users maintain anonymity and privacy.

DeFi Lending Pros

- Peer-to-peer transactions with no third party involved.

- User sovereign as only the user has control over their assets.

DeFi LendingCons

- Since there is no centralized authority, DeFi platforms lack accountability. For instance, losing private keys will result in the loss of digital assets since no intermediary will intervene to aid recovery.

CeFi Lending

CeFi platforms emulate traditional banking infrastructure and regulations, whereby third-party intermediaries keep custody of funds and profit by lending funds to borrowers. They additionally ensure that collateral is securely stored.

CeFi platforms integrate KYC and AML, among other protocols, into their system.

CeFi Lending Pros

- Regulatory protocols like KYC protect the integrity of the system from illegal activities.

- Offer a broader range of financial services like direct support for fiat currencies.

CeFi Lending Cons

- Users have to trust a third party with their funds.

Is crypto lending still safe?

The cryptocurrency market was shaken by the downfall of Celsius, one of the largest centralized crypto lending services. With about $25 billion in assets under management as of October 2021, Celsius filed for bankruptcy following the steep decline of the crypto market during 2022, with bitcoin losing more than half of its value from April to June.

The collapse of Celsius begs the question: is crypto lending still safe?

Well, there are many CeFi platforms that don’t provide insured custody and may even mislead investors, but bigger players are interested in offering the best products with a focus on the security of funds. Companies like Binance or well-established brands like Nexo are interested in maintaining their good reputation, which positively impacts the safety of their crypto lending products. It’s worth mentioning that Celsius made some mistakes by investing their funds without properly diversifying their exposure, which is not the case for other players.

Elsewhere, DeFi crypto lending remains a safe alternative given that users have full control over their funds.

One of the main risks both with CeFi and Defi lending platforms is the extreme volatility of deposited cryptocurrencies, which can greatly affect the value of holdings in dollar terms. However, this is something that crypto lending platforms cannot control and are not responsible for.

Investor Takeaway

Crypto lending platforms might be a good avenue for making your digital assets work for you. That said, CeFi and DeFi lending platforms each have their advantages and drawbacks. Be sure to look for platforms that have been around for several years, with an excellent reputation. And use our calculator to determine how much you’ll really earn.

Want to make your crypto investments work even harder for you? Subscribe to our Bitcoin Market Journal newsletter!