LEGR

The First Trust Indxx Innovative Transaction & Process ETF invests in global companies developing or using blockchain technology.

Read our review

BLOK

The Amplify Transformational Data Sharing ETF invests in companies involved in “transformational data-sharing technologies,” focusing on blockchain technology.

Read our review

KOIN

The Innovation Shares NextGen Protocol ETF tracks the Innovation Labs Blockchain Innovators Index, which uses artificial intelligence to select global companies involved in the development or deployment of blockchain technologies.

Read our review

BLCN

The Reality Shares Nasdaq NexGen Economy ETF invests in global companies that are involved in developing, researching, or deploying blockchain technologies.

Read our reviewBitcoin ETFs vs. Blockchain ETFs: What’s the Difference?

A bitcoin ETF lets you invest in bitcoin, either directly or indirectly, in a fund that can be purchased via a standard brokerage account. (See our Guide to Bitcoin ETFs here.)

In October 2021, the US officially approved its first bitcoin ETF: the Proshares Bitcoin Strategy ETF lets ordinary investors hold bitcoin futures (note: not bitcoin itself) using a standard brokerage account.

A blockchain ETF, by contrast, lets you invest in companies developing blockchain, the underlying technology behind bitcoin and crypto. This makes them more diversified than simply investing in bitcoin.

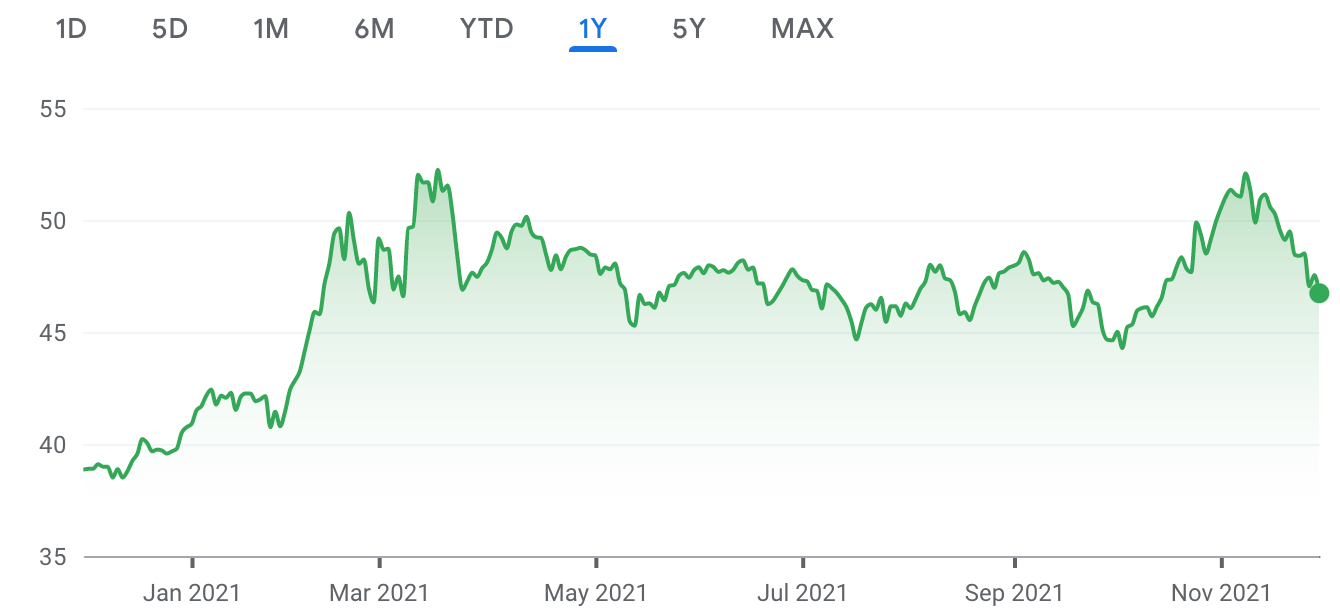

The first blockchain ETF, BLOK, was created in January 2018, and it has greatly outperformed the stock market (see price history here). There are now several blockchain ETFs that you can add to your portfolio of investments.

In this guide, we’ll review the best blockchain ETFs you can invest in today, to gain exposure to this booming industry.

Best Blockchain ETFs, Rated and Reviewed

| ETF | Ticker | AuM ($) | Expense Ratio (%) | Spread (%) | 3-Yr Performance (%) | Score |

| First Trust Indxx Innovative Transaction & Process ETF | LEGR | $137.77M | 0.0065 | 0.0032 | 0.18 | 4 |

| Amplify Transformational Data Sharing ETF | BLOK | $1.57B | 0.0071 | 0.0013 | 0.5217 | 4 |

| Innovation Shares NextGen Protocol ETF | KOIN | $30.98M | 0.0095 | 0.0037 | 0.2493 | 4 |

| Reality Shares Nasdaq NexGen Economy ETF | BLCN | $289.08M | 0.0068 | 0.0036 | 0.3073 | 3.5 |

| Global X Blockchain ETF | BKCH | $121.10M | 0.0050 | 0.0025 | N/A | 3.5 |

| Global X Blockchain and Bitcoin Strategy ETF | BITS | $9.84 | 0.0065 | 0.0051 | N/A | 3.5 |

| Volt Crypto Industry Revolution and Tech ETF | BTCR | $7.82M | 0.0085 | 0.0071 | N/A | 3.5 |

LEGR

The First Trust Indxx Innovative Transaction & Process ETF invests in global companies developing or using blockchain technology.

The actively-managed fund uses a research-heavy approach to selecting the blockchain stocks included in the ETF. The fund’s largest holdings are Xilinx, Intel, Swisscom, Oracle, and PayPal. (Our Score: 4.0)

We rate LEGR highly due to its variety of holdings and terrific one-year performance.

BLOK

The Amplify Transformational Data Sharing ETF invests in companies involved in “transformational data-sharing technologies,” focusing on blockchain technology.

The actively-managed fund invests in stocks of global companies that are developing or deploying blockchain technologies with a focus on enterprises in the US and Asia. The fund’s largest holdings include Square, GMO Internet, SBI Holdings, Overstock, and Digital Garage. (Our Score: 4.0)

BLOK gets a high score from us because of its strong portfolio and diversified holdings.

KOIN

The Innovation Shares NextGen Protocol ETF tracks the Innovation Labs Blockchain Innovators Index, which uses artificial intelligence to select global companies involved in the development or deployment of blockchain technologies.

The tracker fund is predominantly invested in US stocks. Its largest holdings include Intel, Amazon, Taiwan Semiconductor Manufacturing, Visa, and MasterCard. (Our Score: 4.0)

We rate this ETF highly due to its solid three-year performance, one-year return rates, and low expenses and fees.

BLCN

The Reality Shares Nasdaq NexGen Economy ETF invests in global companies that are involved in developing, researching, or deploying blockchain technologies.

The passively-managed fund invests in blockchain stocks primarily located in the US and Asia. The fund’s largest holdings include Red Hat, Intel, Xilinx, Alibaba, and ZTE. (Our Score: 3.5)

While BLCN offers a strong range of holdings, it receives a slightly lower score because it’s fairly new to the market.

BKCH

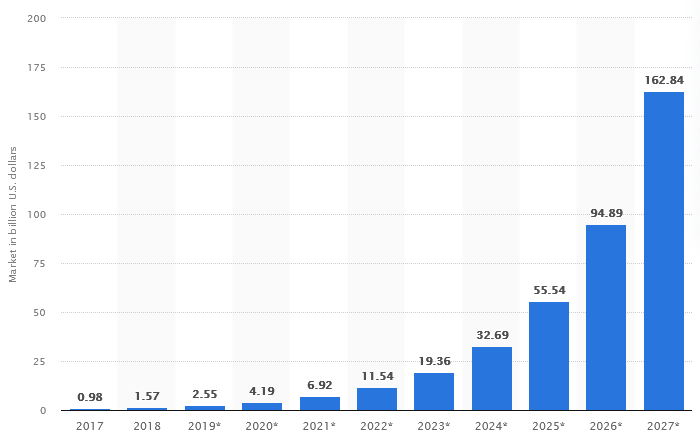

The Global X Blockchain ETF invests in a range of companies positioned to benefit from blockchain technology adoption, including blockchain application companies, digital asset mining companies, digital asset hardware companies, and more.

BKCH is one of the few ETFs that focus on the global blockchain industry. The fund’s largest holdings include Riot Blockchain, Coinbase, and Marathon Digital. (Our Score: 3.5)

BKCH offers some impressive holdings, but receives a middle-range score because it’s still a very new ETF.

BITS

Launched in November 2021, the Global X Blockchain and Bitcoin Strategy ETF will be among the first ETFs designed to offer long-term investors access to both bitcoin futures.

Global X is a member of Mirae Asset Financial Group. A worldwide leader in financial services, Mirae Asset, offers an extensive global ETF platform ranging across the US, Canada, Europe, Brazil, Colombia, Hong Kong, Japan, Korea, India, and Vietnam. (Our Score: 3.5)

BIT receives a solid score due to the extent of its platform. It’s very new on the market, so it still has a long way to go to prove itself as a viable ETF.

BTCR

Volt Crypto Industry Revolution and Tech ETF focuses on investing in companies that have exposure to Bitcoin and the infrastructure surrounding it. BTCR uses a stock-to-flow model to calculate concentrations in its bitcoin-related investments.

BTCR is an actively managed fund that utilizes a call options overlay that intends to boost the performance of extreme run-ups of companies with high Bitcoin correlation. (Our Score: 3.5)

We gave BTCR a score of 3.5 due to the in-depth research process that goes into choosing holdings. BTCR is a young ETF, so its performance over the next year will be telling.

How do Blockchain ETFs Work?

An exchange-traded fund (ETF) is an investment fund that tracks the value of an underlying asset, such as a stock index or a commodity. However, unlike mutual funds, ETFs trade like stocks on securities exchanges, and are accessible to anyone from institutional investors to retail investors.

Blockchain ETFs are exchange-traded funds that invest in public companies that have exposure to the blockchain industry. Blockchain ETFs allow investors to pool their money into a basket of stocks, much like a mutual fund. The ETFs then track the performance of an underlying index, which acts as a benchmark.

Some people will use the terms blockchain ETFs and bitcoin ETFs interchangeably. However, they’re not the same thing. Bitcoin ETFs mimic the price of bitcoin (even though they may not hold bitcoin directly). This allows investors to buy into the cryptocurrency world without going through the complicated process of buying and holding bitcoin. Blockchain ETFs offer a similar advantage, but with traditional company stocks.

Currently, blockchain ETFs are less volatile than bitcoin ETFs, because they’re not completely tied to the roller-coaster price swings of bitcoin. Typical companies in this space have multiple business lines: NVIDIA, for example, manufactures the graphics cards used in crypto mining, but the graphics cards are also used in everyday PCs. Because these companies are more diversified, they’re less susceptible to the day-to-day price swings of bitcoin.

Conclusion

Some believe blockchain technology is the future of finance. Blockchain ETFs are an easy way to help you invest in this future, without the hassle of buying bitcoin or crypto. If you want to hold bitcoin or crypto more directly, you can also check out our list of bitcoin ETFs.

Further Reading:

- Bitcoin ETFs: What They Are and How to Invest

- Best Dividend-Paying Altcoins and Cryptocurrencies

- Top 5 Best Blockchain Mutual Fund Alternatives

Stay on top of all the latest crypto investments: subscribe to Bitcoin Market Journal today!