Bitcoin options are a way for traders to bet on the price of bitcoin using leverage, or to hedge their digital asset portfolio.

In this guide, you’ll discover what bitcoin options are, why they are popular for traders, and how you can get started with Bitcoin options trading in the United States.

What Are Bitcoin Options?

An option is a financial derivative that provides the holder with the right, not the obligation, to buy/sell an asset at a specific price on a pre-defined date in the future.

Options are common in currency and commodity markets, but they can be purchased on other financial assets such as stocks, bonds, indices, and recently, bitcoin.

Bitcoin options allow you to place a leveraged bet on the price or volatility of bitcoin. Moreover, they allow you to hedge your digital asset portfolio.

Note: Bitcoin options are not for beginners. Unless you have prior experience with financial derivatives trading, the steep learning curve that you will face while learning the in’s and out’s of bitcoin options trading, including the potential losses involved, may not be worth it for newcomers.

How to Trade Bitcoin Options

For traders in the United States, there are platforms such as LedgerX, Quedex,

TD Ameritrade, and CME Group where you can sign up and deposit funds to begin trading with relative ease. Once signed up, browse through your chosen platform to find a BTC Options trading dashboard.

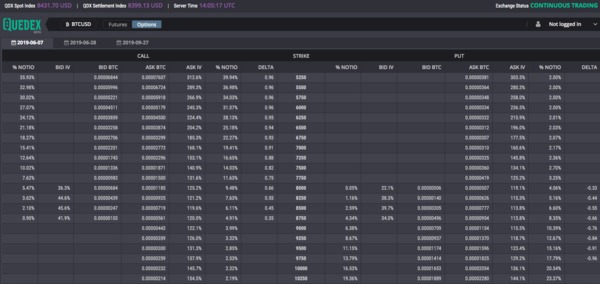

Below is a view from the Quedex dashboard. Here you can see all available BTC options, their bid and ask prices, strike prices, implied volatility, volumes, delta, and maturities:

Once you’ve decided on options that suit your speculative/hedging strategy, you can purchase the call or put options for their denominated amounts. When trading bitcoin options, it’s imperative that you watch the price of the option, the strike price, and its maturity to ensure you’re buying the right bitcoin option for your strategy.

For experienced traders, bitcoin options can be an excellent tool for betting on the price of BTC using leverage. An options trader may only need to spend a few hundred dollars on a bitcoin call option with a 3-month maturity to see returns of over 100%. But bear in mind, this can all be lost in moments, so it’s not for the faint of heart.

Note: Unless you are comfortable with terms like calls, puts, delta, and implied volatility, it is better to gain a thorough understanding of financial options before investing in this type of bitcoin derivative.

Why Trade Bitcoin Options?

There are two reasons to trade bitcoin options: speculation and hedging.

To speculate on the price of bitcoin hitting $10,000 in the next three months, you could purchase bitcoin (BTC) and hold it for that time period, or you can purchase bitcoin options.

In doing so, for a small fee you bet on bitcoin with a strike price of $10,000 and 3 months maturity; if bitcoin exceeds that price, you’ll be “in-the-money”, so to speak.

There is a small premium to pay for bitcoin options, and by leveraging several other options, you could generate higher returns. Note, that if the options expire “out-of-the-money”, e.g. below the strike price, you’ll lose the entire invested amount.

Alternatively, you can use bitcoin options to hedge your digital asset portfolio. This is how a lot of professional investors use bitcoin options.

To hedge using bitcoin options, an individual can, for example, purchase a bitcoin put option with a strike price of $5,000 (approximately 25% lower than the current BTC price) with a six-month maturity. If the price of BTC then collapses by over 25%, dragging down your diversified portfolio by more than 25%, that individual would be partially hedged from further loss. This is because they would be “in-the-money” to compensate for the drop in portfolio value.

Deciding the hedge ratio is up to you, and that will determine how much of your portfolio will be hedged in the event of a market downturn.

Bitcoin options are relatively new, but they have matured quite swiftly and have become incredibly popular over time. It’s no secret that options can provide a trader with the ability to limit losses and create unique payoff profiles.

Considering how volatile BTC can be, it’s no wonder that options have become a very attractive space in the digital asset world.

Related Articles:

- Bitcoin Investing 101: What is Bitcoin? How Does it Work? How Can You Invest in It?

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

- DeFi Investing 101: What Is It? Where Do You Start? What Are the Risks?

If you want to learn more about bitcoin and blockchain investment opportunities, subscribe to the Bitcoin Market Journal newsletter and join the bitcoin revolution today!