Table of Contents:

- What is Bitcoin Mining

- What Is the Outlook of the Crypto Mining Industry

- What Are the Challenges of Mining Bitcoin?

- Top Bitcoin and Crypto Mining Stocks

- Is it Worth Investing in Bitcoin Mining Companies?

- Who’s Investing in Bitcoin Mining?

- What Determines Bitcoin Mining Profits

- Investor Takeaway

A foundational part of the bitcoin architecture is participation through mining. This process of sharing processing power to verify transactions provides this decentralized network with a way to function without a central authority. But, because mining calls for a high threshold of processing power, it has turned into the domain of large mining organizations who can leverage resources to remain competitive in a crowded field.

An investment into bitcoin mining companies has two benefits: you are both indirectly investing in bitcoin, as well as supporting the technology that allows it to grow.

In this article, we’ll cover some of the top bitcoin mining companies for investors, including graphics card manufacturer Nvidia (NVDA), tech company Riot Blockchain (RIOT), and hardware innovator Canaan (CAN).

What Is Bitcoin Mining?

“Bitcoin mining” refers to supporting the bitcoin network using powerful computers called “mining rigs.”

By supporting the network and validating transactions, bitcoin miners are awarded freshly minted bitcoin. This is a block reward, with new blocks created every ten minutes. The newly minted BTC is split amongst each miner, creating a new block.

Over time, however, the processing requirements for mining become higher and higher, and the field becomes a competitive space where the best gear wins.

Miners are competing with each other to confirm more transactions and be the ones to earn the coveted block reward; it’s become a hardware “arms race” of sorts, and there are gigantic mining operations that use the latest hardware to improve their mining efficiency with high-end graphics cards.

Unsurprisingly, bitcoin mining companies have become the norm and, in many cases, have become profitable investment opportunities in their own right.

What Is the Outlook of the Crypto Mining Industry

The top publicly traded crypto mining companies today are:

- Argo Blockchain (ARBK)

- Bit Digital (BTBT)

- Bitfarms (BITF)

- Canaan (CAN)

- Hive Blockchain Technologies (HIVE)

- Hut 8 Mining (HUT)

- Marathon Digital Holdings (MARA)

- Riot Blockchain (RIOT)

Some semiconductor blue chip stocks, such as AMD and NVIDIA, are also indirectly related to the mining sector, although they don’t directly engage in such activities.

These are all public stocks that you can buy with a traditional brokerage account – no crypto needed. Note, however, that these stocks are affected not only by crypto trends but by the broader equities market as well.

As of this writing, the S&P 500 has gained about 15% over the past year. While BTBT has doubled in price during the same period, other stocks, including BITF, HIVE, ARBK, HUT, and MARA, have remained closer to the broader index.

If we extend the timeframe to three years, many of these stocks have shown way more generous returns compared to the stock market. For example, MARA is up almost 300% during that period.

Since Ethereum switched to Proof of Stake, mining has taken a hit with the loss of the second-biggest mining blockchain. Its survival as a practice rests on how well the price of bitcoin can recover.

What Are the Challenges of Mining Bitcoin?

The performance of crypto mining stocks follows the price of bitcoin, which is the most critical factor driving mining profitability. Therefore, when the price of bitcoin falls, it becomes difficult for mining companies to secure revenue and income growth.

Another factor that puts additional pressure on mining profitability is the increase in electricity prices worldwide, driven by geopolitical tensions and inflation trends that hit energy markets. The Federal Reserve Economic Data (FRED) Global Price of Energy Index fell over 80% from Aug 2022 to September 2023, but it has surged over 260% since Apr 2020.

In the US, the Energy Information Administration (EIA) expects wholesale electricity prices to keep close to 2023 levels.

Top Bitcoin and Crypto Mining Stocks

Let’s look at some of the most promising crypto mining stocks you could invest in today.

Riot Blockchain (NASDAQ: RIOT)

Riot Blockchain (NASDAQ: RIOT)

Colorado-based Riot Blockchain “focuses on building, supporting and operating blockchain technologies” and digital currency mining. The company had previously invested in several blockchain startups, such as Canadian bitcoin exchange Coinsquare, but it currently focuses on running its crypto mining operations.

Nasdaq-listed Riot Blockchain can be purchased on most online trading platforms; see the current performance here.

Canaan (NASDAQ: CAN)

Canaan (NASDAQ: CAN)

China-based mining firm Canaan is a major bitcoin mining hardware manufacturer working to create the best mining rigs on the market. This has seen them become suppliers to other mining companies such as Hive Blockchain Technologies.

Canaan is also listed on the Nasdaq, so it can be purchased on most online trading platforms; see the current performance here.

AMD Micro Devices (NASDAQ: AMD)

AMD Micro Devices (NASDAQ: AMD)

Advanced Micro Devices Inc. is a California-based company that develops computer processors and primarily focuses its GPU products in the gaming community. However, some of its GPUs can also be used to improve the efficiency of bitcoin mining rigs, and this has been beneficial for the company as the bitcoin mining boom has massively boosted its sales.

The firm has flourished in the bitcoin mining scene and now produces specialized hardware solutions for digital currency miners.

Like the other stocks mentioned, AMD is listed on the Nasdaq exchange and is available at most online brokerages. Check current performance here.

AMD Micro Devices (NASDAQ: AMD)

AMD Micro Devices (NASDAQ: AMD)

Advanced Micro Devices Inc. is a California-based company that develops computer processors and primarily focuses its GPU products in the gaming community. However, some of its GPUs can also be used to improve the efficiency of bitcoin mining rigs, and this has been beneficial for the company as the bitcoin mining boom has massively boosted its sales.

The firm has flourished in the bitcoin mining scene and now produces specialized hardware solutions for digital currency miners.

Like the other stocks mentioned, AMD is listed on the Nasdaq exchange and is available at most online brokerages. Check current performance here.

Hive Blockchain Technologies (NASDAQ: HIVE)

Hive Blockchain Technologies (NASDAQ: HIVE)

Canadian digital currency mining firm Hive Blockchain Technologies was launched in 2017 as a partnership between Foire Group and leading cloud mining services provider Genesis Mining. The Vancouver-based company runs mining operations in Iceland, Norway, and Sweden and went public in September 2017 on the Toronto Stock Exchange. On July 1, 2021, Hive shares began trading on the Nasdaq exchange.

Available on most online brokerages, you can check the Nasdaq-traded HIVE’s most recent performance here.

Hut 8 Mining (NASDAQ: HUT)

Hut 8 Mining (NASDAQ: HUT)

Hut 8 Mining is another Nasdaq-listed stock that provides equity investors with exposure to the digital currency mining sector. Toronto-based Hut 8 was launched in partnership with Bitfury Group and focuses its business operations on mining and blockchain infrastructure. The company went public in March 2018 and runs its mining farms in Canada.

Hut 8 Mining is listed on Nasdaq: check its recent performance and financials here.

Bit Mining (NYSE: BTCM)

Bit Mining (NYSE: BTCM)

Founded in 2001, Bit Mining owns the blockchain data site BTC.com, as well as mining bitcoin.

In 2022, the China-based company closed the acquisition of Bee Computing, which specializes in manufacturing crypto-mining machinery. It also owns the top blockchain browser BTC.com, and the mining pool business operated under BTC.com.

Bit Mining owns data centers in Ohio, the US, and Hong Kong. In 2023, the company left Kazakhstan due to an unstable electricity supply.

Bit Mining trades on the NYSE. It’s available through most online brokerage platforms; check current performance here.

Bit Digital (NASDAQ: BTBT)

Bit Digital (NASDAQ: BTBT)

Headquartered in New York, Bit Digital has several mining operations in North America. The company focuses on sustainability, with most miners running on carbon-free power.

Bit Digital trades on the Nasdaq, so it’s readily available to most investors. Check financials here.

Nvidia (NASDAQ: NVDA)

Nvidia (NASDAQ: NVDA)

Founded in 1993, Nvidia is considered the leading company in the world for computer graphics cards. Although Nvidia is best known for its GPU gaming processors, the business has a range of GPU cards designed for mining specific cryptocurrencies.

While its cryptocurrency cards add significantly to Nvidia’s profits, its gaming processors remain a vital part of its business, along with data centers and AI chips.

Nvidia trades on the Nasdaq, so it’s an easy buy for most investors. Check its latest financial performance here.

Bitfarms Ltd (NASDAQ: BITF)

Bitfarms Ltd (NASDAQ: BITF)

Emiliano Grodzki founded Bitfarms Ltd, and the company raised $155 million in equity in 2021. It operates 11 bitcoin mining data centers in 4 countries, including Canada, the US, Argentina, and Paraguay. Bitfarms’ treasury now holds just 700 BTC, down from over 4,000 BTC in 2021.

Bitfarms Ltd trades on the Nasdaq; you can see its latest financials here.

Marathon Digital Holdings (NASDAQ: MARA)

Marathon Digital Holdings (NASDAQ: MARA)

Marathon Digital Holdings is a leading provider of bitcoin mining hardware with ambitions to become the United States’ top mining operation. It recently purchased Bitmain’s Antminer S19 XP and is partnering with companies like Compute North and Beowulf Energy. The business was incorporated in 2010 before going public in 2011.

Marathon Digital Holdings trades on the Nasdaq, so it’s also available through most brokerage apps. Click here to see the company’s latest performance.

Is it Worth Investing in Bitcoin Mining Companies?

Crypto mining firms have been in a difficult situation during the latest “crypto winter,” with some going bankrupt. In June 2023, Core Scientific, listed on NASDAQ, filed for bankruptcy in Texas. Previously, Computer North, which operated one of the largest mining data centers in the US, filed for bankruptcy with $500 million in debt.

Additionally, it’s difficult for individual investors to engage in bitcoin mining due to a surge in difficulty levels and high hardware costs. Now, the best way to get exposure to the crypto-mining market is to invest in public companies operating crypto-mining businesses.

Since most crypto mining companies mimic the short-term fluctuations of bitcoin, stock investors can get exposed to the crypto industry with mining stocks. They are traded on the NASDAQ and the NYSE, which makes it easy to include them in any portfolio.

The potential of bitcoin continues to attract many investors, but the risks are also high. If the US chooses to impose tight regulations on bitcoin trading, then the bearish pressure is likely to extend.

However, if bitcoin manages to leverage its safe-haven asset status amid high inflation, the crypto market may recover quite rapidly in 2024, driving the share prices of crypto mining firms higher.

Who’s Investing in Bitcoin Mining?

Institutional investors fueled the crypto mining industry in 2021 when bitcoin rallied to its record high. In the case of Riot and Marathon, over 35% of shares are held by institutions, with common names like Vanguard Group, Blackrock, and State Street Corporation leading the charge.

Still, many institutions showed skepticism even when the crypto mining market was gaining momentum in 2021, and some of them may be closing their positions. As D.A. Davidson analyst Christopher Brendler said back then, “We admit traditional valuation metrics may not apply in this sector as future cash flows are exceedingly difficult to predict.”

Despite the bearish pressure, many institutional investors think this is a great time to enter the crypto mining industry, with many of the stocks in the group being oversold for months.

This might be a generous discount ahead of yet another multi-month crypto rally that is potentially forming right now. Bitcoin is already increasing its pace of recovery. In October 2023, it surged over 25%, experiencing the best month in 2023 and extending the year-to-date gain to over 100%.

Many crypto investors believe that the uptrend will continue to gain traction in the long term despite the potential corrections.

To begin with, bitcoin will experience another halving event in the first half of 2024, and halving has always been a bullish signal.

Additionally, the US Securities and Exchange Commission (SEC) has finally approved 11 spot bitcoin exchange-traded fund (ETF) applications. Financial giants like BlackRock and Fidelity have now launched their spot bitcoin ETFs, which may support the continuation of the rally.

What Determines Bitcoin Mining Profits?

A series of factors determine Bitcoin mining profitability, but the most important one is the price of bitcoin itself. The higher the BTC price, the better for the mining industry.

The cost of BTC mining differs from country to country, ranging from about $1,400 in Kuwait to a whopping $240,000 in Venezuela, with the average potential cost across all countries at about $35,000 per mined coin as of August 2022.

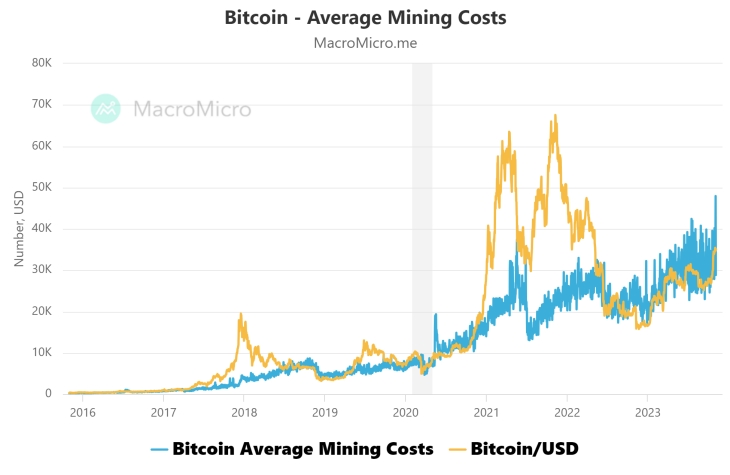

The average mining cost for active mining companies exceeds the $28,000 figure, as per MacroMicro data, which means when bitcoin sinks lower than that, it puts additional pressure on miners.

Besides the BTC price, there are other factors determining mining profitability:

Hashrate

The bitcoin network’s hashrate refers to the total computing power used by all miners. It reflects how secure the network is, showing a direct correlation with the number of nodes competing as well as the computing power of hardware devices used to mine.

Bitcoin’s hash rate is accelerating, driven by increased computing power.

As of this writing, bitcoin’s total hashrate is over 460 terahashes per second (TH/s), up almost 75% year-on-year. In August 2023, the network exceeded the 400 TH/s figure for the first time on record.

This suggests that miners are employing even more computing power, likely thanks to bitcoin’s price nearly doubling in 2023..

The mining companies with higher hashrate figures can generate more bitcoin, directly impacting their profitability. Thus, the more influential the mining machines they use, such as Application-Specific Integrated Circuit (ASIC) devices, the better.

Difficulty

Another factor for bitcoin profitability is the so-called mining difficulty. This is a relative measure that relies on the difficulty level at the launch of the network as the baseline reference. At the time, bitcoin naturally had the lowest mining difficulty, shown by the indicator as 1.

The measure has gradually increased over the years, driven by increased interest from miners, who have employed more sophisticated and powerful hardware devices to compete for the block reward. As of November 2023, bitcoin’s mining difficulty is at an all-time high of 62.46 trillion.

Bitcoin’s mining difficulty is also accelerating, making it harder to compete.

The indicator doesn’t show short-term fluctuations. Instead, the network was programmed by Satoshi to adjust its difficulty level every 2,016 blocks, which occurs about every two weeks.

Every increase in the mining difficulty negatively affects the balance sheet of mining companies.

Electricity

Mining companies try to build their sites in regions with low electricity costs, employing renewable energy technologies, or reaching agreements with governments and municipalities for discounts. Lower electricity costs have a direct positive impact on profitability.

As per Digiconomist, every bitcoin transaction on average requires 1204.11 kWh, which equals the power consumed by a typical US household for over 41 days.

The annual consumption of the bitcoin network is 136 TWh as of this writing, equivalent to the power consumption of entire countries, such as Sweden, Argentina, and Ukraine.

While this is a huge bill for bitcoin miners to bear, it’s still 40% lower than in February-April 2022.

Bitcoin energy Consumption is on the rise. (source: Digiconomist)

Bitcoin Mining Hardware Costs

Hardware costs should also be considered when mining bitcoin, although they’re usually one-time amortized costs for mining companies.

The best-performing mining machines are the latest generation of ASICs, which are designed specifically for mining cryptocurrency. Today, some of the most powerful ASICs are the Antminer S19 Pro (110 Th/s), WhatsMiner M30S++ (112 TH/s), and Antminer KA3 (166 Th/s). Prices for these mining rigs can vary widely, starting at several hundred dollars for low-end machines and rising to several thousand dollars for high-end machines.

Miners looking to participate on a budget can also check out our list of the Best Used Crypto Mining Rigs.

While it is difficult to make short-term predictions about the mining hardware market, given supply chain shortages and fluctuating crypto prices, the long-term analyst outlook is generally positive.

Investor Takeaway

Getting exposure to the crypto mining sector today is risky. Despite the prolonged crypto winter, however, the companies listed in this article have healthier balance sheets that have helped them during these difficult months. Now, they’re ready to benefit from the next rally.

There are positives to investing in this sector now, as most crypto mining stocks may follow the bullish crypto market. Bitcoin has already consolidated above $40,000, and if it manages to go higher, we expect crypto miners to thrive.

If you are a traditional investor with no crypto exposure, investing in the crypto mining sector might be an excellent diversification approach. Now could be a great time to “buy the bottom.”

As always, do your research and don’t invest more than you want to lose. Our strategy is to put no more than 10% of your overall portfolio into crypto and crypto-related assets; read more here.

Subscribe to our free crypto investing newsletter for hot crypto tips (find out before the market does).