Key Takeaways:

- Crypto staking is a way for investors to earn additional income on your crypto: like earning interest in a savings account or money market fund.

- Staking has seen substantial growth, with over $700 billion staked by investors as of this writing.

- Like choosing a bank or brokerage firm for traditional investments, selecting a reliable and trusted crypto staking platform is vital.

- Staking rewards (and risks) vary significantly across different platforms and crypto assets.

We love staking, because it’s an easy way to make your crypto investments work for you. Like earning interest in a traditional savings account, staking your crypto with trustworthy services can earn you additional crypto while you sleep. Maybe that’s why staking has seen substantial growth, with over $700 billion committed by investors as of this writing.

If you are interested in staking, your first decision is to choose a reliable platform. To help you with that decision, we’ve researched our favorite crypto staking platforms, then rating them on fees, usability, security, and trust.

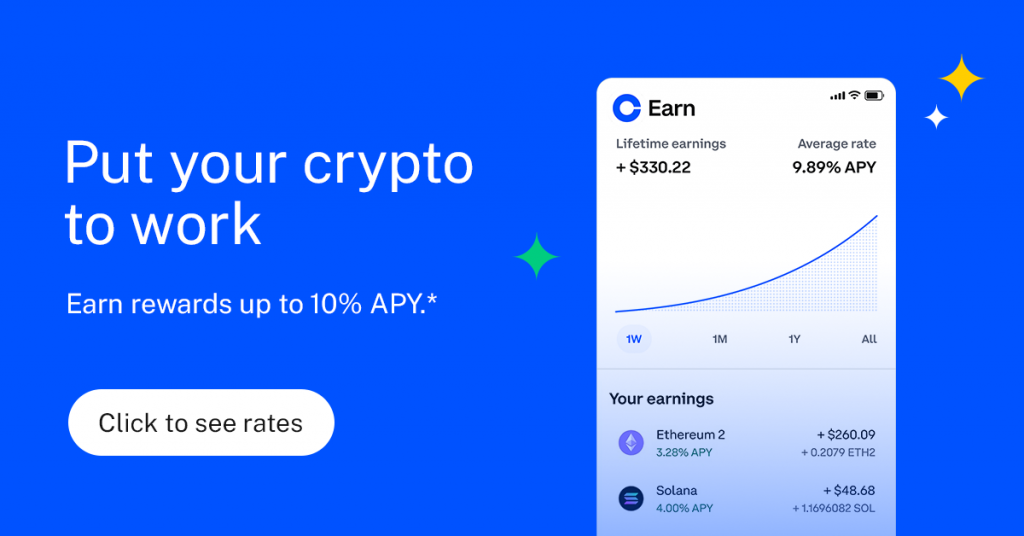

Earn on Coinbase

Earn on Coinbase

With over 110 million verified users worldwide, Coinbase is one of the most popular cryptocurrency exchanges in the world. It is also the first US-based cryptocurrency exchange to receive the approval of federal and state regulators.

Apart from being a market where you can buy and trade over 250 cryptocurrencies, Coinbase also offers users the ability to earn rewards on their tokens through staking.

The staking service is called Earn on Coinbase (not to be confused with Coinbase Learn). To use Earn for staking, you must have a fully verified Coinbase account and reside in a jurisdiction where staking is legal.

As of this writing, Coinbase Earn supports staking on seven cryptocurrencies: ETH, ADA, DOT, POL, SOL, XTZ, and ATOM. The staking rewards range from 2.00% to 10% APY, and the staking fees range from 26.3% to 35%, depending on the token and your account status.

Evaluating Earn on Coinbase

- Ease of Use: A significant reason for Coinbase's enduring popularity is its simplicity and ease of use. The platform's interface is beginner-friendly, making it one of our top picks for staking.

- Trust: Coinbase’s greatest strength, particularly in highly regulated crypto markets like the US, is its strict compliance with regulations, including anti-money laundering (AML) and Know Your Customer (KYC). It is also one of the few crypto companies to be publicly listed on a major stock exchange (Nasdaq).

- Security: The platform is secured using advanced encryption technology. Only a few reported hacking attempts have occurred. You can also access additional security features on your account, like two-factor authentication (2FA).

Kucoin Staking

Kucoin Staking

Based in Seychelles, Kucoin is a relatively popular online cryptocurrency exchange and staking platform in over 200 nations. However, due to a lack of licensing and other compliance issues, KuCoin staking is not available in the US.

If you are based outside the US and want access to over 40 staking tokens, KuCoin might be worth a look. The promised rewards range from 1.5% to 15% or more on exotic, high-risk tokens.

Kucoin supports all the primary staking tokens and lesser-known ones like SUI, HYDRA, APE, and TIA. To attract users from international markets, KuCoin offers its spot trading and staking services at lower fees than the competition.

Evaluating Kucoin Staking

- Ease of Use: If you are an experienced cryptocurrency trader, KuCoin is reasonably easy to use. However, the platform is not very beginner-friendly or intuitive due to a lack of guides, tips, and documentation.

- Trust: Seychelles, KuCoin’s main base of operations, is a tax haven with lax regulations that favor financial crimes like money laundering. The exchange is also not regulated by any reputed authority in North America, the EU, or Australia.

- Security: Kucoin uses industry-standard security features, including regular audits, cold wallets, and multi-signature wallets. Despite all these measures, the exchange has been the target of several major hacks over the years, including one in 2020, where $280 million was lost.

Gemini Staking

Gemini Staking

Gemini is a well-known US-based cryptocurrency exchange launched by the Winklevoss twins in 2014. The platform is available in over 60 countries, including the United States. The staking service is simply called Gemini Staking.

Although Gemini supports around 100 major cryptocurrencies, you can only stake on the platform in SOL, ETH, and MATIC tokens. Staking is available in all US states except New York.

Due to the limited token availability, staking reward prospects are relatively low, ranging from 2.74% to 5.74% APY. The fees, on the other hand, are reasonable at 15%. Gemini also has an advanced staking option on ETH called Staking Pro for institutional clients.

Evaluating Gemini Staking

- Ease of Use: Although it does not have the same level of educational content as Coinbase, Gemini is relatively easy to use. The interface is linear and intuitive, both on the website and the app. However, numerous consumer complaints about needing more adequate support have been made since 2020.

- Trust: In 2022, Gemini was accused of failing to conduct due diligence on a third-party partner (Genesis Global), resulting in losses to its customers using the Earn program. In February 2024, Gemini was ordered to pay customers more than $1.1 billion.

- Security: Most user funds on the platform are stored in cold wallets. The platform uses all security measures, including 2FA authentication and advanced algorithms. Although the exchange has not suffered any major fund hacks, a significant data leak in 2022 resulted in the theft of the personal information of 5.7 million Gemini users.

Binance Staking

Binance is the world’s largest cryptocurrency exchange in terms of international users and trade volumes. Initially based in Shanghai, the company moved its operations to Tokyo and, then, Malta. As of 2024, its holding company is based in the Cayman Islands.

Staking on Binance.com, the global platform, is available in multiple forms, including DeFi staking (high risk), ETH 2.0, and locked staking. The platform supports staking in various forms on at least 100+ tokens.

While US customers are prohibited from using Binance.com, a companion website, Binance.US, offers staking services on a limited number of tokens—18 in total.

Staking rewards on these tokens can reach 16.6%. However, Binance charges a maximum fee of 35% on staking rewards and is barred from trading using US Dollars.

Evaluating Binance Staking

- Ease of Use: The Binance platform is generally user-friendly. However, beginners may find the interface somewhat overwhelming due to the diversity of trading options and other advanced services. It also does not have a built-in wallet or support for USD deposits.

- Trust: Regulators in the US and other countries have accused Binance and its founder of numerous financial irregularities. In 2023, the company agreed to pay $4.3 billion to settle money laundering charges. The SEC has also filed multiple lawsuits against both the international and US versions of the platform. Many of these cases are still ongoing.

- Security: As the world’s largest crypto exchange, Binance has been targeted by hackers numerous times. In 2022, over half a billion was stolen from a blockchain linked to the exchange by hackers. However, the platform protects your funds with cold wallets, encryption, and 2FA authentication

Investor Takeaway

Overall, staking is a great way to earn “interest” on your crypto investments. Our investing approach involves holding quality crypto investments for the long term, so staking is a low-risk strategy of maximizing your returns.

Trust, legality, security, platform fees, and staking options are critical factors when choosing a staking platform. Always conduct additional research on a platform before committing your funds.

In terms of striking a balance between token availability, ease of use, compliance, and reliability, it’s our opinion that Coinbase is the best staking platform for both newcomers and seasoned users.

While many platforms promise double-digit staking rewards, it is essential to note that these are usually on lesser-known, high-risk tokens. With more established PoS tokens like ETH, ADA, and SOL, you can expect more modest returns. (Click here for our best staking rates.)