Are you confused regarding what kind of bitcoin system to trade? Why not check out the time-tested bitcoin trading styles of swing trading and trend following.

What Is Bitcoin Swing Trading?

Here’s Investopedia’s definition of swing trading:

Swing trading is a style of trading that attempts to capture gains in a stock (or any financial instrument) over a period of a few days to several weeks. Swing traders primarily use technical analysis to look for trading opportunities. These traders may utilize fundamental analysis in addition to analyzing price trends and patterns.

As a Bitcoin swing trader, you seek to profit from the numerous short-term (two weeks or less) trade opportunities that can present themselves within a larger-scale trend move, one which may take weeks or even months to play out.

Swing trading may be ideal for bitcoin fans who like lots of trading opportunities. It may also be a good fit for you if you possess above-average chart-reading skills, as that might help you fine-tune trade entries and exits for more gains or smaller losses.

The Fast and the Slow

If you are the personality type who likes to see frequent and fast resolutions to the situations you deal with in life, then, by all means, give swing trading a whirl. Trend following will likely bore you to death, and might even tempt you to take profits too fast, long before a big trend has time to run to completion.

Take a glance at this daily bitcoin chart, one that depicts a recent valid long swing trading op:

Figure 1.) BTCUSD, daily

Bitcoin swing trading systems produce more trading opportunities than trend following systems. However, profit factors and average profit per trade stats are typically less than those produced by trend systems.

Short entry trigger:

A double stochastic oscillator rises above 85, turns down and a 3-period Gann Hi/Lo activator triggers a short setup bar. Bitcoin must also be trading below its downsloping 100-period exponential moving average for this to be a valid trade setup. The actual trade entry occurs one tick below the setup bar low.

Short exit trigger:

A reversal and close back above the 3-period Gann Hi/Lo activator.

Long entry trigger:

A 5-period double stochastic oscillator drops below 15, turns up and a 3-period Gann Hi/Lo activator triggers a long setup bar. Bitcoin must also be trading above its upsloping 100-period exponential moving average for this to be a valid trade setup. The actual entry occurs one tick above the setup bar high.

Long exit trigger:

A reversal and close back below the 3-period Gann Hi/Lo activator.

Using a hypothetical $25,000 allocation per trade, this bitcoin swing trading model produced the following system stats:

- Number of trades: 17

- Profit Factor: 2.89

- Average win/average loss: 3.25

- Winning percentage: 47.06 percent

- Short trades: 14

- Long trades: 3

- Profits: $18,564

- Average trade: $1,092

- (commissions and slippage not factored)

A Healthy Trading System

The above bitcoin swing system stats are considered very good by any measure. In fact, the only real downer here is the poor winning percentage. However, once bitcoin can manage a sustained bullish trend, the win percentage may climb closer to 55 or even 60 percent. Time will tell.

This is a very basic system, one that could use some optimization to improve its performance. Your job now is to take these raw inputs and massage them into a system that works well for your own trading temperament.

What Is Bitcoin Trend Following?

Here’s Investopedia’s definition of trend trading:

“Trend trading is a trading style that attempts to capture gains through the analysis of an asset’s momentum in a particular direction. When the price is moving in one overall direction, such as up or down, that is called a trend.”

When you’re a bitcoin trend trader (or trend follower), you’ll typically seek to ride an emerging trend, staying onboard for as long as it takes for it to finally exhaust. You’ll ignore the random (and the not-so-random) fluctuations against the trend, seeking truly big winning trades.

Trend followers have fewer trade ops available compared to swing traders, but the price moves can often be breathtaking. Trend following could be a great match for you if you are patient, possess only modest chart-reading acumen, and have very little time to monitor the altcoin markets during the day.

At times, the bitcoin market becomes highly volatile. Swing traders might be needlessly stopped out for a loss, whereas your bitcoin trend following system may just keep plodding along, oblivious to such temporary market gyrations.

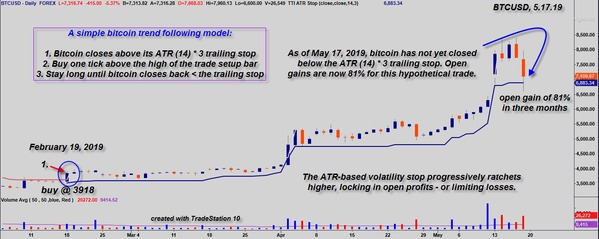

Since February 2018, there have been only six completed BTCUSD trend following setups. The most recent hypothetical trade (long on February 19, 2019) is still open and is up by 81 percent currently.

Entry trigger:

A daily close beyond an ATR(14) * 3 volatility trailing stop, followed by a one-tick move beyond the trade setup bar.

Exit trigger:

A daily violation and subsequent close beyond the same ATR(14) * 3 volatility trailing stop.

Long trade filter:

Bitcoin must be trading above its upsloping 100-period exponential moving average (ema) for a valid long entry.

Short trade filter:

Bitcoin must be trading below its downsloping 100-period exponential moving average (ema) for a valid short entry.

Using a hypothetical $25,000 allocation per trade, this bitcoin trend following model produced the following system stats:

- Number of trades: 6

- Profit Factor: 3.45

- Average win/average loss: 3.46

- Winning percentage: 57.14 percent

- Short trades: 4

- Long trades: 2

- Profits: $9,406

- Average trade: $1,568

- (commissions and slippage not factored)

Is this a good bitcoin trend following system? Yes, at least over the past 15 months, anyway! Remember, the current trade is still open and is up by 81 percent (as of May 17, 2019) and is not included in the above stats.

If you like the idea of only a few trades per year, minimal time in front of a computer screen, and a high likelihood of catching every large trend move (and some smaller losses, too), then this simple volatility stop trend following system might be right up your alley.

Experiment with this trending model by adjusting its volatility stop input parameters, adding profit-taking exits, testing it on a variety of altcoins, or even running it on intraday, weekly, and monthly time frame charts.

Figure 2.) BTCUSD, daily:

This basic bitcoin trend following system produced superior trading stats compared to the swing system previously examined. However, both sets of hypothetical stats are very impressive. Time will tell if they continue to perform consistently well.

Potential Pathways to Bitcoin Profits

Bitcoin swing trading and bitcoin trend trading are two of the best pathways available for you to participate in a systematic, disciplined method of extracting profits from the bitcoin market via wise use of statistics, careful evaluation of your trading personality, and wise allocation of your risk capital.

For additional valuable information about bitcoin and altcoin investing, be sure to subscribe to the Bitcoin Market Journal newsletter today!

Disclaimer: Author holds no position in bitcoin currently. All trading systems were constructed with the tools included standard in TradeStation 10, along with a double stochastic oscillator available at Bressert.com. All system results are hypothetical and are not specific trading/investing advice for any specific person or entity.