Decentralized Finance (DeFi) is a digital world full of decentralized applications (DApps) that bring new and exciting innovations to the world. As of January 2021, DeFi protocols manage over $25 billion worth of digital assets, and a continued increase is to be expected.

One of the most popular types of DeFi products would be ‘yield farming’ platforms, where users can purchase a digital asset, stake it (much like a savings account), and accrue rewards for their participation.

C.R.E.A.M Finance

In a nod to the famous Wu-Tang Clan song “C.R.E.A.M” (Cash Rules Everything Around Me), this DeFi protocol has opted for “Crypto Rules Everything Around Me” as its slogan.

Their aim? To develop a rounded and reliable financial system and doing away with the red tape often associated with banks.

CREAM Finance is a decentralized swap borrowing and lending protocol and automated market maker, where users can leverage their own crypto as collateral in order to borrow, or supply them to the platform as liquidity for lending or token swapping, activities that can yield interest and rewards for users.

Furthermore, the platform also serves as an exchange (swapping) platform akin to the likes of Uniswap, as well as a payment and asset tokenization platform.

How Does CREAM Work?

CREAM Finance believes in financial inclusivity, meaning that no matter where you are, there should be universal access to modern financial instruments, banking infrastructure, and so on. The platform accommodates this belief, offering a fully permissionless environment, where there are no identity or credit checks.

Instead, all a user needs is a smartphone or computer, and some understanding of how to send and store digital assets. CREAM Finance has two DApps with which you can seamlessly connect and transfer tokens to and from the CREAM platform.

The platform’s governance token is of course called CREAM, and only 9 million of them will ever be in circulation. On CREAM, users can borrow, lend, and supply digital assets to liquidity pools, all of which can earn them interest/rewards in one for another.

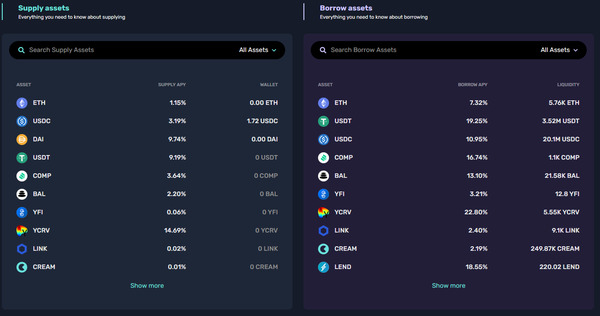

CREAM Finance supports the borrowing and lending of many digital assets including ether (ETH), DeFi tokens such as yearn finance (YFI), 1ich (1INCH), and uniswap (UNI); stablecoins like Tether (USDT), USD coin (USDC), and binance USD (BUSD); as well as nuanced tokens like wrapped bitcoin (WBTC).

How to Supply Tokens and Earn

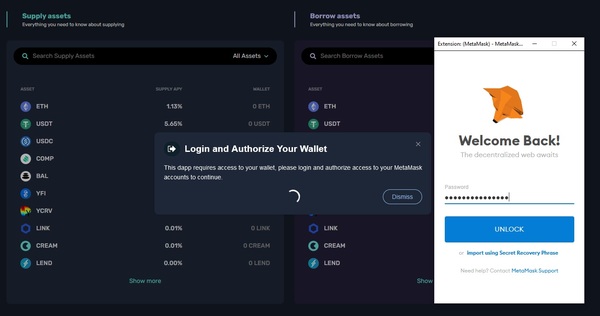

On CREAM, you’re able to connect either MetaMask or WalleConnect, these can be installed as mobile apps/web browser plugins. In short, these DApps can connect to multiple platforms, wallets, and protocols, which make for a satisfying user experience. In this example, we’ll be using MetaMask.

1) Once you’re on the CREAM platform, click connect and select MetaMask.

(You’ll then be prompted to then “Unlock”, which will connect your wallet to CREAM.)

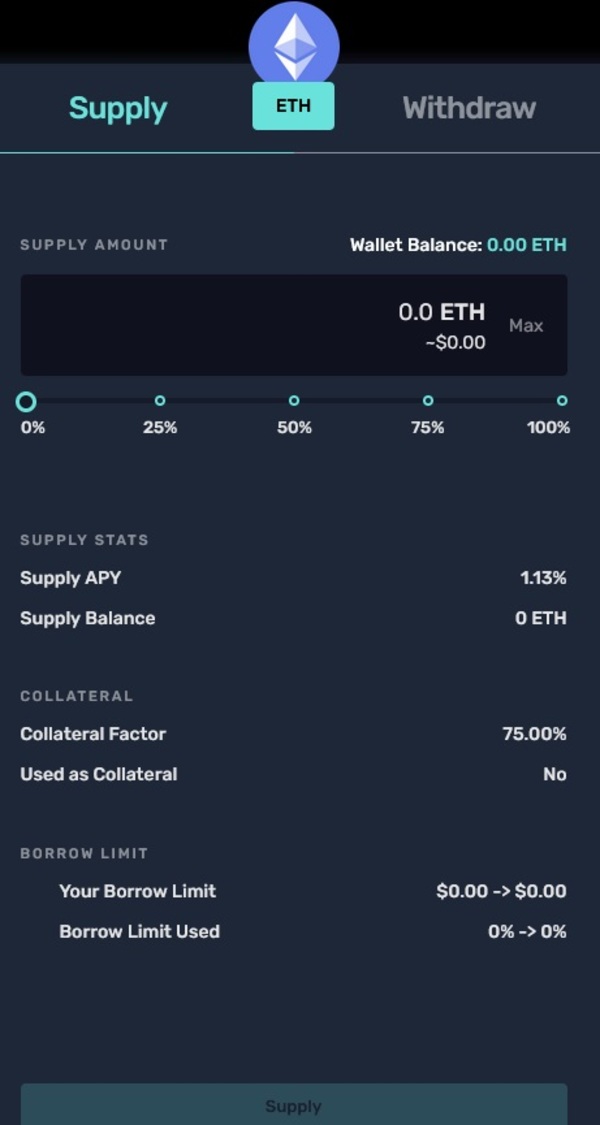

2) Once connected, select a digital asset you wish to supply from the “Supply assets” box. In this instance, we have selected ETH.

Here you’ll have the option to choose how much ETH you’d like to supply. The only metric here worth viewing is the Supply APY, which will determine the interest rate for your yield farming.

From there, just hit “Supply” and MetaMask will prompt you to confirm the action, and voila!

You’ve just learned how to earn interest through CREAM Finance.

Supply and Demand

If a user supplies an asset to the platform, they are actively providing liquidity for the platform’s token swap and borrowing functionalities. Simply select which crypto you wish to supply and you’ll receive a ‘crToken’ of it as proof of your supplied asset on CREAM lending.

For example, if we were to supply ETH, we would receive ‘crETH’ as this representation of the user’s interest-earning assets that will be lent.

Interest rates (APY) are based on supply and demand, and as you can see from the above screenshot, rates can vary by quite some degree.

A particularly interesting facet of the supply and lending protocol is that users can immediately take their crToken and place them into the creamY pools without leaving CREAM, meaning that interest can be earned for lending assets, as well as gains from trading fees for being a liquidity provider to the pool.

Scooping the Cream

DeFi platforms are in hyperdrive as blockchain and digital asset technologies continue to proliferate at an extraordinary pace. CREAM, much like Uniswap or Compound, is attempting to bridge the gap between legacy finance and digital finance, and seemingly the team behind it is working to release updates and upgrades on an almost weekly basis.

CREAM serves an important function within the DeFi ecosystem, and with the integration of the Binance Smart Chain, it won’t be long before more CREAM furthers its applications.

Further Reading

- What is Uniswap & How Can You Make Money With It?

- What is Curve Finance & How Can You Make Money With It?

- What is dYdX & How Can You Make Money With It?

Discover all there is to know about DeFi, crypto, and blockchain technologies, and subscribe to Bitcoin Market Journal today!