You’ve found an investment that looks right, and you’re about to pull the trigger. But how do you know you’re getting the best APR? Yearn Finance aims to solve this challenge.

In this guide, you will learn about Yearn Finance and how you can earn an investment income on this new DeFi protocol.

What Is Yearn Finance?

Yearn Finance offers DeFi investors a way to automatically search for the best APRs. It scours liquidity pools, looking for the best returns so traders don’t have to spend time continuously switching between different protocols to evaluate APRs one-by-one.

Yearn Finance first officially entered the DeFi arena on July 17, 2020. The idea came from its founder, Andre Cronje, when he was in the process of handling money for some of his friends and family members. To maximize returns, Cronje started shopping through Aave, Compound, dYdX, and Fulcrum, looking for the best APRs on stablecoin deposits.

When he found a better APR, he would move the token from one platform to another, and while that would help nab a better rate, it took time. It was also expensive because the transactions required Ethereum gas fees. So he decided to code his own solution. He wrote code that would check the different APRs of the available platforms and figure out which ones were the best. Next, he coded other iterations for yTokens, which were able to analyze APRs and choose the place that had the best returns.

At first, Cronje kept it to himself, but soon he opened it up for others. As each user interacted with the system, the smart contract would check the rates to figure out whether it was still giving users the best ones. Cronje would then send more funds to the place with the best returns.

How yTokens Work

yTokens function like a pool. Anytime a user makes a deposit or a withdrawal into the pool, the smart contract looks at the APR. According to Cronje, everything happens on-chain. yTokens hunt for the best APRs and then automatically moves the funds to that place.

Take, for example, a pool of NEO. Whenever a user deposits more NEO, the system checks all the available APRs for NEO. This means it looks into the APRs on multiple platforms in an instant to try to find the user the best deal. If the best APR is on Curve, for instance, the system automatically moves the NEO to Curve. All the user has to do is kick back and enjoy their earnings on Curve—comfortable knowing they got the best APR available at that moment.

How to Make Money With yEarn as an Investor

Even though Cronje has repeatedly stated that he feels the Yearn token, YFI, is worthless, the opposite has proven to be true. At the time of writing, YFI is worth a head-turning $26,269. If you’re “yEarning” to get in on the action, you have a few entry points.

One way to earn YFI is to use the yCurve pool. Anytime a liquidity provider supplies yTokens to the yPool of Curve Finance, they get yCRV. The next step would be to then deposit into the yGov pool at yEarn.

Another way is to take advantage of the Balancer protocol because you can use it to get BAL tokens. If you deposit a combination of DAI and YFI into the Balancer protocol, you can take the BAL tokens you get and deposit them in the yGov pool. There, they can be exchanged for YFI.

How the yEarn Token (YFI) Works

The Yearn.Finance ecosystem is governed by YFI, which is an ERC-20 token. If you choose to be a liquidity provider, the protocol distributes YFI to you when you supply certain yTokens.

The YFI token also gives those who hold it the right to have a say in the governance of the protocol. There are only 30,000 tokens, and they all have been distributed. This means the pool of people voting on governance decisions isn’t going to grow any larger, so some may choose to hold on to the YFI they have simply to help steer the platform in the right direction going forward.

Stemming from some discussion in July on the Yearn.finance platform, voting on the direction of the Yearn.Finance platform is going to be based on the amount of YFI tokens an investor holds. In other words, because you have to vote with your YFI, the more YFI you have, the more your opinion is worth. In effect, this rewards YFI hodlers with more voting power.

How to Start Earning on Yearn.Finance

Although, as of the time of writing, the project is still in beta, the steps to starting earning with yEarn are simple.

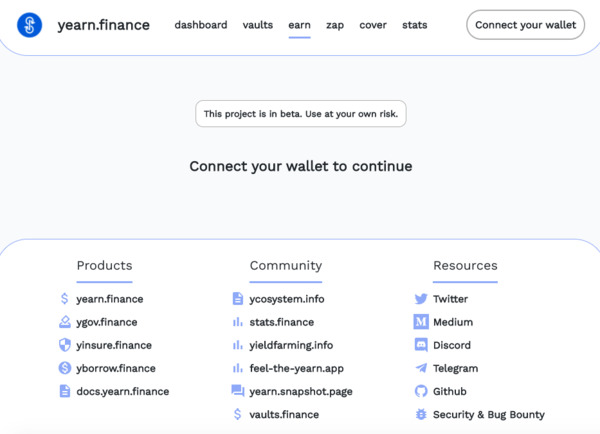

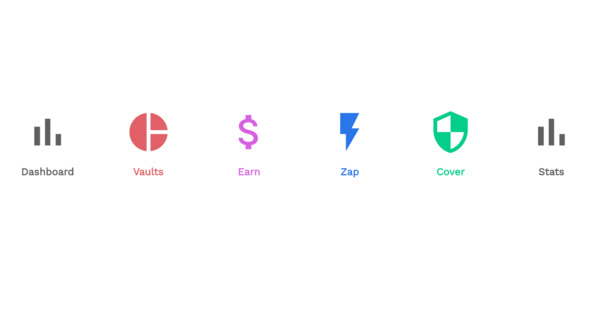

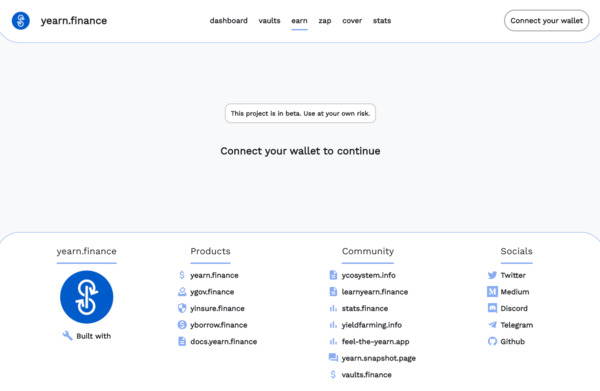

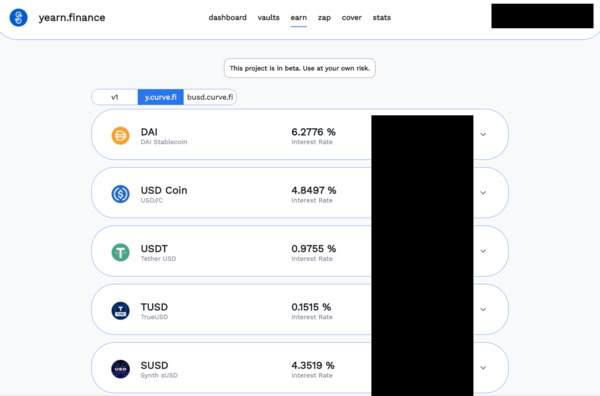

1. Go to yearn.finance and select Earn.

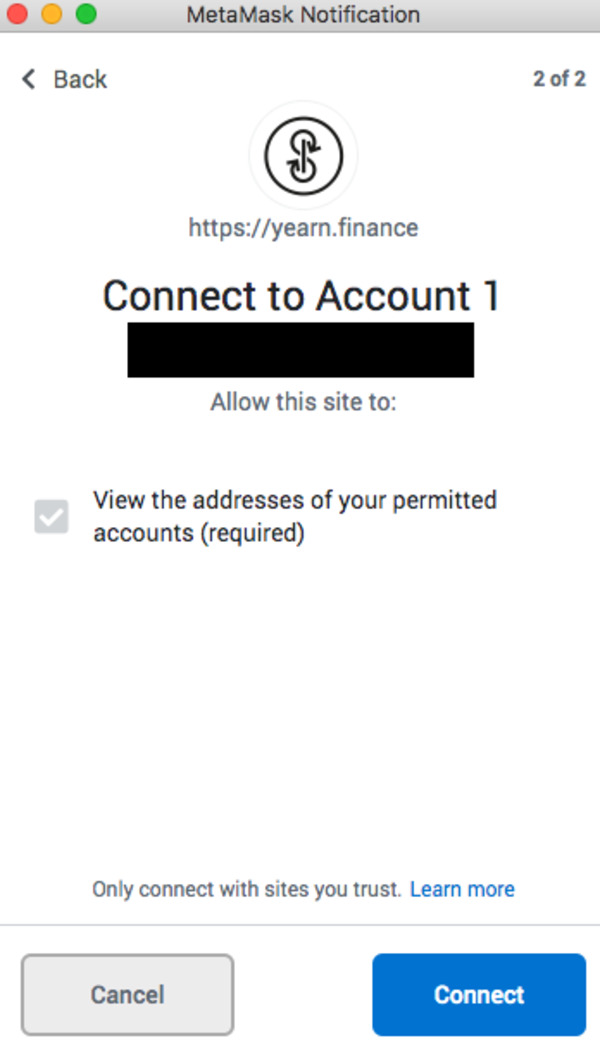

2. Start the process of connecting your wallet by selecting the button in the upper-right corner.

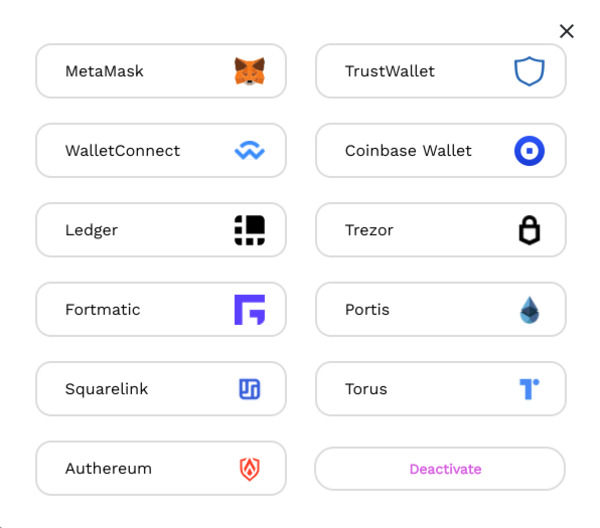

3. Select your wallet.

4. Choose your investment.

Yearn.Finance could make it a whole lot easier for investors to ensure they’re getting the best APRs at any given moment possible.

Further Reading:

- What Is DeFi?

- Top 10 DeFi Platforms in 2020

- What is Wrapped Bitcoin (WBTC) and How Can DeFi Investors Use It?

Subscribe to Bitcoin Market Journal today to receive daily updates on the latest trends and developments in the digital asset markets.