Without market makers providing liquidity, the trading world would come to a screeching halt. In traditional markets, involvement in the market-making process is inaccessible for the average investor. In the DeFi space, Uniswap is changing that, making it possible for everyday investors to get a piece of the market-making pie.

In this guide, you will learn how Uniswap works and how you can use the decentralized application to earn investment income.

What Is Uniswap?

Uniswap is an open-source, automated liquidity protocol that runs on the Ethereum blockchain. Users can use Uniswap to engage in decentralized trading without having to worry about a middleman or order book.

Centralized exchanges have played a major role in the digital asset markets. They have long-offered a convenient, familiar source of liquidity. However, mirroring the trustless infrastructure of digital currency transactions to form decentralized exchanges (DEX) has long been a real, yet elusive, objective.

Uniswap seems to have become the “unicorn” of decentralized exchanges: a completely trustless liquidity pool.

How Does Uniswap Work?

Uniswap differs from traditional digital exchanges because there is no order book involved. It uses a protocol named Constant Product Market Maker, which is another form of an Automated Market Maker (AMM).

Automated market makers are smart contracts designed to maintain liquidity pools, and traders can trade against these pools. The pools are funded by people who choose to invest in the system by providing liquidity.

To invest, you just have to deposit two tokens in the pool. Traders pay fees to the pool with each transaction they make. The proceeds from the receipts are distributed to those in the pool, according to how much each individual has provided to the reserve.

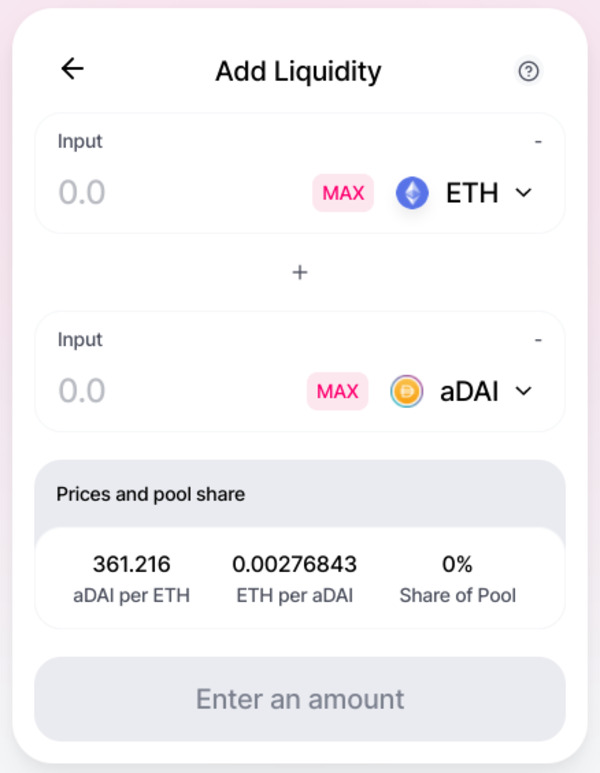

The two tokens liquidity providers deposit can be an ETH and an ERC-20 token or a pair of ERC-20 tokens.

After liquidity providers make a deposit into the pool, they receive liquidity tokens, which can be redeemed according to the percentage of the pool they represent.

The “k” Formula

The calculation of “k” is central to the Uniswap valuation system. Trades made on a pair get their pricing from a constant product formula. The result is regardless of the number of tokens that get added or removed from the pair’s reserves, the product of the reserves remains the same.

The value of “k” only changes after liquidity is withdrawn or deposited. This is an important detail because it helps in the calculation of fees. When the amount that is paid into a Uniswap pair is reduced by the fee, 0.3%, prior to checking the constancy of the value of “k,” the fee gets added to the reserves.

Moreover, each liquidity provider earns UNI tokens as an incentive to provide liquidity.

How to Use Uniswap to Earn Investment Income

On Uniswap, a 0.3% fee is taken from each transaction made on the platform. The more trades, the larger the pool. One way to earn income with Uniswap is to invest in the liquidity pool. As Uniswap gains popularity, more and more traders may get in on the action, and the amount you earn may rise proportionately.

The amount of income you earn is determined by your percentage of the pool. For example, if you provide 10% of the liquidity in the pool, you get 10% of the fees that are collected. This fee gets put back into the liquidity depth of the pool. As a result, the amount you actually get will depend on how each token involved in the exchange stacks up against USD. Also, the price between two tokens fluctuates according to the trading activity on Uniswap, and that will also affect your ROI.

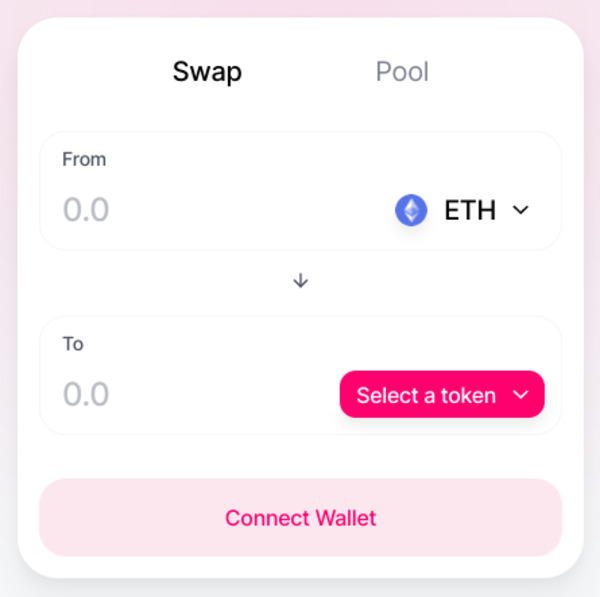

To get started on Uniswap:

- Go to the main Uniswap page and select Launch App

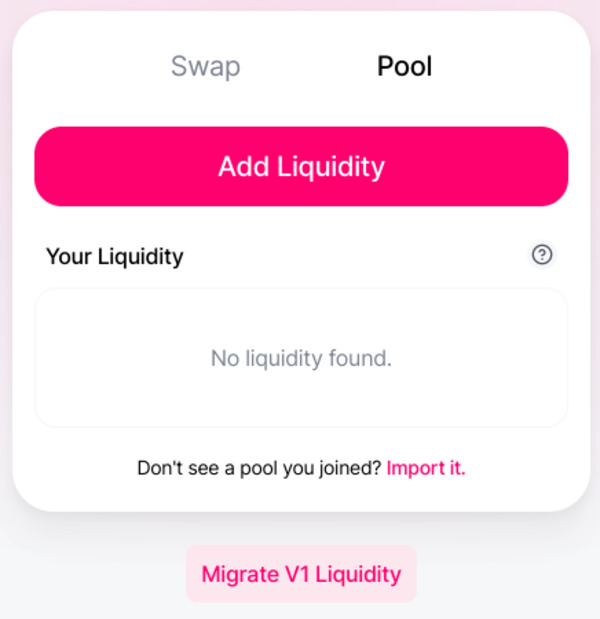

- Select Pool

- Select Add Liquidity

- Choose a pair, either from a list or manually, and enter the amount you want to add to the pool

Withdrawing Your Earned Fees

With Uniswap, when you withdraw your fees, you also withdraw your liquidity. However, you don’t have to remove all liquidity whenever you cash in. You can choose to withdraw just some of your liquidity and keep the rest in the liquidity pool. When you make a withdrawal, the amount you take out includes both the fees you’ve earned as a liquidity provider and the amount you’re taking out of the pool.

Additionally, since late September, liquidity providers also earn UNI tokens as an additional incentive.

Uniswap also allows you to keep track of the fees you collect. Within the platform, you have access to a dashboard that displays data regarding your ROI, including Net, ROI, Price ROI, and Uniswap ROI.

Uniswap presents a straightforward digital asset investment solution. The platform enjoys a significant market share of well over $500 million at the time of writing—which may be a testament to the rising trust engendered by trustless exchanges.

Further reading:

To keep up-to-date with the latest developments in DeFi and the broader digital asset markets, subscribe to Bitcoin Market Journal today.