Bitcoin is the oldest and most popular digital currency in the market. However, there are over 1000 other digital currencies (known as “altcoins”) that can be also purchased and held as an investment. In this guide, we’ll compare four of the most popular altcoins with bitcoin, so you can become familiar with other potential digital currency investment opportunities.

Bitcoin vs. Litecoin

| Features | Bitcoin | Litecoin |

|---|---|---|

| Use | Peer-to-peer payments | Peer-to-peer payments |

| YTD Performance | 1500% | 6000% |

| Total Supply | 21,000,000 | 84,000,000 |

| Public Awareness | High | Low |

| Community | Very Large | Large |

| Rank (According to Market Cap) | 1 | 5 |

Bitcoin vs. Litecoin (LTC)

When Litecoin first launched in 2011, it was said that “if bitcoin is digital gold, then litecoin is digital silver”. For a long time, that was the case. Litecoin quickly emerged as the second largest digital currency after bitcoin, as measured by market capitalization. The altcoin even experienced a degree of merchant adoption in its early years.

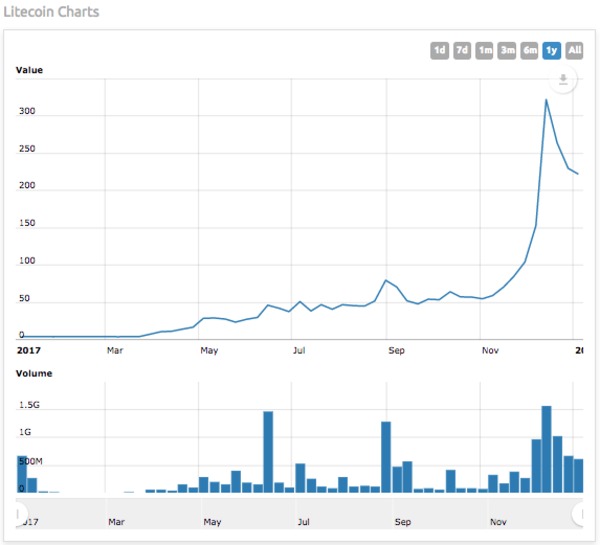

Its popularity faded somewhat as the Ethereum project and its native digital currency, ether, became the second largest digital currency in 2016. However, when it was announced in early 2017 that litecoin would adopt the so-called “SegWit” upgrade for its blockchain, which addresses blockchain scaling issues, the price of litecoin shot up from its 2-year trading range of $3 to $5 to reach a new all-time high of over $366 on December 19, 2017.

(Chart by WorldCoinIndex)

Litecoin has become a very popular digital currency because it has all the benefits of bitcoin but has faster transaction times and lower transaction fees. This is why many digital currency experts believe it has the potential to challenge bitcoin as the go-to digital currency of the future. This belief is shared by many digital currency investors, which may explain why the price of litecoin has rallied by over 6000 percent year-to-date.

If you believe that global adoption of litecoin (LTC) will surge since its transactions are faster and cheaper than bitcoin, then adding litecoin exposure to your portfolio could be the right move.

Bitcoin vs. Ethereum

| Features | Bitcoin | Ethereum |

|---|---|---|

| Use | Peer-to-peer payments | Smart Contracts with Embedded Payments |

| YTD Performance | 1500% | 7500% |

| Total Supply | 21,000,000 | No Cap |

| Public Awareness | High | High |

| Community | Very Large | Very Large |

| Rank (According to Market Cap) | 1 | 2 |

Bitcoin vs. Ethereum (ETH)

Ethereum’s ether is the second biggest digital currency in the market with a market capitalization of over $75 billion. Ether is the digital currency of the Ethereum blockchain, which is an open source blockchain platform that allows for the creation of so-called “smart contracts”.

Smart contracts are computer protocols that create digital contracts which are intended to facilitate, verify, and enforce contractual agreements between two parties. These contracts can also include self-executing payments when certain contractual agreements are met. The currency for these payments is ether.

(Chart by WorldCoinIndex)

The Ethereum blockchain has gathered substantial interest from financial institutions and corporations that believe that the ability to securely store and transfer data using blockchain technology combined with self-executing smart contracts will reduce operational costs and streamline business processes in the future. For this reason, Ethereum has grown into the second largest blockchain and its currency ether has rallied to become the second most valuable digital currency in the market.

If you believe that smart contracts will play an integral role in business in the future, then adding Ethereum’s digital currency ether (ETH) to your portfolio could be the right play.

Bitcoin vs. Ripple

| Features | Bitcoin | Ripple |

|---|---|---|

| Use | Peer-to-peer payments | Interbank Payments |

| YTD Performance | 1500% | 30,000% |

| Total Supply | 21,000,000 | 100,000,000,000 |

| Public Awareness | High | Low |

| Community | Very Large | Small |

| Rank (According to Market Cap) | 1 | 4 |

Bitcoin vs. Ripple (XRP)

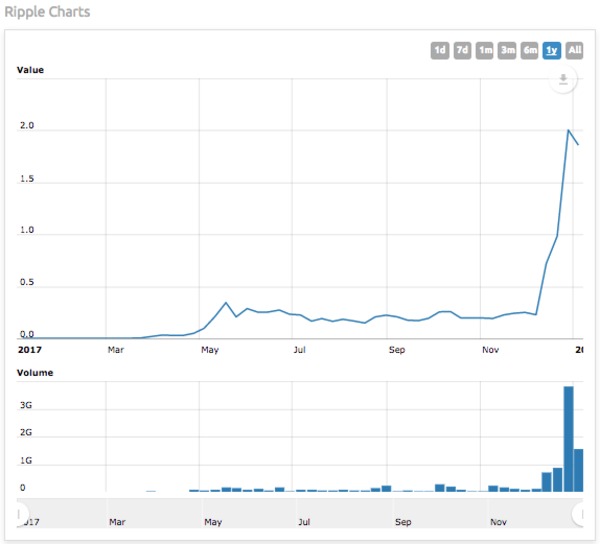

Ripple is currently the fourth largest digital currency with a market capitalization of $50 billion. It is the digital currency of the Ripple Interbank Payment Network, which aims to provide a high-speed, low-cost payment framework for financial institutions across the globe.

Currently, more than 50 banks in Europe, Asia, Australia, and the U.S. have implemented the Ripple payment system, while over 100 banks have engaged in a trial of Ripple’s payment network in attempts to implement this innovative new cost-reducing payment technology.

(Chart by WorldCoinIndex)

If you believe that the Ripple’s Global Payments Network will become the standard for interbank payments, then adding Ripple exposure to your digital currency holdings could be the right move.

Bitcoin vs. DASH

| Features | Bitcoin | DASH |

|---|---|---|

| Use | Peer-to-peer payments | Anonymous Peer-to-peer payments |

| YTD Performance | 1500% | 10,000% |

| Total Supply | 21,000,000 | 18,900,000 |

| Public Awareness | High | Low |

| Community | Very Large | Medium |

| Rank (According to Market Cap) | 1 | 8 |

Bitcoin vs. DASH (DASH)

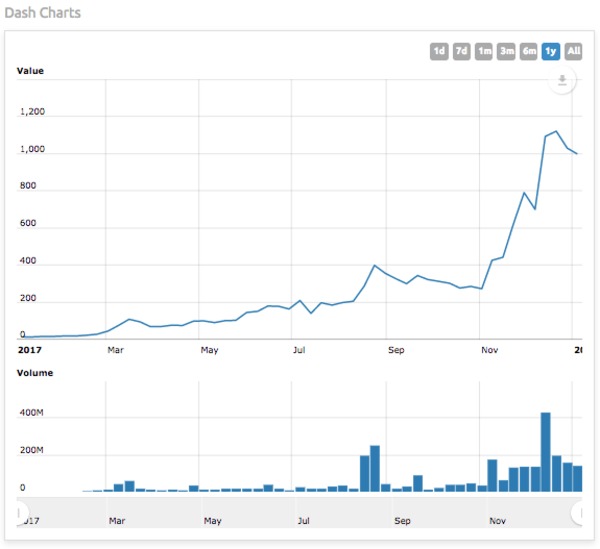

DASH, which stands for digital cash, is currently the leading anonymity-centric digital currency. It has a market capitalization of $10 billion and is the eighth largest digital currency in the market.

Mass media regularly claim that bitcoin is anonymous. However, that is actually incorrect, as all transactions can be publicly viewed on the bitcoin blockchain and each transaction is linked to a bitcoin wallet address. While bitcoin wallet addresses do not contain personal information of the wallet owner, various analysis methods have been created that allow wallet addresses to be linked to IP addresses to de-anonymize bitcoin holders and their transactions.

(Chart by WorldCoinIndex)

For this reason, anonymous digital currencies, such as DASH, have gained popularity as digital currency users are increasingly valuing privacy when making financial transactions. DASH not only allows users to transact anonymously, it also allows users to make instant transactions with lower transaction fees than bitcoin. These three features combined have been the key drivers behind DASH’s increase in popularity and market value.

If you believe that individuals will increasingly move towards the use of anonymous digital currencies to make transactions, then buying DASH for your portfolio could make sense.

If you are happy with the high-risk/high-return profile of bitcoin, then diversifying your digital currency portfolio by buying one or several of the above-mentioned digital currencies could make sense. Not only could you benefit from a reduction of risk through diversification, but you could also potentially increase your overall returns should any of your altcoin investments outperform their peers.

For more information about digital currency investments, subscribe to the Bitcoin Market Journal newsletter today!

- Bitcoin vs. the Top 10 Altcoins by Market Cap

- What is Bitcoin’s Price Correlation With Other Digital Currencies?

- Building a Balanced Bitcoin Investment Portfolio