Feel like there are better ways to make money with bitcoin than HODLing? Does bitcoin day trading seem like an attractive proposition to you?

Before you jump into day trading, you need to be aware of a couple of basic truths:

- It is theoretically possible to make more money day trading bitcoin than simply buying and holding.

- Statistically, most day traders lose money. Let that sink in.

To increase your chances of success as a day trader, here are some of the fundamentals you should know.

What Is Bitcoin Day Trading?

- A day trader executes intraday trading strategies, looking to cash in on short-term price movements.

- Day trading is mostly focused on exploiting market inefficiencies which bring about such price movements.

- Technical analysis is the main tool on the day trader, though fundamentals do come into the picture every now and then as well. Trading the news is a popular approach.

- Volatility and volume are friends of the digital asset day trader. Thankfully, bitcoin provides both in abundance.

Bitcoin Day Trading Entails a Set of Variables

Successful bitcoin day traders use strategies capable of yielding consistent profits. Beyond that, they also exercise self-discipline and maintain objectivity.

Before we get down to such specifics, it is well worth going over a checklist of variables not connected to the abilities of the human in the equation.

- Bitcoin can be traded directly, by buying and selling it through digital asset exchanges. Some people trade it through derivatives such as CFDs. Such derivatives are offered by most Forex brokers these days. The liquidity behind these CFDs is often questionable, however. Brokers are also oft-accused of spread manipulation, stop loss hunting, and slippage.

- You will need a secure exchange that offers a solid trading platform.

- Fees will bite into your profit margin. The types of fees you are likely to encounter are exchange fees, trading fees, and fees associated with transfers of funds (deposits and withdrawals). Exchange fees are the fees the exchange charges you for using its service. Trading fees come down to maker and taker fees, depending on whether you act as a market maker or simply make use of the offers posted by other users. Deposit and withdrawal fees depend on the exchange you use and your preferred money transfer method.

- Understand the laws that govern virtual currencies in the jurisdiction where you reside.

- Your digital asset day trading profits may qualify as capital gains. As such, they may be subject to a better tax regime than normal income. Educate yourself in this regard.

- Be aware that you can use trading bots to automate your profitable trading strategies. Such an approach may save you time and it may increase your overall profit potential. It does come with some serious caveats, though. For instance, if you do resort to automated day trading, never leave your bot on full autopilot.

Bitcoin Day Trading Strategies

There is a lot of contradictory information out there regarding bitcoin day trading strategies. People push and peddle various strategies, some of which make no sense. There are “experts” out there telling you to pick coins with as little volatility as possible. Since volatility is the day trader’s friend, that flies in the face of common sense.

Understand that:

- You need volatility. The good news is that most digital assets are extremely volatile.

- You need proper trading volumes to avoid slippage. Slippage is possibly the most frustrating component of the day trading equation.

- Having a basic grasp of blockchain technology is useful. You will need it to be able to trade news and announcements properly.

Here are a couple of day trading strategies that make perfect sense and are simple enough for beginners.

Trading Trends and Corrections

This is probably the simplest day trading approach. It is all about keeping an eye on the evolution of the price. Some people wait for trend corrections to occur and trade those.

Others trade the resumption of the trend after a correction. In all cases, spotting the beginning and end of the correction is essential. Day traders accomplish this by following candlestick patterns.

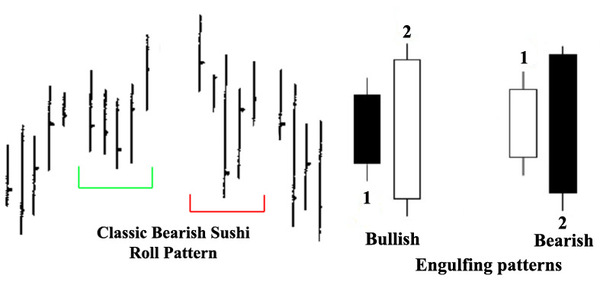

The Sushi Roll reversal pattern provides such a clue. It works in a similar fashion to other candlestick patterns, such as the bearish and bullish engulfing patterns, or even the head-and-shoulders. The Sushi Roll delivers an earlier trend-reversal signal, however.

The Sushi Roll consists of ten bars, the first five of which are stuck in a relatively narrow range of lows and highs. The second five bars engulf the first five, with higher highs and lower lows.

Like the bearish and bullish engulfing patterns which consist of just two bars, the Sushi Roll can be bearish or bullish.

MFI-Based Technical Trading

Applying various technical indicators to the charts is a common practice among bitcoin day traders. The MFI (Money Flow Index) indicator makes it easy to spot the activity of “smart money.”

The following strategy involving the MFI can be effective. It does, however, require some hands-on attention.

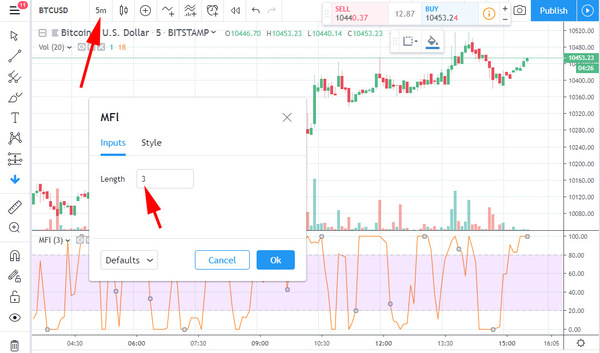

- Find a crypto pair like BTC/USDT with high volatility and high trading volumes.

- Pick the 5-minute time frame and apply the indicator. Set the MFI period to 3.

- Wait for the MFI level to hit 100. Keep your eye on it as it hits 100 two times. See if the price drops following such a hit. If it does, you have an indication of a down day.

- Following the third move to 100, watch for the candlestick to be a bullish one. If it is, you are ready to place your Buy trade. As described here, this strategy only works for long trades. With some tweaks, it can, however, be adapted to shorts.

- Set your Stop Loss to the low of the day and your Take Profit to 60 minutes after the launching of your trade. This way, you won’t have to hang around, watching the price. You will have the setup on semi-auto pilot.

- Do not give in to the temptation of keeping your trade open for more than 60 minutes.

Statistically speaking, this setup could make you money. Exactly how much you might make with it depends on a number of other factors, such as the amount you buy, etc.

Conclusion

Bitcoin day trading is a game of patience, discipline, and emotional detachment. If you are in short supply of these attributes, you are better off staying away from it. If, however, you have these trading traits in spades, day trading may be something you could try.

Subscribe to the Bitcoin Market Journal newsletter for the latest in digital asset investment opportunities. Contact us and let us know how day trading has worked out for you!