Sidechains are some of the most highly-anticipated technological improvements to bitcoin, due to the practically limitless functionality that can be enabled once they are deployed. Originally announced as a concept in 2014, sidechains are now perhaps only months away from being available on the bitcoin network.

If successful, sidechains could have a massive impact on the future prospects of the bitcoin price.

What is a Sidechain?

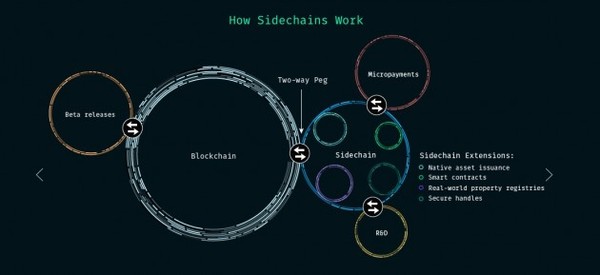

A sidechain is effectively a way to allow bitcoin users to move their coins to a completely different blockchain with different features. The idea is that these new blockchains will allow bitcoin users to enjoy new functionality in a manner that does not impact the main bitcoin blockchain without the need to create a new digital currency.

There are a few different types of sidechains that have been proposed over the years, and each one of them comes with a different security model for users. Some sidechains use a federation of notaries, which means the sidechain is under the full control of a collection of (usually competing) entities, while other sidechains seek a much more decentralized approach.

As of now, it is thought that sidechains will not have the same level of security as what is found on bitcoin’s main chain, although Bloq Economist and drivechains creator Paul Sztorc disagrees with that assessment.

What are Some Examples of Possible Bitcoin Sidechains?

What kinds of features can be added to Bitcoin via sidechains?

Firstly, a lower-security, higher-throughput blockchain can be added to bitcoin, which may at least partially solve some of the contention around whether bitcoin should be digital gold or a global payments system.

Secondly, the previously mentioned Paul Sztorc is working on Bitcoin Hivemind, which is intended to be a decentralized prediction market. With this sidechain, bitcoin users would be able to hold the value of any asset in the world in the same censorship-resistant manner as they hold bitcoin.

Two other sidechains worth mentioning are MimbleWimble, which is a much more private and scalable alternative to the current version of the bitcoin blockchain, and RSK, which intends to enable advanced smart contracts, such as those found on Ethereum, in bitcoin.

What Do Sidechains Mean for the Bitcoin Price?

One of the main goals outlined in the original sidechains white paper was the removal of the need to create alternative tokens for new types of blockchains. In other words, one of the potential side effects of sidechains is that they could completely remove the need for altcoins.

While many speculators are excited about the more than 1,000 altcoins that exist today, sidechains could eventually lead to a situation where all of the value in the entire altcoin market returns to bitcoin.

In addition to capturing the value found on other blockchains, sidechains may also have the side effect of increasing bitcoin’s network effect as money more generally. Sidechains enable new use cases for bitcoin, which might translate into more people joining the network. The destruction of the altcoin market could also lead to much greater certainty around bitcoin not being surpassed by an altcoin in the future.

Interested in finding out more about all things bitcoin? Subscribe to Bitcoin Market Journal today!