The trend known as DeFi, or Decentralized Finance, is taking the blockchain world by storm. As of this writing, the total amount invested (or “locked”) in DeFi is about $7.5 billion, and growing. This is either a blockchain breakthrough, or a blockchain bubble. (Turns out, it’s both.)

I recently went in deep on DeFi. My goal was to see if there’s real value there, and to understand why people have bet $7.5 billion on its future. Is DeFi worth the investment? Read on to find out what I learned … and the easy way for ordinary people to invest.

What the DeFi

At a high level, DeFi (or Decentralized Finance) is a set of websites and apps where digital assets (like Ethereum) can be used to create new financial products like loans, index funds, and derivatives. That’s a mouthful to explain, so here’s a simple example.

In a traditional bank, let’s say you want to take out a loan to start out a new business. Applying for this loan will require hours of time and mountains of paperwork. You might have to put up your house as collateral – if you can’t pay back the loan, in other words, the bank can take your house. If you’re approved, the bank gives you the money, then you gradually pay back this loan (with interest).

This is what we call traditional or centralized finance – it’s managed by a central institution (a bank), which itself reports to a bigger central institution — what we literally call the “Central Bank.”

With a decentralized loan, this model gets flipped on its head: you’re borrowing not from banks, but from other users. You buy digital assets (like Ethereum), then use simple, one-click apps like Compound to take out a loan, using that Ethereum as collateral. Behind the scenes, the app finds lenders — not banks, but other investors who are earning interest by lending to you.

If you can’t pay back the loan – or the price of your original Ethereum drops suddenly – the app will sell your original Ethereum (just as the bank might seize your house). This is one reason DeFi apps are incredibly risky, and you should be prepared to lose 100% of your investment.

| Centralized Finance | Decentralized Finance |

| Run by banks | Run by users |

| Slow and cumbersome | Instant and fun |

| Relatively safe | Highly risky |

That said, there is definitely something important going on with DeFi, and it is actually the banks that should be afraid. The banks should be very afraid.

DeFi Step-by-Step

In a nutshell: most DeFi apps work on Ethereum. So the process is:

- Buy some Ethereum (through a service like Coinbase);

- Transfer that to a wallet (like MetaMask);

- Connect the wallet to these services (here’s a list of the top DeFi apps).

Using these DeFi apps is like flying an alien spacecraft. The spaceship is so easy to steer that it flies with the power of your mind – but you have no idea how the technology works, and you might crash into the surface of Saturn.

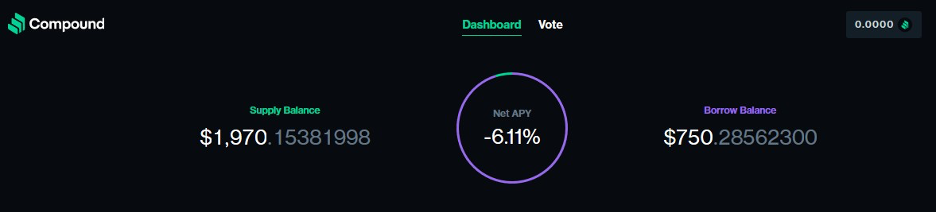

On one hand, these apps are so easy to use that they make the banking system look like an outdated relic. This week, my traditional banking website was down (they never explained why), while Compound was giving real-time feedback on how much I was earning with my Ethereum loan.

On the other hand, the user manual for these apps is pretty much non-existent. This is bleeding-edge financial technology, so you are pretty much on your own to figure it out: you can either sit through long-winded YouTube instructional videos, or wade through difficult technical documentation.

Once you’re in, though, I must confess it is incredibly fun to watch the real-time numbers flowing around. It’s like you’re in a casino, because you’re not playing with “real” money, you’re playing with chips — but of course the chips represent real money, so ultimately your real wealth is on the line.

After hours of working on this process of converting and sending tokens, a few things became clear.

- DeFi apps are really good at taking your money. It is creazy (or crazy easy) to send your Ethereum over to these apps – you don’t even need a username and password, they just hook up to your Metamask wallet and drain it directly.

- DeFi apps are really good at charging fees. You pay these fees in the form of service fees, or “gas,” required to make transactions on the Ethereum network. Additionally, these apps generally tack on their own service fees. These fees are subtle and insidious: just to get in, you’ve already lost wealth.

- This is all funny money. Until you convert it back into a stable store of value, you are earning an imaginary return on imaginary money. It’s a house of sand, or castles in the sky. So the $7.5 billion invested in DeFi is misleading: it’s not like $7.5 billion in U.S. dollars, but rather $7.5 billion of multi-layer money (which we will abbreviate as MLM).

Let me give you an example of MLM. Joan buys $100 worth of ETH, puts it into her MetaMask account, then deposits it into Compound, where she can buy an additional $50 worth of some other token — which she can then take over to another DeFi platform, and do the same thing. Again and again.

Financial assets built on top of other financial assets are nothing new: they’re called derivatives. But this “money built on money” — MLM, or multi-layered money — can be a house of cards: if the table shakes, the whole thing comes crashing down.

I’m pretty sure that after all the work I did on DeFi, I lost money. (It’s a research expense.) Still, there is something very interesting going on here: easy-to-use financial applications that are not being run by banks, but by individual users and software. Here are a few takeaways.

5 DeFi Investing Principles

First, if you’re going to put money into DeFi applications, do not invest more than you are willing to lose 100%. These are early-stage applications, so they’re vulnerable to hackers. The entire market could crash overnight. Your parrot could eat your passwords. Ask yourself, “If I lost 100% of this money, would it be OK?”

That said, consider investing a little bit into DeFi. Even if it’s just $100, you’ll get your feet wet. The process of using these applications will teach you a lot. You’ll see the opportunities for this stuff: that someday soon we will be trading stocks, bonds, real estate, sports teams, pop stars, and everything else on these platforms.

Next, keep track of what you’re doing. It is so easy to throw money into these platforms that you can quickly lose track of what you own, how much you invested, and how much you’ve paid in fees. At minimum, keep an Excel sheet or Google sheet with each transaction, the platform, and the fees.

On that point, watch fees carefully. Fees are the silent killer. There’s no use earning 5% interest on your Ethereum if you’re paying 6% in fees to transfer it in and out. To reduce gas fees, for example, consider making transactions during night time hours, when the Ethereum network is not so congested.

Finally, be vigilant. Because we are dealing with MLM (multi-level money, similar to multi-level marketing), a sudden crash in the blockchain market can have a domino effect through the entire system. As Selena Gomez explained this concept in The Big Short:

With DeFi, we are building new layers of MLM, which in my view is not a good thing. It’s risky and dangerous. However, that MLM is funding a new generation of financial products, which will completely overhaul the current financial system, which in my view is a good thing.

Ultimately, the free flow of value is good – especially the free flow of value to where it is most needed. When we can get money to an entrepreneur in Mombasa, or a relative in Iceland, or schoolchildren in Beirut – instantly, and without financial gatekeepers – we will be on our way to a fairer world. Human progress will accelerate faster and faster.

Also, let’s be honest: banks are generally difficult, bureaucratic, and unfriendly. My bank holds all my money, but they never call me on my birthday. They tell me how friendly they are, but it takes forever to get someone on the phone. The banking industry is about due for a shake-up.

There is one super-simple way to invest in DeFi: invest in Ethereum. Nearly all of that $7.5 billion is invested in apps that are built on Ethereum. Like investing in the early days of Microsoft, when everyone was trying to figure out what an operating system was, Ethereum is quietly eating the banks.

Ethereum is emerging as the de facto standard for DeFi.

As I’ve said in previous columns, investing in Ethereum is not investing in a company. You don’t own shares of stock. But as the value of the Ethereum network continues to grow, the value of the Ethereum token (ETH) will likely continue to grow. When you buy Ethereum, you are betting on the future of Ethereum.

Today, that future looks brighter than ever.

You will hear plenty of get-rich-quick stories about DeFi in the months ahead, but that’s not our style. We’re here to help you build a lifetime of health, wealth, and happiness – by delivering value to where it is needed most.

Even though DeFi is an enormous bubble, even though it’s a massive MLM, this software-based, peer-to-peer model of finance is going to radically disrupt the traditional financial industry. So if you have a little money to spare, consider playing around with these apps – but remember, the simplest DeFi investment is to buy and hold Ethereum.

P.S. Don’t forget to sign up for our free weekly blockchain investing newsletter.