Executive Summary: Scalability and interoperability have been some of the most significant issues in the blockchain industry. Layer-0, or “cross-chain” blockchains, are helping solve these issues.

Think of Layer-0 blockchains as sitting below Layer-1 blockchains, acting as a kind of “universal connector” between Layer-1 blockchains like Ethereum and Solana, moving data between them.

The Layer-0 industry is growing, with popular projects like Polkadot and Cosmos already connecting multiple Layer-1 chains on their network. However, it may take some time before the vision of Layer-0 projects fully materializes — or it may never happen at all, with L1 blockchains remaining siloed and separate.

In this piece, we will provide an overview of Layer-0 blockchains and their role in the blockchain industry. We will also examine some of the most prominent Layer-0 blockchain projects and how to approach them as investment opportunities.

What Is a Layer-0 Blockchain?

To use another analogy, think of Layer-0 blockchains as the operating system of your computer and Layer-1 blockchains like Ethereum and Solana as applications that run on the computer.

In the same way an OS manages hardware resources and enables the execution of applications, Layer-0 protocols govern how data is transmitted, validated, and stored across blockchains. Layer-1 protocols, like a software application sitting on top of an OS, provide specific functionalities and use cases.

Layer-0 blockchains are the solution to the problem of cross-chain interoperability. Presently, to move from the bitcoin to the Ethereum ecosystem, you need to sell your BTC for, say, USDT to get into the ETH ecosystem.

It’s even more difficult for developers, who have to deploy their smart contracts on different blockchains (which requires learning each ecosystem’s programming language), which fragments users and liquidity.

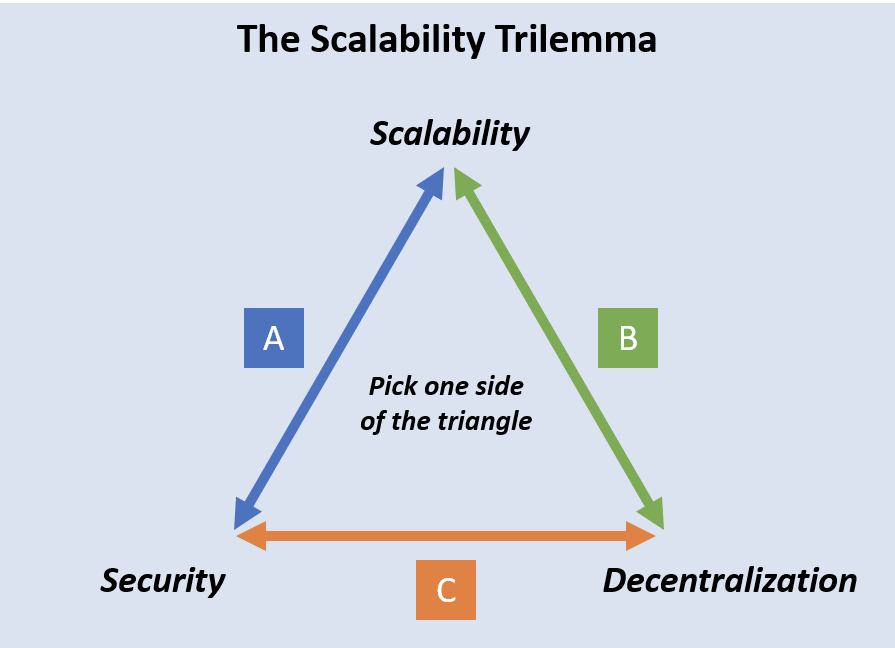

Layer-0 blockchains are also solving scalability issues. Blockchains have to handle critical functions like consensus, transaction execution, and data availability, all while dealing with rising user demand, making it difficult to scale without trading off security and decentralization. This concept coined by Ethereum’s founder, Vitalik Buterin, is known as the “blockchain trilemma.”

A protocol can either be decentralized, increasing its security and censorship but trading off speed — or it can be more centralized, making it faster but less secure and resistant to censorship.

Layer-0 chains can help projects work around the blockchain trilemma, delegating the primary responsibility for these three functions to different sidechains on the Layer-0 protocol.

These are some of the problems that Layer-0 blockchains are trying to solve, which is only possible due to their structure. Different Layer-0 solutions come with different designs, but generally, they have three main components:

- The mainnet: This chain is the primary chain that stores data from the different Layer-1s built on it.

- Sidechains: This layer includes independent Layer-1 blockchains with their own consensus mechanisms and validator nodes.

- Cross-chain protocol: Used to allow different blockchains to communicate and exchange assets and information in a trustless and secure manner.

| Layer-0 Blockchain | Layer-1 Blockchain | |

| Functionality | Provides the basic building blocks for other blockchains to be built on top of it | Runs on top of a Layer-0 blockchain and adds functionality and features to it |

| Ability to create sidechains | Unique to Layer-0 blockchains. | Only allows layers to be created e.g Layer-2 solutions like Arbitrum on Ethereum |

| Scalability | Tend to be more scalable than L1 due to their use of sidechains. | Generally less scalable due to their monolithic architecture |

| Interoperability | Can support interoperability between multiple Layer-1 blockchains and networks | Exist as ‘islands’ therefore, a lesser degree of interoperability between different chains. |

| Examples | Cosmos, Polkadot, Horizen | Ethereum, Solana, Cardano |

Investing in Layer-0 Blockchains

Before investing in any Layer-0 project, do your own research to get an idea of what they’ve already accomplished and what they are trying to achieve in the short and long term. A great place to start when assessing Layer-0 projects is by looking at these key metrics.

- Daily active users: This is one of the most important metrics for any blockchain project as it details how many people are actually using the protocol on a regular basis. (Think of it like regular customers of a traditional business.) This is one of the key metrics we monitor — see our piece on crypto financial statements.

- Transaction throughput: How many transactions can the blockchain handle within a given time frame? Throughput impacts scalability: a blockchain with a low throughput may struggle to meet growing demand, leading to longer confirmation times, higher transaction fees, and potentially a less reliable network. This may make the network less attractive to developers and new users, hindering growth.

- Security: You can start by looking at the network’s level of decentralization, audits, and even the team’s track record. Generally speaking, a well-established network with a large user base and an active development community is more likely to be secure than a new, untested network.

- Tokenomics: Tokenomics (or the economics of the token) helps to ensure network security, fund development, and creates a fair distribution of the cryptocurrency, among other things. Successful projects carefully design their tokenomics model with long-term sustainability in mind.

- Scalability and interoperability: Layer-0 projects that can reliably support a large number of users and applications, while allowing for cross-chain transactions, have a better shot at growing a loyal user base.

In addition to these metrics, crypto investors can also look at these Layer-0 factors:

Market Trends

For example, if there is a trend toward crypto tokens being able to work across chains (like the USDC stablecoin does), then Layer-0 projects that provide these features may be in high demand.

On the other hand, there may be negative market trends (security, regulatory risks) that may help you identify potential risks and challenges that Layer-0 projects may face. We cover many of these for individual projects in our Blockchain Investor and Blockchain Risk Scorecards.

Team and Development Progress

Do the members have a good track record of success in the crypto industry, or are they relative newbies? Are they honest and trustworthy? Are they delivering on their promises

By evaluating development progress, investors can assess the team’s ability to execute their vision, meet milestones, and ultimately build a successful business.

Use Cases and Partnerships

A Layer-0 project partnering with other reputable organizations is a good sign, as it expands its real-world use cases and user base. Also, it can help you assess the project’s competitive advantage. What is the project’s unique value proposition, and how is it differentiated from competitors?

Portfolio Risk and Diversification

Investing in Layer-0 projects has risks, and diversifying your portfolio might be a great way to mitigate them. Instead of investing in a single Layer-0 project, you can consider spreading your investment across different projects to minimize the impact of any one asset’s price movements on your overall portfolio.

Also, by diversifying your portfolio, you can gain exposure to different opportunities and market trends.

What Are the Most Popular Layer-0s?

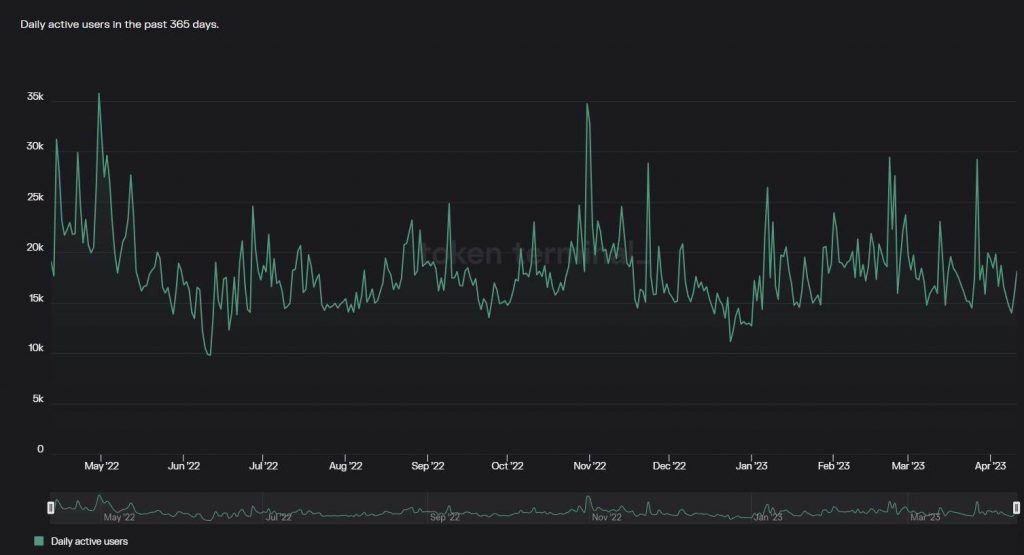

Polkadot

Polkadot

Daily Active Users (30-day avg): 4,570

Market Cap: $7.88 billion

Founding Date: 2020

Polkadot was launched in 2020 by three experienced developers, including Ethereum co-founder Gavin Wood. The network includes a main chain known as a relay chain that allows for multiple parallel blockchain networks, called parachains, to connect and interact with each other. Polkadot has maintained a strong presence as one of the top projects by market cap. It also reported that towards the end of 2022, its parachains had achieved a sizable TVL growth despite launching earlier that year.

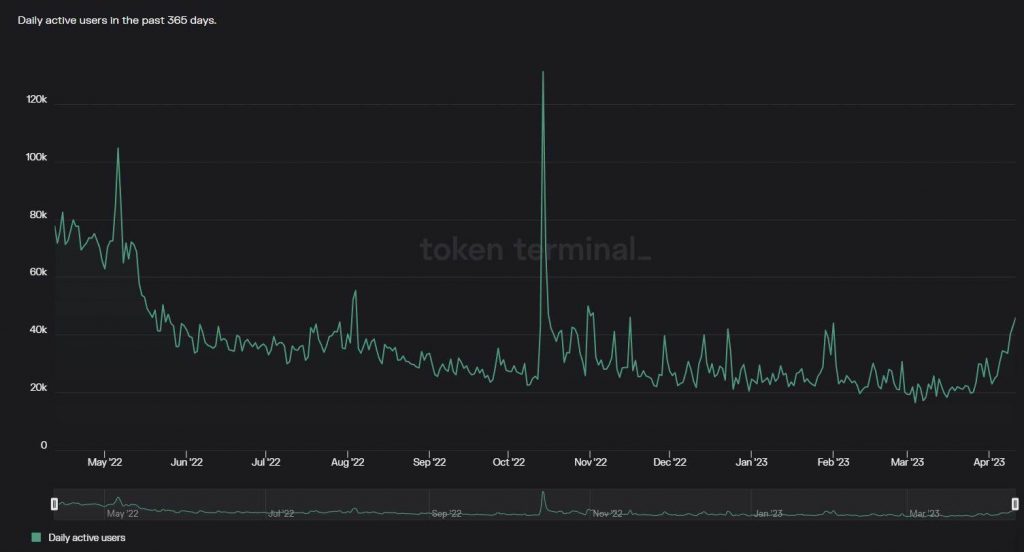

Cosmos

Daily Active Users (30-day avg): 17,640

Market Cap: $3.30 billion

Founding Date: 2014

Cosmos, the so-called “internet of blockchains,” was also created to tackle scalability and interoperability issues in the industry. The project has various components such as Cosmos SDK, which allows developers to create application-specific blockchains and the Inter Blockchain Communication (IBC) protocol which allows chains to transfer value or data with each other. The project reports over 270 apps and services in its network, including Binance Chain, Terra, and Crypto.org, with over $61 billion of digital assets under management.

Avalanche

Daily Active Users (30-day avg): 257,300

Market Cap: $5.99 billion

Founding Date: 2020

Avalanche is a smart contract platform for building and launching blockchain applications. This happens on one of the three key chains in the network, known as the Contract chain. The other two chains are the Exchange chain, which facilitates the creation and exchange of assets, and the Platform chain, which coordinates validators and enables the creation of subnets(which allow users to create and run their own blockchain networks). Avalanche follows Polkadot in terms of Layer-0 projects’ market cap and has a TVL of over $850 million.

Horizen

Daily Active Users (30-day avg): N/A

Market Cap: $226.5 million

Founding Date: 2017

Horizen is a privacy-focused blockchain network launched as a fork of Zcash. The project carries on the zero-knowledge privacy technology from Zcash. It incorporates the sidechain and mainchain architecture to build a “zero-knowledge enabled network of blockchains.” The team has been rolling out multiple upgrades, including the launch of an EVM-compatible sidechain earlier this year. However, the project is far behind Polkadot in terms of market cap, with just over $140 million.

Investor Takeaway

Layer-0 blockchains provide an alternative way to scale blockchains without compromising on the industry’s key principles. They are also trying to bridge the gap between different ecosystems, making them interoperable. Plus, they promote collaboration and innovation within the industry, instead of siloing off projects from each other.

If this is the direction that the industry evolves, Layer-0 blockchains will likely play a huge part. In this scenario, investing in Layer-0 blockchains can potentially provide exposure to the growth of the blockchain ecosystem.

On the other hand, Layer-1s may evolve into a “winner-takes-all” monopoly scenario (like Google in search), or a “winner-takes-most” duopoly (like iPhone and Android in mobile operating systems). If this is the way the industry evolves Layer-0s will be an interesting, but ultimately insignificant, curiosity.

The key metric to watch is Daily Active Users on the top Layer-0s. If this number continues to show steady gains across the different platforms mentioned above, then we’ve got a winning investment category.

50,000 crypto investors stay up-to-date on the market with our free daily newsletter. Click to subscribe and join the tribe.