Investor Takeaway: Layer-1 blockchains are central to the growth of the cryptocurrency and DeFi markets. While there’s been a massive boost in investor interest (and subsequent boom/bust cycles), the SEC’s recent labeling of some Layer-1s as securities means some caution might be prudent.

The modern cryptocurrency ecosystem is based around Layer-1 blockchains. Scalable blockchains like Ethereum, Solana, and Cardano have played, and continue to play, a vital role in the development of notable DeFi technology like NFTs. As such, billions of dollars from investors have flowed into the industry in the last five years.

There’s always some give-and-take, however. The inherent volatility of native Layer-1 tokens has also drawn the attention of regulators in the US and EU. In 2023, the SEC is taking a tough stance against all prominent Layer-1 blockchains apart from the big two – Ethereum and Bitcoin.

In this sector report, we will focus on the broad trends in the industry around Layer-1 blockchains, along with a closer look at the potential impact of the recent SEC decisions regarding Layer-1 tokens like Cardano, Solana, and BNB Coin.

Industry Overview

Layer-1 (L1) blockchains are the true backbone of the nascent cryptocurrency markets. Bitcoin led the way with the first-ever viable Layer-1 protocol. However, its technology and architecture have since been overtaken by more innovative and scalable networks like Ethereum.

Although bitcoin is still the king of Layer-1 protocols, its utility is largely limited to being a highly lucrative speculative asset. Other protocols like Ethereum, Solana, and Cardano offer a host of other benefits.

Many experts think blockchain technology has the potential to revolutionize finance, payments, banking, and other economic spheres. Through their support for smart contracts and decentralized apps, the newer Layer-1 protocols are actively contributing to the evolution of the blockchain space.

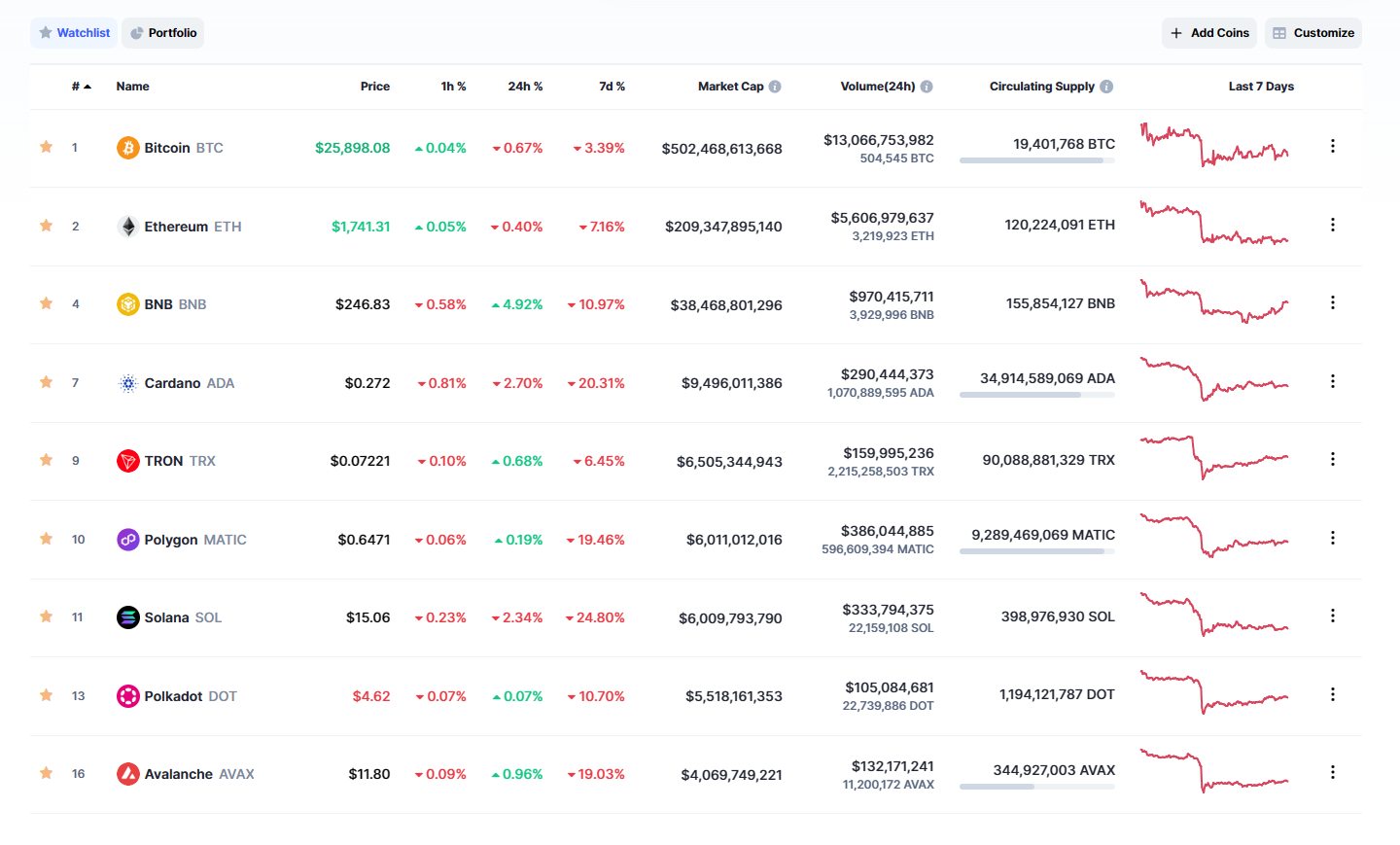

As of Q2 2023, over $270 billion is invested in the top 9 Layer-1 blockchains below bitcoin. The latter dwarfs them all with a market cap of $500 billion, but it has also been around for over 12 years.

Apart from Ethereum, which launched in 2015, all other Layer-1 blockchains started after 2017. In a relatively short time frame, many of these projects have managed to attract upwards of $5 billion each in market cap.

The top players in the descending order of magnitude are Ethereum, BNB Chain, Cardano, Tron, Solana, Polkadot, and Avalanche. Ethereum dwarfs them all with a total market cap of $209 billion, nearly three times the combined market cap of all other L1 blockchains (besides bitcoin).

All these blockchains, including bitcoin and Ethereum, have suffered heavy losses in the crypto bear market of 2022. The entire blockchain sector suffered a collective loss of $2 trillion in market cap from January 1, 2022 through June 2023.

Despite these losses, we believe the industry still has an upbeat future, at least in the case of the two main blockchains – bitcoin and Ethereum. Both are firmly established, with stable ecosystems and global user bases, and are least likely to suffer a catastrophic collapse.

However, the fate of the remaining players in the market is less clear, largely due to factors like increased competition, internal weaknesses, and above all, increasing regulatory pressure. This vital point will be discussed in greater detail in our investor thesis below.

Top Layer-1 Projects

| Project | Market Cap | Annualized Revenue | Assets Staked (market cap) | Total Daily Transactions | Daily Active Addresses |

| Ethereum | $209.2b | $2.51b | $34.4b | $474k | 527.6k |

| BNB Chain | $37.1b | $20.12m | $5.39b | 3.49 | 2.0m |

| Cardano | $9.6b | $0 | $6.47b | 66,791 | 54,977 |

| Solana | $6.0b | $561k | $6.02b | 29m | 143.3k |

| Polkadot | $5.7b | $222.75k | $2.62b | 8.82k | 4.3k |

| Tron | $6.5b | $89.4m | $2.69b | 12m | 2.7m |

| Avalanche | $4.1b | $1.3m | $3.14b | 457.9k | 161k |

Investment Thesis

Blockchain proposes a radically different way of handling large volumes of sensitive data in a secure yet highly decentralized manner. This model has massive ramifications for our modern economy, where data is traditionally stored in centralized databases.

In sectors as diverse as finance, health care, real estate, business, and logistics, organizations are forced to spend vast amounts of resources to maintain database security. This often comes at the cost of efficiency, economy, and privacy.

Blockchain technology has the power to change all that. And Layer-1 blockchains are the building blocks of this decentralized future, particularly in the space of payments, finance, and banking. L1s are like the operating system for the blockchain ecosystem. They provide the base layer upon which everything else is being built.

This is particularly true for Ethereum. It’s smart contracts allow developers to build all sorts of interesting (and potentially profitable) dApps on top of the base Ethereum layer. Investors can also use DeFi apps and smart contracts on Ethereum and other L1 ecosystems to put their crypto assets to work in yield farming and crypto lending. You can also hold the coins native to the blockchain for speculative trades.

Layer-1 blockchains are popular among investors because they open the doors to a wide range of investment opportunities with varying levels of risk. However, because of the very nature of the L1s, that is to provide the base layer for everything, it’s not likely that they can all survive. In order to survive, Layer-1 relies on a growing developer community, and the associated network effects. This means that in the future it is likely that we will see 1 or two dominant L1s and perhaps another 1-2 more “niche” and smaller L1s take over the blockchain ecosystem.

Investor Alert: The Potential Impact of SEC Regulations in 2023

While they hold an immense promise of high ROI, investments in Layer-1 blockchains do present risks. Market volatility is a major threat in the crypto space. Bear markets and flash crashes routinely wipe out billions of dollars in market cap in a matter of days or weeks.

However, many of the Layer-1 blockchains face another threat from agencies like the Securities and Exchange Commission (SEC) in the United States: more stringent regulations. In the aftermath of the collapse of Terra/LUNA and FTX, regulators are cracking down on the crypto space.

Leading the charge, the SEC has classified the tokens of more than 12 major blockchains as securities. Under current US regulations, entities selling securities to the public have to be registered with the SEC.

It also brings stringent compliance rules regarding the disclosure of information, and other extensive financial regulations, audits, and oversight. The SEC has also filed lawsuits against the two major centralized exchanges – Binance and Coinbase – for selling Layer-1 tokens and other crypto products in the US.

The SEC has classified all the major Layer-1 tokens, except Bitcoin and Ethereum, as securities. Trading or selling these tokens may incur penalties for cryptocurrency exchanges.

For investors, the Layer-1 blockchain landscape has become a lot more complicated outside of ETH and BTC. The recent SEC regulations could also hurt the price and liquidity of all L1s.

We strongly recommend all investors think carefully before investing in any of the other L1 tokens targeted by the SEC. It could be a while before we get further clarity on the matter since multiple lawsuits are pending in the courts, and could take years to settle. In addition, it seems Congress is weighing in on the recent SEC actions, and looking to push back with new regulatory frameworks, which could be a win for the crypto industry.

Who’s Investing: Institutional Backing

The Layer-1 blockchain space has probably seen the largest influx of institutional capital in the entire crypto space. Bitcoin leads due to its unique status as a high ROI speculative asset. Major investors holding bitcoin worth hundreds of millions of dollars include companies like MicroStrategy, Tesla, Galaxy Digital Holdings, Block, Coinbase Global, and Riot Blockchain.

Due to its highly scalable and environmentally-friendly technology, Ethereum has also attracted considerable interest from companies like Tesla, Alphabet, Square, and Paypal. Hedge Funds like Fortress Investment Group, Ark Investment Management, and Renaissance Technologies have also bet on Ethereum since 2021.

And all that is just an investment into buying the native tokens of these blockchains. Some projects have also raised cash over time through multiple avenues like initial coin offerings (ICOs) and subsequent funding rounds.

For instance, Solana’s ICO invited interest from investors like Coin Shares, Multicoin Capital, Buck Stash, and the now-defunct Alameda Research. Major investors in Polygon include Disney Accelerator, Crown Venture Capital, Celsius Network, SoftBank Vision Fund, and Steadview Capital.

Top Layer-1 Protocols by Market Cap

Ethereum

Ethereum

Price: $1,738.66

Annualized Revenues: $2.51b

Daily Active Users: 338k

Twitter Followers: 3.08m

As the second largest blockchain by market cap behind bitcoin, Ethereum requires no introduction. The project was launched in 2015 as a Proof of Work blockchain by several developers, including Vitalik Buterin.

Ethereum is incredibly popular due to its excellent support for smart contracts and decentralized apps that can solve real-world problems. The native asset of the blockchain is Ether (ETH), the second largest cryptocurrency by market cap.

Due to increasing network congestion and high transaction fees (gas), Ethereum began a switch from Proof of Work to Proof of Stake (PoS) in 2020. The final network update (the Merge) was completed in April 2023.

Further updates will bring other features like sharding to solve the problem of network congestion. Among all the blockchains on this list, Ethereum undoubtedly has the most well-developed Layer-1 ecosystem and – in our opinion – the best growth prospects.

Thanks to the promise of additional rewards through staking and other DeFi projects, demand for ETH remains quite high in 2023. The risk of regulatory sanctions are also lower as the SEC considers ETH to be a commodity, not a security.

BNB Chain (BNB)

BNB Chain (BNB)

Price: $237.46

Annualized Revenues:

Daily Active Users: 1.2m

Twitter Followers: 10.5m

BNB Chain was originally called Binance Smart Chain. It was launched in 2020 by Binance, the largest cryptocurrency exchange in the world. Although Binance is a centralized exchange, BNB Chain is designed to be a decentralized and permissionless blockchain.

BNB began life as an ERC-20 token on the Ethereum blockchain before it was elevated to a proper cryptocurrency on its native Layer-1 protocol. Think of BNB Chain as a competitor to Ethereum, and BNB as a competitor to ETH.

Like Ethereum, BNB Chain supports DeFi, smart contracts, and scalable Layer-2 chains. The Layer-1 protocol also uses a PoS, with validators receiving rewards in the form of Binance Coin for providing liquidity and processing transactions.

BNB Chain enjoys massive popularity in key markets outside the United States due to its association with the Binance exchange. However, the company has been hit hard by regulatory action in the US.

A 2023 lawsuit by the SEC has severely affected Binance’s ability to serve US customers. Pending the outcome, both the exchange and the BNB chain could face higher operating costs and compliance burdens in the United States. Other countries have followed suit.

Due to the ongoing regulatory uncertainty in a key market like the US, it is hard to comment on the long-term growth prospects and viability of BNB Chain.

Cardano

Cardano

Price: $0.276

Annualized Revenues: $0

Daily Active Users: 50k

Twitter Followers: 844k

Between 2017 and 2020, several new blockchains were launched with highly scalable PoS consensus mechanisms. These Layer-1 protocols rose in popularity as alternatives to Ethereum, as the latter was getting bogged down by network congestion and high transaction charges.

Cardano was a leading contender among these protocols for the title “Ethereum Killer.” It is named after an Italian genius from the 16th century – Gerolamo Cardano. And the native token is named ADA in honor of Ada Lovelace, a pioneer of computer programming.

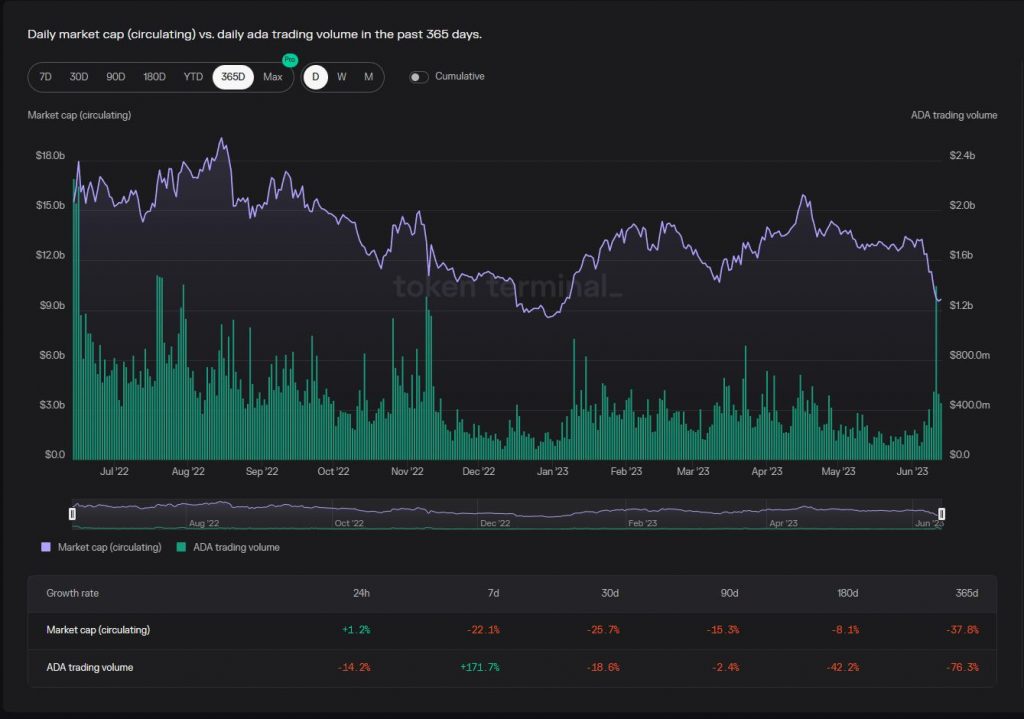

Over the years, Cardano added various innovative features including support for NFTs and smart contracts. However, despite a thriving Layer-1 ecosystem, the blockchain has largely failed to live up to the name of “Ethereum Killer.”

As a further blow, Cardano is among the 13 cryptos labeled as securities by the SEC. In the long term, this has the potential to severely restrict the trade of ADA on US exchanges. As of this writing, Cardano’s long-term growth potential looks rather bleak due to the high level of regulatory uncertainties.

Solana (SOL)

Solana (SOL)

Price: $15.20

Annualized Revenues: $6.83m

Daily Active Users: 150k

Twitter Followers: 2.25m

Solana is a Layer-1 protocol with a heavy focus on DeFi, smart contracts, and NFTs. The blockchain has its bases in Geneva and San Francisco and was launched in 2020. In its early years, Solana was touted as a promising Ethereum killer due to its scalability and speed.

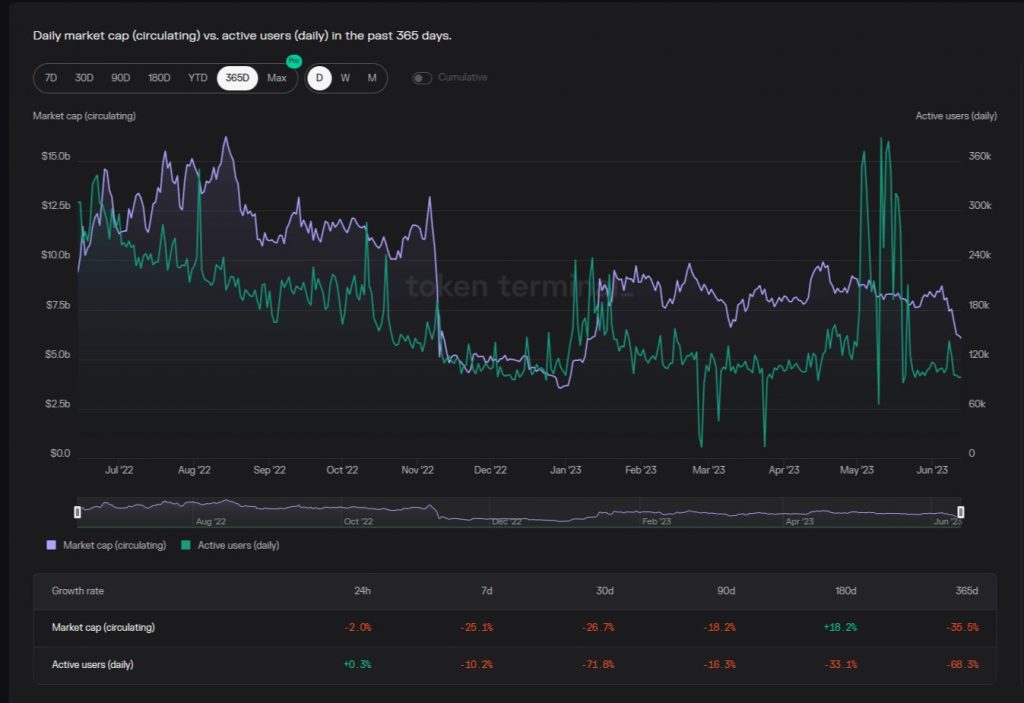

However, the blockchain has endured a stunning fall from grace since 2022. The native SOL token tanked in value by 94% in a single year. Solana was heavily affected by its association with Sam Bankman-Fried, the disgraced founder of the FTX exchange.

His investment firm had a major stake in SOL and he was also an early backer of the Solana protocol. There is even a suspicion among some quarters that Bankman-Fried’s involvement may have contributed at least indirectly to SOL’s meteoric rise.

Despite its promise of speed and scalability, Solana has struggled to live up to its billing in the contest with Ethereum. With the latter’s switch to PoS, Solana faces an even steeper climb for future relevance and growth.

Probably the biggest setback to the protocol after the FTX debacle is its listing by the SEC as a security. Lower trading opportunities in the US market could severely affect Solana’s popularity at a time when the token is already facing internal challenges and stiff competition.

Polkadot (DOT)

Price: $4.63

Annualized Revenues: $222.75k

Daily Active Users: 3.61k

Twitter Followers: 1.4m

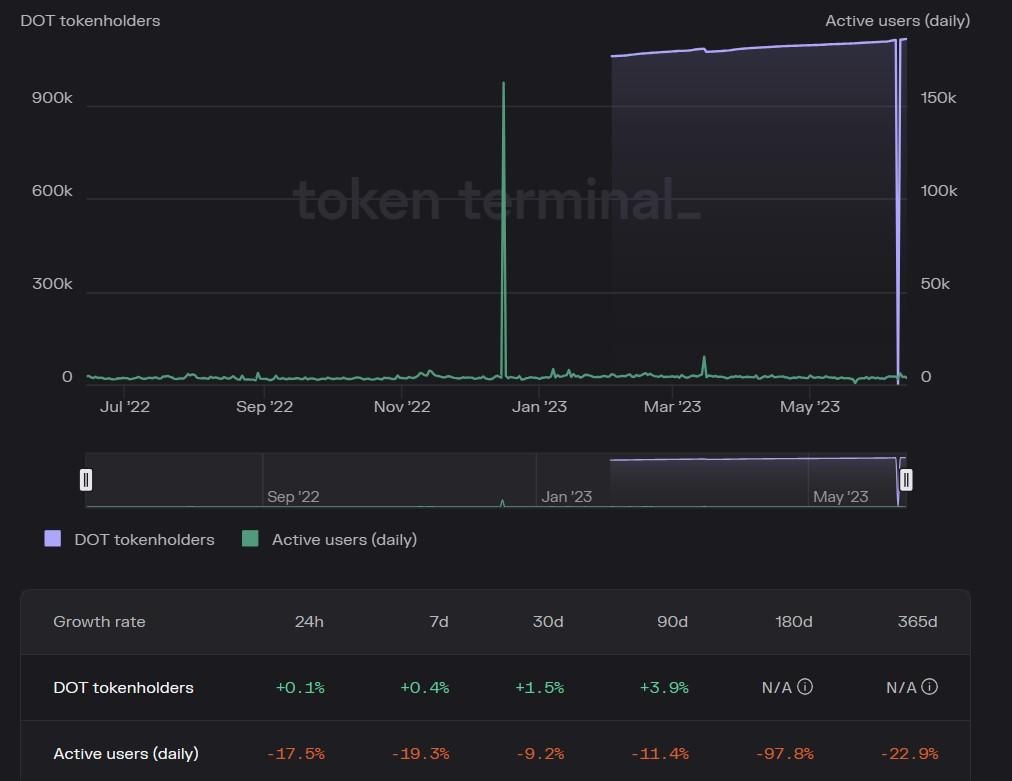

Polkadot is technically not a Layer-1 blockchain. Unlike most other protocols on this list, it operates at a much deeper level and is called a Layer-0 protocol. Polkadot was launched with the ambitious plan to act as a “blockchain for all blockchains.”

It serves as a platform where all other blockchains can exist as interconnected protocols. In other words, it is a “meta protocol.” Layer-0 protocols provide the infrastructure that facilitates secure and easy interactions between Layer-1 protocols like Ethereum and bitcoin.

In the highly fragmented blockchain ecosystem, Layer-1 protocols exist as independent silos. Launched in 2020, Polkadot has the potential to revolutionize the entire space. However, due to its complex nature, the blockchain is more oriented toward developers than retail users.

The Polkadot system has a central protocol called the relay chain. Users can create additional chains in parallel to the relay chain. These “parachains” can connect among themselves and with other popular blockchains using a connecting layer or bridge.

The native token on the protocol is called DOT. It acts as the governance token and can also be used to earn staking rewards. Polkadot had a rough year in 2022, as many of its associated NFT and DeFi projects failed to gain traction due to the market crash.

Another major setback was the de-pegging of the algorithmic stablecoin Acala. The Acala network was a major source of revenue for the Polkadot platform. The subsequent crash of major CEXs and stablecoins in the market has also contributed to a steep fall in DOT prices.

In the ongoing bear market, Polkadot faces an uncertain future. However, there is no doubt that the parachain concept has immense utility in a diverse crypto market filled with multiple Layer-1 protocols. Polkadot’s growth prospects are tied to the wider prospects of the crypto/NFT/DeFi markets.

Tron (TRX)

Tron (TRX)

Price: $0.0724

Annualized Revenues: $1.09b

Daily Active Users: 2.03m

Twitter Followers: 1.4m

Tron is a Layer-1 blockchain launched in 2017 with a heavy focus on content creation and media consumption. It aims to act as a platform where creators – musicians, designers, artists – can remove intermediaries and claim full ownership of their creations and deal directly with their audience.

The blockchain is extremely popular among users because it does not charge any fees on transactions. This has allowed the protocol to remain viable despite a long series of controversies and scandals.

Tron’s founder Justin Sun is one of the most outspoken and controversial figures in the cryptocurrency industry. Despite (or maybe because of) this, Tron has retained a significant following in Asia. In its early years, the protocol developers focused heavily on the Asian crypto markets.

Due to its absurdly low transaction fees and heavy involvement in DeFi/NFT space, Tron still has robust growth prospects in its overseas markets. However, inside the US, its chances are much bleaker given the regulatory stance.

Tron’s native token TRX was labeled a security by the SEC in early 2023. In a lawsuit, the regulator charged founder Justin Sun and eight others with a wide range of charges including securities fraud.

Avalanche (AVAX)

Price: $11.81

Annualized Revenues: $15.92m

Daily Active Users: 70k

Twitter Followers: 954k

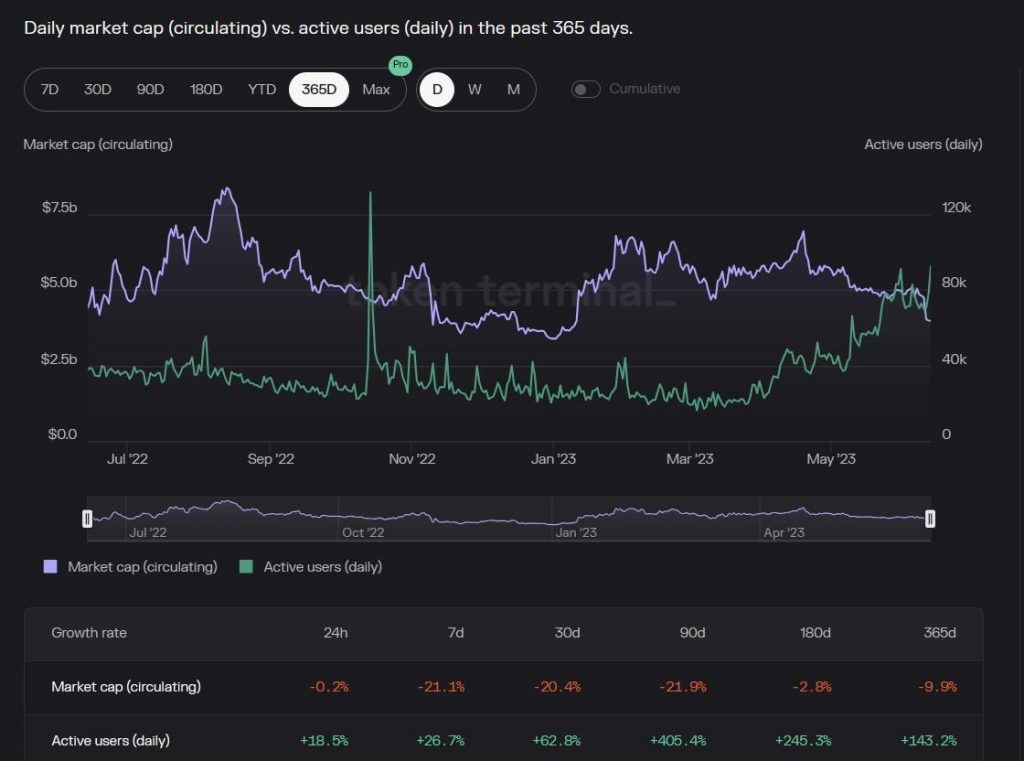

Like Cardano and Solana, Avalanche is another Layer-1 blockchain designed to provide a better user experience than Ethereum. The protocol was launched in 2019 when Ethereum was going through one of its worst phases of network congestion.

The native token on Avalanche is called AVAX. It can be staked for passive rewards. Owners also get governance rights on the protocol. With a circulating market cap of $4 billion, AVAX is nowhere close to ETH in terms of adoption. But among L1 protocols, it easily slots into the top 5 lists.

And over the years, AVAX has remained relatively free of major scandals and controversies. The protocol has a unique network architecture with three separate chains handling different functions and use cases.

The protocol has steadily cultivated a layer-ecosystem filled with DeFi projects, NFTs, and other decentralized apps. It also offers excellent integration with Ethereum through a bridge that is under constant development.

AVAX has not been labeled a security by the SEC as of this writing. If things hold, this could be a major boost for the blockchain against its direct rivals like Solana, Cardano, and Polygon. The project is probably never going to overtake the post-PoS switch Ethereum. But it still has quite a lot of staying power in its present condition.

Investor Takeaway

Layer-1 blockchains are central to the growth of the cryptocurrency and DeFi markets. Over the years, the sector has attracted massive investor inflows while undergoing frequent boom and bust cycles.

The most recent crash in 2022 was particularly severe, wiping out nearly two trillion dollars in investor funds. That, and the high-profile collapse of major entities like Terra/LUNA and FTX has increased regulatory scrutiny over the entire space.

Outside of the top two blockchains – bitcoin and Ethereum – all other Layer-1 blockchains are on the radar of the SEC in the United States. These tokens have all been labeled as securities. Any sale or trading of unregistered securities could attract regulatory penalties.

Many US-based exchanges and platforms have already stopped offering trades or sales on the affected layer-1 blockchain tokens. If you are already an investor, we strongly suggest that you think carefully before investing in other L1s, outside of bitcoin and Ethereum.

Subscribe to Bitcoin Market Journal to learn more about blockchain investing in Layer 1 protocols.