In my book Blockchain For Everyone (now a bestseller), I outlined a simple method for investing in digital assets without breaking the bank. If you’re still watching from the sidelines, the new year is a great time to get invested — and to review the results of our investing strategy so far.

The basic idea is to “seed” your account with a one-time investment (for illustrative purposes I chose $10,000), then sock away a set amount on the 1st of every month (I chose $100). You can use any starting amount, and any monthly amount — the important thing is to be consistent. (Details here.)

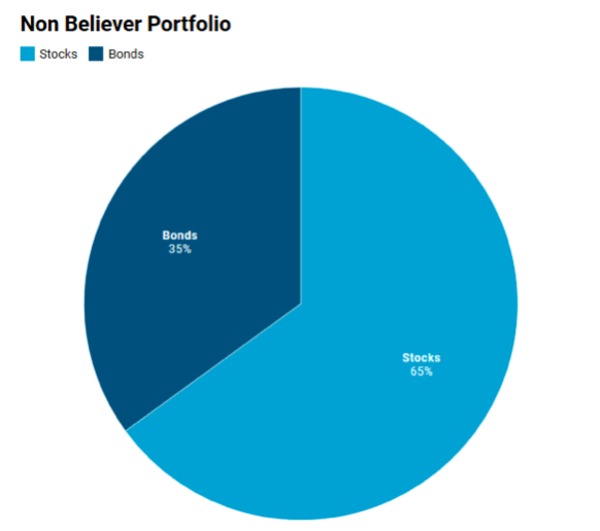

In a plain-vanilla portfolio, you might invest these monthly installments in traditional stocks and bonds, like so:

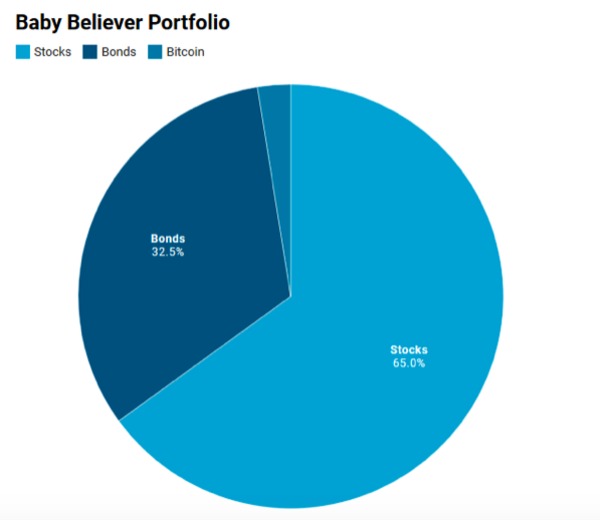

But let’s say you’re a smart investor who’s heard of the incredible profits made by bitcoin billionaires. You want to buy a little bit of bitcoin, without betting the bank. In the “Baby Believers Portfolio,” you put 2.5% of your monthly contribution into bitcoin:

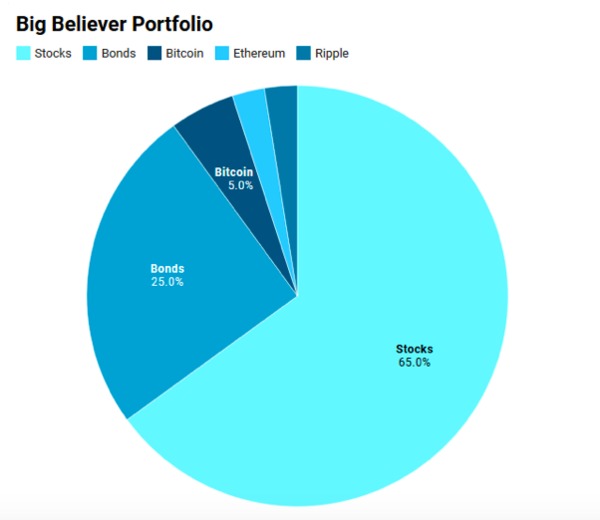

And if you believe even more strongly in this new class of digital assets, you can invest up to 10% in the top 3 altcoins (5% bitcoin, 2.5% Ethereum, 2.5% Ripple):

The Honest Results

Anyone can make a “winning portfolio” by looking at past performance, just like anyone can pick “winning lottery numbers” by looking at what was picked last night. The trick is to come up with a winning portfolio for the future.

This requires honesty. In the book, of course, I looked at past performance to come up with my winning portfolio — I had to show that this approach was both sensible and profitable. But would it hold into the future?

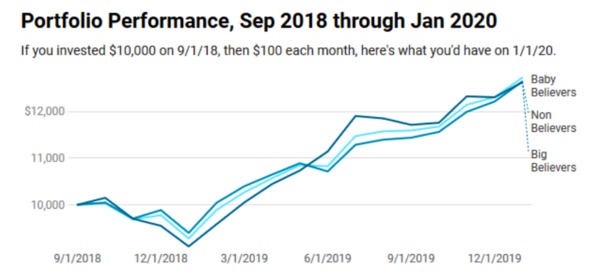

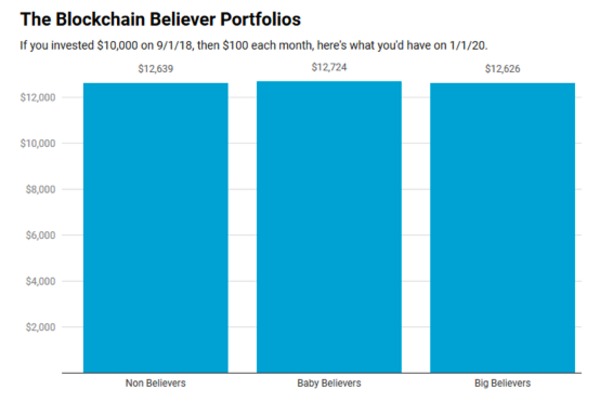

After I finished the manuscript in August 2018, I began tracking the performance of the Baby Believers and the Big Believers, judged against the Non Believers. And here’s where we are today: the Non Believers and the Big Believers are just about even, while the Baby Believers are edging them both out.

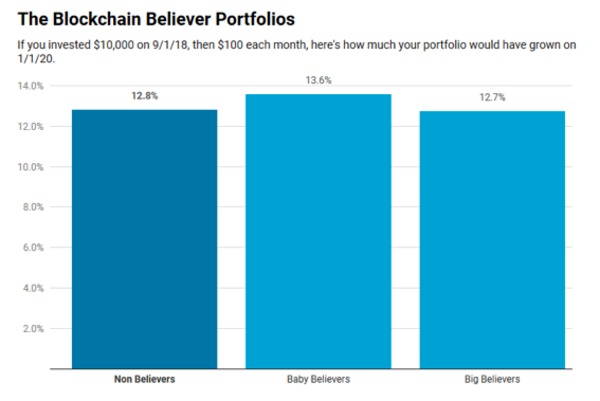

Here are the three portfolios, by percentage gains:

Here are the three portfolios, by percentage gains:

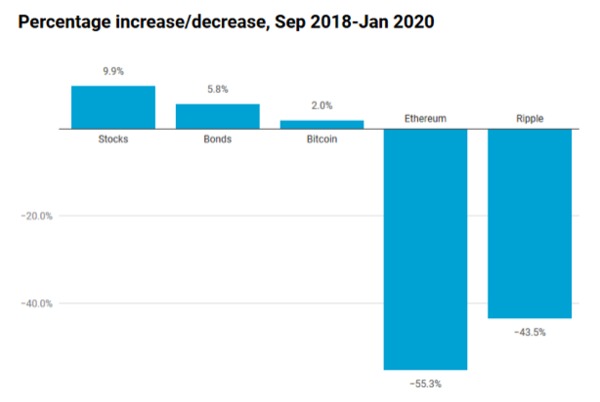

To explain these results, let’s look at the fortunes of each of the “ingredients” in the “pie.” While both the stock market is up 10%, Ethereum and Ripple have lost around half their value:

The extreme volatility of these digital assets is why we invest only a small amount. By limiting our exposure to Ethereum and Ripple, we are still on par with the Non Believers who invested only in stocks and bonds. And those who invested in bitcoin (the Baby Believers) performed best.

Of course, all this is a lot of work for not a lot of return. Buying these digital assets, taking the additional risk, reinvesting the profits—and this is the thanks we get?

It comes down to what you believe. If you think digital assets are the future of finance, you’re still keeping up with the stock market, and you’re poised to take advantage of future gains.

If you’re not a believer, then I urge you to consider what you do believe. Do you think that the entire digital asset market — all $200 billion of it — will go to zero? That it will all turn out to be a weird dream, and the global economy will just return to exactly where it was before bitcoin? If not, then what?

If you believe — as I do — that change is inevitable, particularly in money matters, then you can keep investing. (Or start investing.) You can invest — as I do — primarily in the traditional markets, with a small “side bet” on the new digital markets.

Rebalance Portfolios on January 1 and July 4

These returns assume that you are rebalancing your portfolio every month. For many people, this is impractical, so consider rebalancing at least twice a year (January 1 and July 4 are easy dates to remember — at least for our American readers).

For a Baby Believer, this means if you are holding more than 2.5% of your portfolio in bitcoin (which you are), sell the bitcoin and reinvest it in the other slices of the pie.

This is the hardest thing to do, since we naturally want to hold onto a winning hand. But it must be done. If you’re following the Baby Believer or Big Believer strategies, please consider reallocating your entire portfolio so you’re back in line with the percentages — and believe in them.

Bottom line: If you’re making New Year’s Resolutions or planning your financial strategy for 2020, here’s an investing blueprint to get you started. And once you’re started, don’t stop believing.

Related Articles:

- A Roadmap Toward Better Blockchain Education

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

- Best Bitcoin and Cryptocurrency Exchanges 2020

Stay up-to-date with the most important developments in the digital asset markets by subscribing to Bitcoin Market Journal today!