When the United Kingdom made the decision to leave the European Union, commonly referred to as “Brexit,” the price of bitcoin soared against the British pound, which weakened substantially against all currencies as a result of the uncertainty pertaining to Britain leaving the EU.

In the years to follow, the price of bitcoin regularly spiked following important Brexit-related events. As a result, Bitcoin Market Journal has decided to dive deeper to investigate correlations between Brexit and price movements of bitcoin.

The Brexit Referendum Spike

Historically, the price of bitcoin has spiked during times of political and economic uncertainty. You likely witnessed that during the Cypress bank bail-in in 2013 and during the height of the Greek debt crisis in 2015, for example. The same effect occurred after the British population surprisingly voted to leave the European Union during the June 23, 2016 referendum.

As soon as the results were announced, the price of bitcoin rallied by over $100 from the mid $500s to the high $600s, which marked a 20 percent jump in value within 24 hours.

Perhaps, unsurprisingly, the currency pair BTC/GBP rallied even more as the value of the British pound plummeted to a historic 31-year low against other currencies.

The post-referendum price spike, however, is not the only correlation between Brexit events and the price of bitcoin.

A Google Trends Analysis

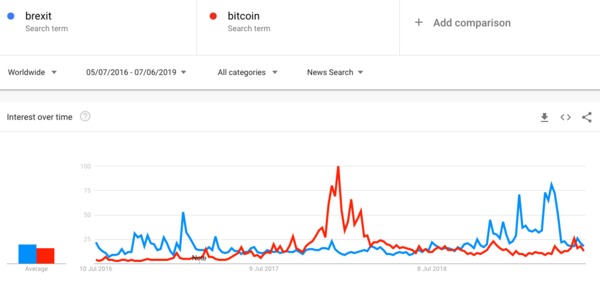

Comparing the search terms ‘Brexit’ and ‘bitcoin’ for Google News searches, you can observe that there have been numerous spikes in search interest for Brexit and bitcoin at the same time over the course of the last three years.

Of course, the correlation is not one-to-one as the search demand for bitcoin was massive during its late 2017 rally and Brexit searches spiked in early 2019 when the details of Britain’s EU departure were supposed to have been finalized.

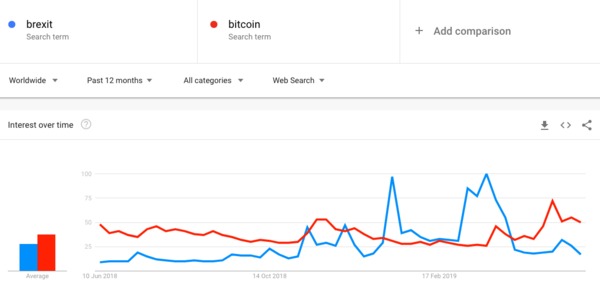

A correlation can also be witnessed when looking at web search volumes for Brexit and bitcoin in the past twelve months. Here, it is visible that the search demand for bitcoin rose shortly after people were searching for updates on Brexit, which could suggest that investors were looking at purchasing bitcoin following more uncertainty surrounding the UK’s departure out of the European Union.

Bitcoin vs Key Brexit Dates

Perhaps the most interesting for bitcoin traders is the reaction of the price of bitcoin following key Brexit dates. The price of bitcoin rallied aggressively after the surprise leave vote in June 2016, but how has bitcoin responded to the following Brexit dates and key announcements?

October 2, 2016: Prime Minister Theresa May announced that Britain will start the formal process to leave the EU by March 2017 – Bitcoin does not react.

March 29, 2017: Britain triggers Article 50 to start the leaving process to be completed by March 2019 – Bitcoin rallies by 2 percent.

November 25, 2018: The EU approves a withdrawal deal reached with Britain that yet needs to be approved in the British parliament – Bitcoin jumps by around 7 percent.

January 15, March 12, and March 30, 2019: Proposed Brexit deals are rejected by UK Parliament – Bitcoin does not react.

April 11, 2019: The UK and the EU agree to extend Brexit deadline to October 31 – Bitcoin does not react.

Conclusion

The price of bitcoin reacted aggressively to the results of the referendum and you can view some correlation between bitcoin and Brexit Google Search trends. Additionally, Brexit announcements that suggest the UK will leave the EU coincide with spikes in the price of bitcoin, which would substantiate the claim that there is a Brexit-bitcoin correlation.

The price of bitcoin reacted aggressively to the results of the referendum and you can view some correlation between bitcoin and Brexit Google Search trends. Additionally, Brexit announcements that suggest the UK will leave the EU coincide with spikes in the price of bitcoin, which would substantiate the claim that there is a Brexit-bitcoin correlation.

Traders who are looking to place bets on the Brexit-bitcoin correlation could potentially benefit by positioning themselves ahead of important Brexit dates. Moreover, bitcoin traders would likely benefit from extreme scenarios such as an overturning of the decision to leave the EU or the day that all involved parties finally agree for the UK to leave the EU.

For long-term investors, the Brexit-bitcoin connection should have little bearing on investment decisions as the short-term volatility caused by a reaction to Brexit events is unlikely to have any bearing on the long-term price developments of bitcoin.

Related Articles:

- How Many People Use Bitcoin in 2019

- How to Open a Bitcoin Wallet, Step by Step (With Photos)

- Best Bitcoin Trading Platforms

To learn more about trading, mining, or investing in bitcoin and other digital currencies, subscribe to the Bitcoin Market Journal newsletter today!