Well, I suppose it was only a matter of time. Thanks to the magic of tokenization, the crypto community can all have piece of what they want.

That’s right bro…. tokenized lambos!!

Kidding aside, according to Knight Frank’s Luxury Investment Index, classic cars have been one of the best performing investments of the last decade. So, as we transition to a fully digital, fully tokenized economy, you may not be able to get behind the wheel but at least you can use these beautiful machines as part of your portfolio.

Happy Brexit Day

Muted celebrations ring out through the United Kingdom today. Even those who voted against the Brexit are no doubt at least somewhat relieved that after 3.5 years, it’s finally over.

The divorce has been finalized and now the healing process can begin. The very first part of that process will be for the UK and the EU to negotiate on a comprehensive trade deal, which has a tentative deadline of the end of the year.

Far as I know, the issue of the Irish border has yet to be resolved and there are still a few key sticking points. Come to think of it, I’m not even sure if we can classify this as a hard or a soft Brexit?

At least Mark Carney will be able to fulfill his dream and leave the UK as planned on March 16th. At his final meeting at the helm of the Bank of England yesterday Mark refused to give into market demand for a rate cut and instead will leave that decision up to his successor. Got to hand it to the guy, all things considered he’s handing off an incredibly stable currency.

Here we can see the GBPUSD over the last few years. For reference, I’ve drawn a Fibonacci Retracement line from the day of the referendum until the lows that held fast. At the moment, we’re sitting just below the 2nd fib level, which could mean that the price is still pretty low, especially now that a lot of the Brexit uncertainty is gone.

So Many Crypto Options

So, it seems my lambo/moon projections from yesterday didn’t exactly play out as planned. Sorry about that. The bullish flag was indeed broken to the upside and the Bitcoin ended up being rejected by resistance at $9,600. A rejection it didn’t handle too well and is now again testing the $9,200 handle.

Don’t get me wrong. The action is still quite promising as we remain well above the 200 DMA and outside of the downward channel. Two levels that have yet to be tested to the downside. Conservatives however, will prefer to wait until we get a golden cross before declaring an official bull market. Notice in this chart how the orange line is closing in on the blue, but has not yet crossed over.

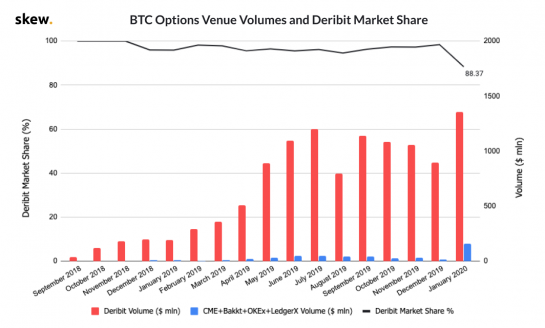

Volumes on exchanges remain quite strong as are the CME futures. One thing that’s caught my attention though is the growing presence of the crypto options market. Not of Bakkt unfortunately. The new Bakkt bitcoin options seem to be yet another flop for Wall Street’s crypto darling. Perhaps they’ll build up volumes later on like they did with their futures.

However, the options over at Deribit have in fact been growing traction lately. Especially this month due to the breakout. Even though they’ve lost a bit of market share thanks to competitors coming online, volumes surpassing $1 billion a month is definitely noteworthy.

For your entertainment pleasure this weekend, I highly recommend the following video interview with Campbell R. Harvey, J. Paul Sticht Professor of International Business at Duke University and the inventor of the Yield Curve signal, which we spoke about earlier this week.

Cam not only discusses Bitcoin’s status as a safe haven but also backs my projection of a new tokenization enabled barter system that we’ve been speaking about lately as well. So check it out….