It never fails. Hit the send button on a piece of analysis that you’ve poured your sweat and tears into, then 30 seconds later, watch the market render it irrelevant.

This is a particularly bad problem in the digital asset space, since crypto is so volatile, but it’s certainly not a new phenomenon.

Those of you who’ve ever written any sort of financial analysis know exactly what I’m talking about. Over time, the good ones tend to develop a sense of covering both sides of the market, not trying to predict the future, but rather exploring the various paths the markets may take.

Much to my dismay, this almost happened yesterday, as we suggested in the BMJ newsletter that bitcoin was holding up well against the U.S. dollar strength, only to see it take a spill shortly after publishing and give yet another strong test of the key psychological level of $10,000.

By now though, as tends to happen far more often then can be explained by skill, the market has found a way to vindicate my words.

A strong surge in bitcoin, which seems to have been caused by a timely short squeeze, is seen showing a strong push off that technical level and massive green gains in the rest of the coins as well, moves that are only loosely reciprocated by the traditional markets.

In the short-term, it’s unclear if we’re out of the woods or going in deeper, but market analysis always works better in the long-term, as do investment strategies.

Back to reality

Speaking of long-term vs short-term trading, we can now see the traditional markets coming back down to Earth in many ways.

There was a while there where things were completely unrealistic and markets were doing some rather bizarre things. Like any drunkard may tell you sobering up can be a painful process but is really necessary every once in a while to maintain clarity of mind.

Just take a look at this chart. …

Many of you will likely recognize the company name, as they’ve been in the news a lot lately. This is a live look at how pump-and-dump schemes are not exclusive to crypto.

Nikola is listed on the Nasdaq and falls under the watchful eye of New York’s finest financial regulators, yet somehow even though they’ve never actually produced a single product, they managed to see their shares appreciate by a factor of 10X in just a few short months, based on hype alone.

Yeah, they did strike some rather interesting partnerships with large multinational corporations and make a bunch of headlines. But at the end of the day they have yet to create anything of value.

Thus, it should have been obvious to everyone at the time that those share prices were simply unsustainable.

Both Hertz and Wirecard, who witnessed similar sort of hot-air pumps, have also returned to more realistic market prices. Is the craziness over?

Well, is it?

Undoubtedly, yes.

Of the factors that drove the markets to the brink of insanity during the last few months, by far the strongest two were a) the copious amounts of stimulus used by governments and central banks and b) a rush of new retail traders.

Both of these factors are now pretty much gone. The Federal Reserve isn’t printing any more. The shock-and-awe campaign is over, and now they’re begging Congress to inject cash directly into people’s pockets again, something Congress can’t seem to do while divided.

The House of Representatives and the Senate are held independently by the two political parties, who have something new to bicker about following the passing of Supreme Court Justice Ruth Bader Ginsburg, making the possibility of any sort of compromise on fiscal stimulus nothing more than a pipe dream.

The retail traders also seem to be gone. Yes, even if we count up everyone in the 99%, they only have a limited amount of free capital that can be deployed, unlike the 1% that has an endless amount.

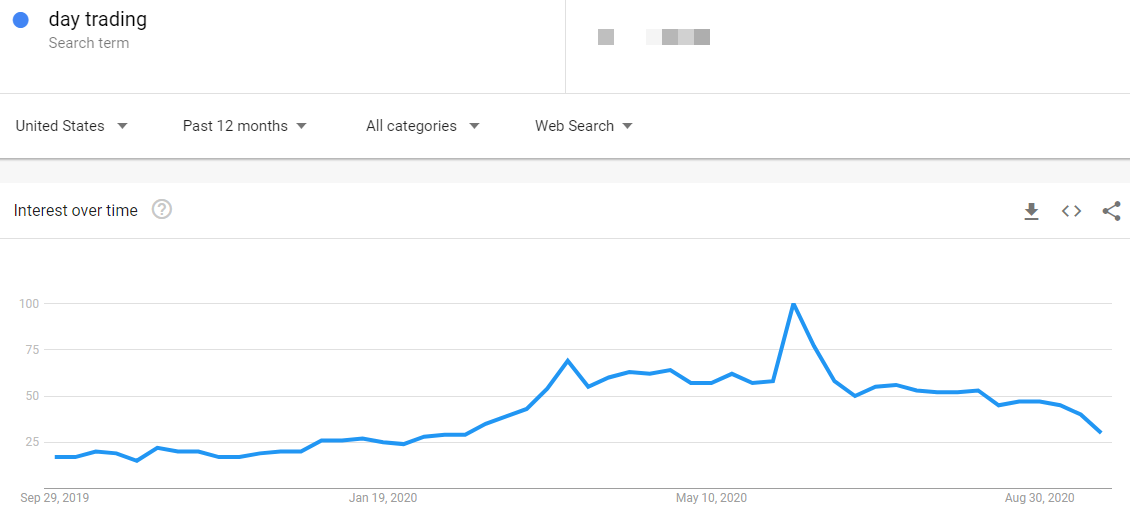

Here we can see searches for the term “Day Trading,” which was so popular in March through June, have by now has completely waned.

So yeah, the market dynamic is shifting now and fast. Of course, with the U.S. election coming up, no doubt we’re in for a lot of volatility ahead.