Don’t you just love these markets?

The Nasdaq Composite is down about 10% from her peak last week. The dip on ether is more like 30% from tip to trough.

Further down the ladder we have DeFi, which is a world that exists under Ethereum within the sphere of FinTech, a subset of technology that hasn’t really penetrated the NASDAQ too much to date.

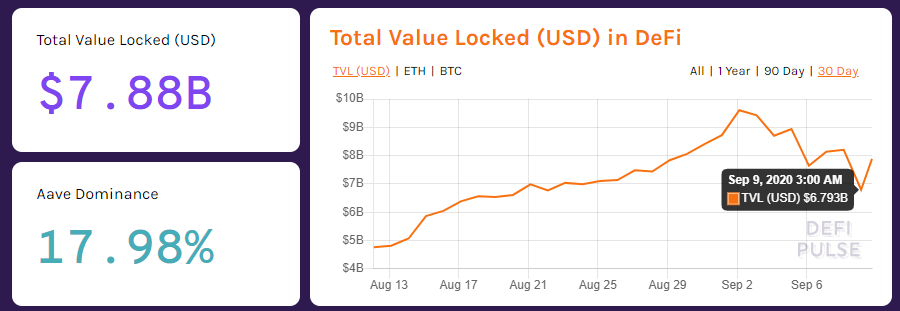

The total amount of money currently deployed in DeFi contracts almost hit $10 billion at the beginning of the month, before the slide.

What’s most awesome about this is the dominant project now accounts for less than 18% of the total market share, which tells us that the world of decentralized finance is getting progressively more … decentralized.

In fact, there are now four separate projects with an allocation of more than $1 billion and more than half a dozen more with an allocation greater than $100 million.

This is still a pretty small market, but the progress over the last few months has been astounding. Whether this bubble is about to pop or just in its infancy is impossible to tell at this point, but one thing is for sure. It’s very exciting to watch.

Almost like that song by Fastball: The Way

Drank up the wine

If there’s something that caught my eye in the news today it’s this new ETF that just came online at the NYSE today. As someone who’s spent a copious amount of time lately researching funds and fund structures, the listing of a new fund is interesting, but what’s more interesting is what it is investing in.

On Aug. 1 last year, I wrote a post titled Probably Nothing to Worry About, in which we explored a new trend at that time called CLOs, which are basically the corporate debt version of the retail-based CDOs that played a key role in the 2008 financial crisis.

Basically, they bundle up a bunch of corporate debt and make an investment product out of it. So this new ETF will be primarily investing in those. Now, there’s probably nothing to worry about here, but it does seem a bit cheeky that the ticker for this new ETF is AAA.

Especially at this time, it’s highly likely that a whole bunch of corporate debt will eventually default. So, is this just a clever way for the big banks to offload some of their garbage onto retail investors at a time when there are so many green participants that even bankrupt companies are pumping from hype?

In any case, it does sound a bit dubious. I think we’ll be steering clear of this one.