Ethereum has begun its evolution toward Ethereum 2.0, moving from a proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS). The transition officially began on December 2, 2020, and won’t finish entirely until 2021 or later.

The change will solve the issue of scalability which in turn, provides several enhancements to the network. Ethereum 2.0 will be faster, more secure, and capable of processing far greater amounts of transactions than before.

What’s more, holders of the network’s native currency ETH will be able to earn ‘interest’ in the form of newly issued ETH via staking.

Ethereum Staking: How to Stake ETH

To stake Ether (ETH), and thus to earn interest in the form of new ETH, users can deposit a minimum required sum of ETH into a special wallet or pool, linked to a smart contract (masternode). The size of the deposit determines that of the reward that stakers receive.

What is the minimum staking amount? The minimum stake to become a validator is 32 ETH. You can stake less in staking pools, however.

Becoming a validator

Becoming a validator does require a good standard PC/Laptop to operate, as well as some serious technical know-how. There are also minimum coding requirements, so if this is for you, you can begin by downloading the Ethereum client here.

To assist you, there are plenty of validator services that may remove some of the technical hurdles for a fee. This list here is a great place to get started.

As a validator, a user who stakes 32 ETH could earn up to $7.04 a day according to stakingrewards.com; with a yearly earning of $2,571.

PC Minimum requirements:

- Operating System: 64-bit Linux, Mac OS X, Windows

- Processor: Intel Core i5-760 or AMD FX-8110 (or better)

- Memory: 4GB RAM

- Storage: 20GB available space SSD

- Internet: Broadband internet connection (10 Mbps)

- Power: Uninterruptible power supply (UPS)

ETH Staking Using a Third-Party Provider

Staking in a Pool: Staking pools are a means to become a staker without having to have 32 ETH or run complicated software systems. Instead, these handle the hard work for you and users share the rewards respective to their staked amounts, a list of staking pools can be viewed here.

Staking on an Exchange: If neither of the above appeals to you, there are plenty of exchanges that also provide Ethereum staking services. Below is a list of exchanges offering ETH 2.0 staking:

- Binance – A minimum of 0.0001 ETH is required to stake on this exchange, with projected returns of between 5% – 20% a year.

- Coinbase – The leading U.S. exchange is yet to reveal any major details as of yet, but they have publicly announced their support.

- Kraken – Kraken announced that ETH2 tokens staked on their exchange generate a return of 5% – 17%, though no details on minimum deposit amounts have been announced.

- Huobi – China’s No.1 exchange is open for staking, with a minimum of 0.1 ETH required and an estimated return of 6% – 20% per year.

- OKEx – OKEx requires a minimum of 0.1 ETH to begin staking, with returns between 6% – 20% per year. There is also a USDT rewards program for users of the Ethereum 2.0 staking service.

Important note: As the migration to Ethereum 2.0 is only just beginning, it will be some time before validators are able to withdraw their stake until certain upgrades have been released. This also applies to those looking to stake in pools, as many services aren’t accepting deposits for that same reason.

How Does Ethereum Move from PoW to PoS?

The consensus protocol switch is part of a larger set of planned upgrades, known as Serenity. Once fully implemented, Serenity will take Ethereum to Ethereum 2.0.

The scope of Serenity is much wider than the PoW-to-PoS move. It also encompasses the replacement of the Ethereum Virtual Engine, the “heart” of the network, with eWASM, some quantum-proofing elements, and the radical improvement of the survivability of the network.

The introduction of Ethereum staking is the very first step of Serenity.

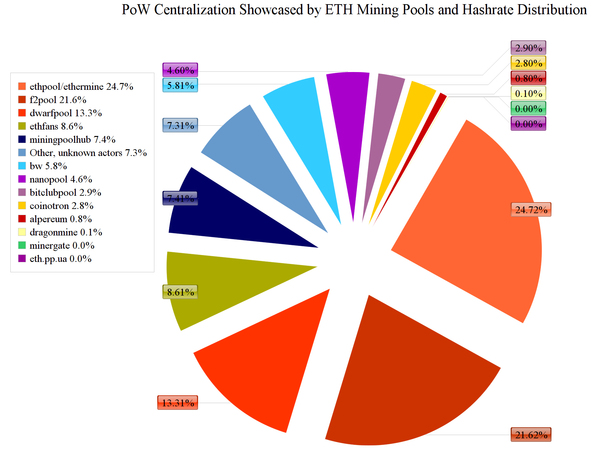

- It all begins with the implementation of the Casper PoS protocol, on a parallel blockchain called Beacon Chain. Casper will address the issue of scalability and the threat of centralization through PoW. In a PoW environment, a handful of mining pools are responsible for the majority of hashing.

- Casper sets the stage for a process called “sharding”.

Sharding spreads the workload over several smaller databases, radically increasing efficiency. It is extremely difficult to implement on PoW blockchains but much easier in a PoS environment. - Hot on Casper’s heels, comes a PoW “difficulty bomb”. It makes mining very difficult at first and quite impossible down the line. It is meant to herd miners over to the PoS chain.

- Eventually, the entire PoW chain gets folded into the PoS one, using a massive smart contract.

The migration to PoS does indeed involve some serious challenges, and there are certainly some technical pitfalls still beguiling the Ethereum team as they carefully roll out all these new protocols and changes.

ETH Staking Is a BIG Deal

This is a watershed moment for the entire industry. Ethereum 2.0 is the biggest transformation undertaken by a single blockchain network. If Serenity is successful, the landscape will be transformed by this new precedent.The move has been garnering attention from investors and tech-minded people for some time now, and many are stacking ETH in anticipation of the full 2.0 rollout.If PoS proves to be the silver bullet that solves scalability for Ethereum, then the effects will ripple throughout the ecosystem, bringing big changes to DeFi, dApps, and other blockchain technologies that use the Ethereum network.With slow and costly transactions soon to potentially be a thing of the past, there may be a whole heap of exciting new applications waiting for the finished product to make their debut.

Related Articles:

- Bitcoin Investing 101: What is Bitcoin? How Does it Work? How Can You Invest in It?

- Blockchain Investing 101: How to Build Long-Term Wealth in the Digital Asset Markets

- DeFi Investing 101: What Is It? Where Do You Start? What Are the Risks?

The future of this space is very exciting. To stay up-to-date, sign up to the Bitcoin Market Journal newsletter today!