Have you noticed how green everything is?

One of the many benefits of the pandemic is this heightened clarity of nature. A few weeks ago, I was taking a run with my dog in the early evening. The sunlight was exquisite: golden beams filtering through the trees, and through the dog’s fur, like a Pixar film in 8K. I was suddenly gobsmacked by the beauty of nature, which had kicked into HD. Everything seemed so alive.

I thought perhaps it was my imagination, that all the time in quarantine had just given me a renewed appreciation for the outdoors. But when I shared this experience on social media, many people told me they were experiencing the same thing. As one of my friends said, “Nature is happy.”

Nature is not the only thing growing. At the beginning of the U.S. pandemic – way back on March 15, 2020, a lifetime ago – we put together “The Health and Wealth Portfolio,” a collection of traditional stocks that our research suggested might grow during the pandemic.

Those four companies – Amazon, Clorox, Netflix, and Zoom – seem obvious now, but they weren’t at the time. Three months seems like ages ago, but try to remember the widespread agreement that any quarantine would be temporary, that we’d stay home for a couple of days and then it would all be over.

In the words of Ron Burgundy, “That escalated quickly.”

And so did the growth of our Health and Wealth Portfolio.

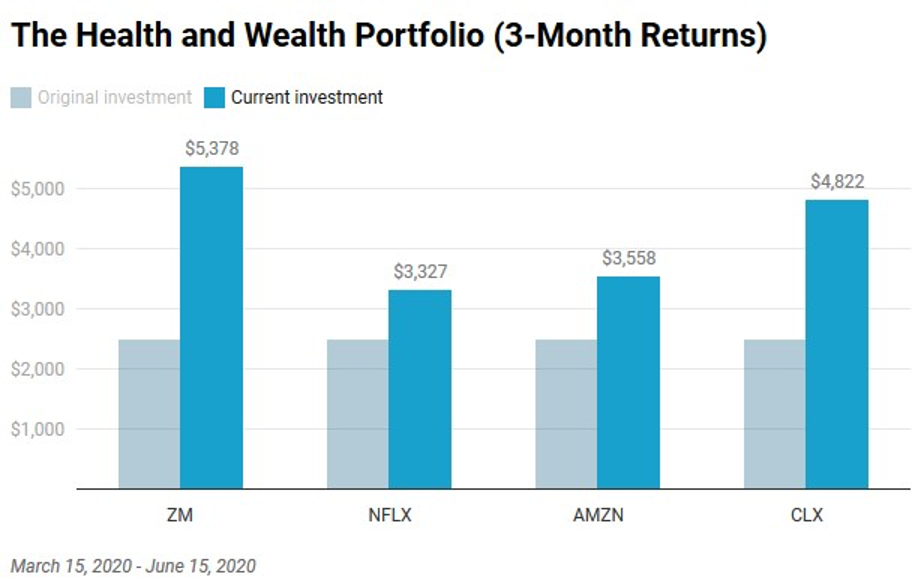

- The stock price of Zoom (ZM) has more than doubled, as its videoconference software became the default way we communicate with each other. (To “Zoom” is now a verb.)

- The stock price of The Clorox Company (CLX) has nearly doubled, with its disinfectant products becoming essential items for homes, businesses, and schools.

- The stock price of Amazon (AMZN), already high before the pandemic, has grown 42% as the company has successfully navigated what Jeff Bezos called “the hardest time we’ve ever faced.” (And as I discussed in another blog post, Bezos is back at the wheel.)

- The stock price of Netflix (NFLX), which had also been on a growth tear since fall 2019, has surged an additional 33%, as it added a record number of paid subscribers.

This is all great news for those who invested in these companies when we highlighted them in mid-March. (Full disclaimer: I bought these stocks, too. I put my money where my mouth is.) But what’s the takeaway for blockchain investors?

Let’s start with the big question.

Why the Hell Does the Stock Market Keep Going Up?

I mean, this makes no sense, right?

Unemployment is at record highs. Bankruptcies are rampant. The IMF predicts a new Great Depression (maybe an even Greater Depression). So why do investors keep plowing money into the stock market?

I’ve spent a lot of time thinking about this. Like a good investor, I’ve read a lot from reliable sources, and I’ve talked it over with other smart people. I have a few theories:

- Most people are still spending because of government stimulus checks. These will eventually run out.

- Many governments also deferred income tax payments, which (in the U.S.) are scheduled to become due on July 15, 2020. This will hurt.

- Most people are still under the illusion that the virus is temporary: because they see people back out in public without masks, they think the worst is behind us. This is unlikely.

- Most people do not understand how the economy works. They do not understand the “lag factor” by which economic results (like corporate earnings reports) are delayed. This will be a rude awakening.

- Options for gambling were limited during lockdown (no casinos, no sports), so many gamblers have entered the stock market instead. This will be a crash course in investing.

While the economy is incredibly complex (even economists don’t understand it, which makes you question the name of their profession), these are some of the factors that might be continuing to buoy the market … not to mention a steady drumbeat of government-sponsored news.

I’m not a financial adviser, just an ordinary investor like you. However, I do have a privileged position of talking with a lot of companies and investors in my day job, and I’ve noticed a lot of worrying changes since March. Compared to the reliable sources above, consider these my anecdotal impressions:

- People are distracted. This is understandable, as they’ve been thrown into the deep end of the pool, having to work from home while dealing with kids, pets, and the overall world craziness.

- People are desperate. As soon as they can get out, they’re going back to restaurants, pools, beaches, hair salons, just to regain a sense of normalcy: the way things “used to be.”

- People are depressed. I have noticed a growing sense of lethargy, that many of our clients are literally “phoning it in” (e.g., showing up on Zoom with no video). People are tired.

To me, these anecdotal signs are even more concerning, because when employees are less productive, companies are less productive. People already have less money to spend because they’re out of work, so businesses hold off on future investment, which means the economy slows down even faster.

This is a lot of bad news to digest, and I know you already have a stomachful. So let me give you a healthy dose of optimism: you can’t control the future, but you can control your response to it.

What You Can Do to Prepare for the Future

Don’t panic. You’ll remember the science fiction comedy novel Hitch-Hikers Guide to the Galaxy, where the first rule when traveling the unexplored reaches of the universe is DON’T PANIC. No matter what happens—from complete financial meltdown to nothing at all—don’t panic.

To make money, you’ve got to sometimes zig when everyone else is zagging. You’ve got to zag when everyone else is zigging. To beat the market, you’ve got to bet against the market. That means keeping your head when everyone else is screaming and running for the hills. No matter how bad things get…

Invest in yourself. Early in my career, during the dot-com downturn, I was considering graduate school, and I asked my financial adviser whether it was worth the expense. He said, “An investment in yourself is worth it.” During this time—especially this summer, especially now—invest in yourself.

Invest in your skills (especially digital skills). Invest in that certification (especially professional certifications). Invest some time and money in learning something new (especially new career skills). Technology and digital companies will do well in the months ahead; you’ll do well to build these skills.

Invest in great businesses. No matter how the stock market tanks, understand that companies provide real value. They provide real goods and services, which help the wheels of society turn. If they do this with a well-run “machine” that’s sustainable for the long term, good companies are still a good bet.

For example, I bought the four stocks in our Health and Wealth Portfolio because I really believed in those companies. I did the research, and I thought they were well-run businesses. Many people say they’re undervalued or overvalued, but I’m in this for the long term. Our mantra: “Get rich slowly.”

Be prepared for massive change. I am concerned about financial systems the world over. I am concerned that governments are essentially “printing money” in the form of stimulus payments, and this might render traditional money worthless. Even as a blockchain investor, I don’t look forward to this outcome.

“Hope for the best, but prepare for the worst.” I don’t mean stock up on toilet paper and canned tuna, but prepare yourself for financial and political turbulence in the months ahead. Like a plane that is going through turbulence, hold the hands of your fellow passengers and trust that you’re going to land safely.

Consider digital assets (as part of a balanced breakfast). Traditionally during turbulent times, investors flee to “safe” assets like gold. In this new world – where even “reliable” assets like bonds might tank – you’ll be tempted to take your money and hide it under an air mattress, which might also deflate.

In such an environment, I think it’s likely we’ll see a new “bitcoin boom,” as investors flee the traditional market and into digital assets of all kinds. In that case, we’ll have the opposite problem: the massive overvaluation of digital assets, as we saw in 2017.

Long story short: Consider setting up your Blockchain Believer Portfolio now.

Gird yourself with optimism. Humans are resilient. We get through crisis. It’s kind of what we do. No matter how bad things get, we’ve made it through much worse. Tough times generally lead to big benefits: increased cooperation, better governance, and a more peaceful planet.

After you’ve been through World War I, it’s no longer radical to give women the right to vote. After you’ve been through World War II, people are hungry for a United Nations. After we’re through this time in history—the “Great Lockdown,” the CoronaCrisis, whatever we’ll call it—we’ll end up better, faster, stronger.

Much of what I write today is educated estimations, but of this I am confident: we will come through this crisis better and stronger on the other side—both as humans, and as a human species. This growth is just the beginning.

P.S.: Sign up for our newsletter and get a free copy of our Blockchain Investors Manifesto.