One of the main narratives driving stocks higher at the moment is there is no alternative (TINA).

With large thanks to the world’s governments and central banks, there’s too much money out there looking for a home, and far too few viable homes for that money.

It’s not all the stocks though. That would be silly. COVID-19 is displacing business models left and right, and many industries are seeing major disruptions, so most of the fresh money isn’t going to them. Rather, it’s going to the companies that are perceived as immune to the virus.

You know, technology innovators and disruptors. Simply the best. <— Link to Tina Turner, of course, because she herself is simply the best.

There’s little doubt that this is also contributing to massive income inequality in the United States. Today Apple’s market capitalization reached a new, all-time record of $2 Trillion.

For me though, and many that I’ve spoken with and am advising, fiat money is a terrible store of value, and overpriced tech stocks are not the solution. That’s why I propose we repurpose the above statement. No, not Tina Turner, Wall Street. Because there really is no alternative to Bitcoin.

Bondnanza

Some of the more savvy investors lately are trying to outsmart those convinced there’s no viable alternative, and are going headlong into the bond market. The strategy is actually quite interesting, too.

William Boyer further pointed me to a guy named Steven Van Metre, who he got the idea from. I did try reaching out, but I have received no response as of yet.

In any case, the idea is that if yields are going down, bond prices are going up. So by trading them in the short-term, you can take advantage of that price increase at relatively low risk.

Of course, that only works out if the yields continue to fall. According to an analyst I heard on Bloomberg this morning, if you’re holding 30-year bonds and the yield drops just 0.5%, the loss on the value of your holdings will be something to the tune of 10%.

So, it’s not exactly a risk-free trade, but certainly carries less risk than a lot of other things that move much quicker.

Then again, this is not my personal area of expertise, but I can certainly relate to the desire to reduce risk in one’s portfolio. Either way, no matter what short-term cowboys might be doing, it does seem clear to all that holding U.S. Treasuries long-term is a losing strategy.

That’s not to say people aren’t buying them. Today, a 30-year Bund sale in Germany ended with record sales, despite having a negative yield. It’s baffling stuff, really.

Fighting Back

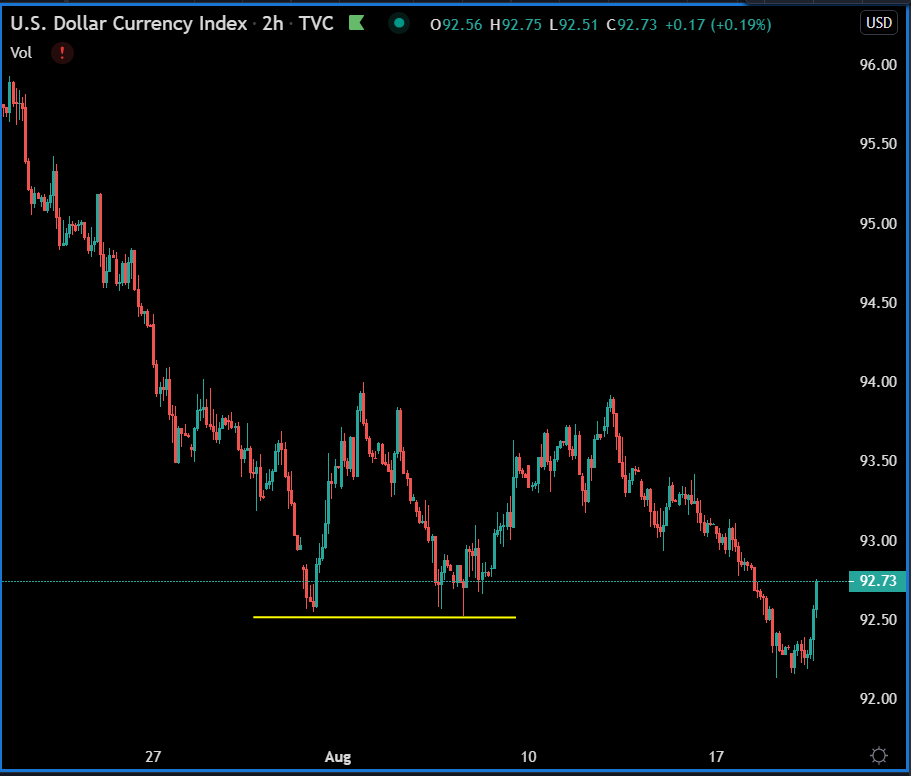

Almost just as baffling is the way that the U.S. dollar flipped on a dime this morning, and after yesterday’s fresh lows is now bouncing back in a big way. In fact, the way it’s looking at this very moment, yesterday’s move could well turn into a false breakout, a classic example of markets running stops before spinning around.

Gold is falling as well, and the stock markets … well, they’re not zooming today. As mentioned above, the need to reduce exposure is something I can personally relate to, and have therefore closed out a large chunk of my eToro crypto portfolio, just in case the U.S. dollar strength bleeds into our market as well.