Jackson Hole, Wyoming has been the setting of many exclusive Federal Reserve meetings, but none so exclusive as the one that will be held Thursday for the first time by Zoom. Though nothing has been confirmed yet, many analysts are expecting a whopper!!

Yup, you read that right.

The Fed is quite likely to embark on a groundbreaking campaign to increase inflation. Click to tweet

Honestly, this is baffling to me, especially now with all the monetary and fiscal stimulus going around. At a time when the people are just starting to ask questions about the intrinsic value of money, the Fed is announcing that they’re about to intentionally decrease that value?

The Fed is basically playing with fire!!!

Of course, it’s not a complete surprise. U.S. authorities have just taken on an inordinate amount of debt, more than they could possibly ever hope to pay back.

So the only viable option is to decrease the value of that debt by way of monetary debasement. It’s despicable and dangerous, but the only other option is austerity, which is too unpopular for any public servant to mention at this time.

What seems to be last on their minds, however, is the general population and how they might react to such a shift in policy. After all, most American’s don’t even know who Fed Chair Jerome Powell is, let alone how monetary policy works. But they’re learning fast.

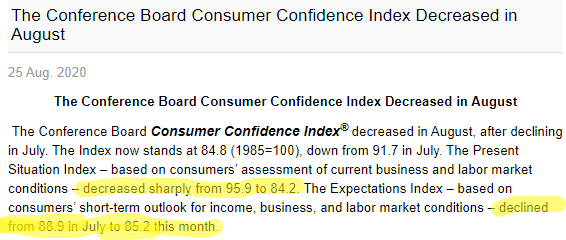

Unconfident economy

As far as the most recent data is concerned, consumer confidence just took a turn for the worse…

See, it’s very important for any person or entity to display confidence in order to perform well. This is especially true of an economy.

The current expectation is that things probably won’t improve in the near-term. The fiscal stimulus negotiations have stalled and people understand that they’re not getting any further handouts from the government, so America, just like many other countries is now a hiber-nation.

So that more or less reflects the people without money, what about the people who have money in the bank right now?

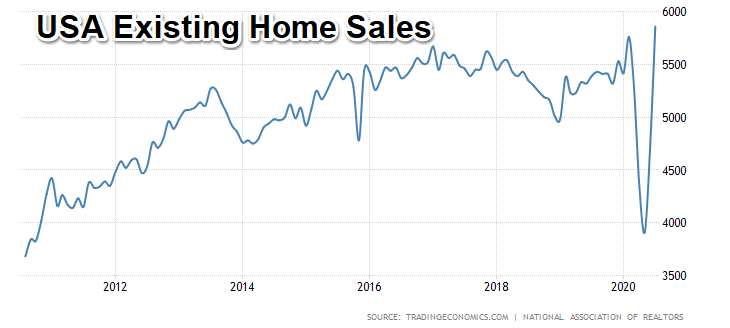

Well, they’re quickly learning that holding a bank balance while the money printer issues more fiat currency is a liability. We’ve already spoken at length about how people with no investment experience are currently snapping up their favorite narrative stocks. The more intelligent ones right now are buying houses.

Data from last Friday shows a record surge in existing home sales for the month of July. The figure is now at its highest levels since before the financial crisis.

See, people aren’t stupid. They understand what those in charge of the money are doing to it. But the Fed can’t devalue a plot of land. Real estate holds its value no matter what happens to the money.

So does bitcoin

Monetary stimulus is rocket fuel for bitcoin. We’ve seen a bit of a dip today in digital asset prices, which is largely in line with the stocks and precious metals.

In this chart we can see bitcoin’s March pandemic fall and subsequent recovery. At this point we’re locked in an upward facing channel (yellow lines) that seems to be pointed at the moon.

However, we are currently testing the lower yellow line as a viable support. If it holds, great. But if not, as may well be the case, we’d look to build some kind of support on or above the all important critical level of $10,000 per coin (dotted orange line).

Usually whenever a major level is busted to the upside, as we see above, we’d expect the market to then try and test that same level as a floor for prices to be supported. However, the breakout above $10,000 in July was so incredibly strong that we never got that chance.

Therefore, I believe that a retracement at this point would be extremely healthy for bitcoin’s price discovery. Of course, a quick trip to the moon could be exciting, but a slow crawl is certainly more sustainable.