Paraskevidekatriaphobia, like opening an umbrella in the house, breaking a mirror, or seeing a black cat might be an irrational superstition but as a trader it always pays to avoid bad luck.

Just a Minor Correction

What seems most amazing about the historic action we’re seeing in the traditional markets is not the short term charts, nor the extreme volatility that is now near the highest levels ever, or even the fact that this is the fastest bear market in history. It’s the way things looks when we actually zoom out.

In this graph, we can see the longest bull market in history. Notice the dotted yellow trend line, which hasn’t even really been broken as of yet.

If we think about it, the only thing that’s happened so far is a simple reversal of the very latest part of the speculative mania. A return to levels last seen at the end of 2018, just 15 months ago.

No doubt many on Wall Street will see this as a nice discount. Indeed, just looking at the price action it’s still unclear if this is just a correction or if we do continue downward, where the eventual bottom might be.

Crypto Fear Too

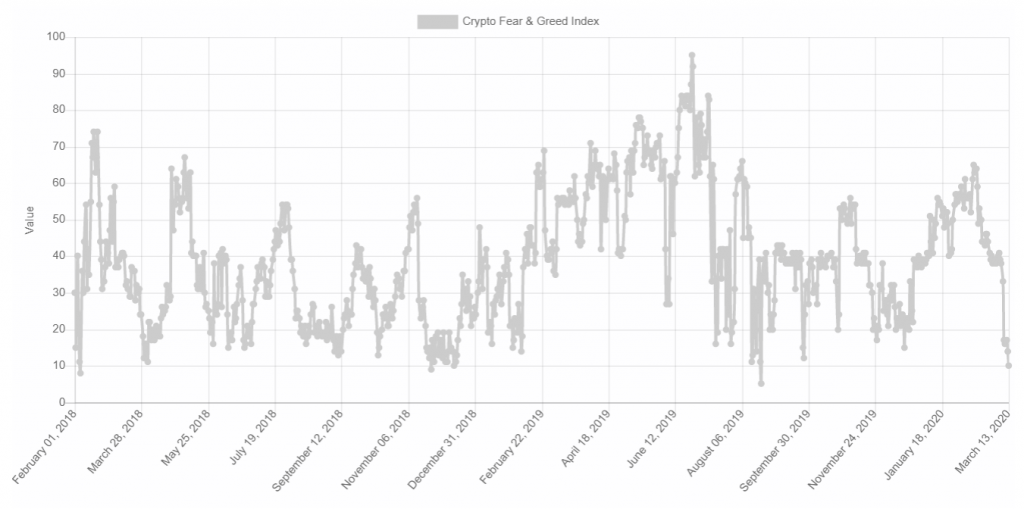

The crypto market after taking a massive hit yesterday is also extremely fearful right now. As we can see, the Crypto Fear & Greed index is pretty close to it’s lowest level ever.

Sentiment on social media however does seem to indicate that many are using this as an opportunity to buy the dip. Even Snowden is on feeling the FOMO at this point. Looking at the data from LunarCRUSH, it’s quite clear that he’s not alone. Bullish sentiment on social media has now spiked to it’s highest level ever recorded.

In my public crypto portfolio, we’ve taken a hit as well and will soon be adding further funds to buy this dip as well.

For this weekend’s dose of entertainment, make sure to catch this episode of What Bitcoin Did with the legendary Andreas Antonopoulos from January 3rd. The beginning of the interview is pretty standard stuff, why bitcoin and all that jazz. Around the 40 minute mark, Andreas basically calls the yesterday’s crash and explains exactly why it happened.

Many thanks for reading and huge thanks for everyone who’s sending in your feedback and questions, keep em coming. Please make sure to share these updates with all your friends and groups and if you’re a first time reader, make sure to subscribe now.