You can’t make an omelet without breaking a few eggs, and it seems like the DeFi market just broke a few flats.

For those of you who haven’t heard by now…

For anyone not familiar, Compound protocol is by far one of the most prominent projects in DeFi lending, and the recent incident comes after a routine upgrade led to a critical bug in the system, not too dissimilar to what happened to Facebook yesterday.

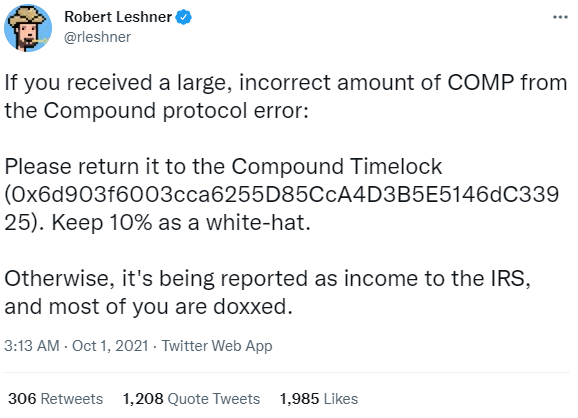

Many analysts chose to focus on the reaction provided by Robert Leshner, founder and CEO of Compound Labs, who sent out a particularly controversial tweet in response to the bug asking users to please return the funds, or else. …

For what it’s worth, Leshner was quite quick to walk back these comments.

It’s still not clear whether he was threatening to report users to the IRS, or whether he’s even able to do that.

It’s more likely that he was trying to say that if people cashed out, they’d need to pay taxes, which doesn’t seem like a great deterrent.

Moral compass

The entire saga brings up some serious soul-searching questions about what crypto represents and why are we into it.

When I was eight years old, a cashier accidentally gave me five dollar bill instead of a single. It took me several difficult moments of deliberation outside the store to decide that the right thing to do was to return the money.

Would I have made the same call if we were talking about millions of dollars? Would you?

Now, add to the equation that when it comes to the Compound situation, the money potentially being kept isn’t actually coming from anyone’s pocket.

The COMP tokens that were mistakenly distributed came from the protocol itself, a protocol that currently has approximately $10 billion locked in it.

The major impact on other users would be that the freshly unlocked tokens would add to the circulating supply and possibly dilute the price.

Certainly, dumping them on the open market would be the wrong thing to do, but what harm would be caused by holding on to them for a bit? After all, we’re here to make money, aren’t we?

Despite all that and the founder’s impulsive reaction, apparently some people have decided to send the money back. As reported by CNBC yesterday, a total of $38.7 million has already been returned.

This comes as little surprise to me though. The community spirit is incredibly strong in the crypto world.

This same mentality is also responsible for an Ethereum miner who recently returned an erroneous $24 million mining fee and the now famous polymath hacker who returned almost all of the $600 million stolen in a legendary crypto heist.

The way forward

All programs have bugs. We saw that with Facebook yesterday in their record-breaking downtime.

Unlike Facebook, however, the people building this new and exciting market clearly have a strong moral compass and are often choosing to prioritize the virtues of what we’re creating above accumulating personal wealth.

DeFi may not be ready for prime-time finance just yet. Most of the projects are still under construction and new economic models are being tested.

But we’re getting there quickly. Just today, we saw The Financial Conduct Authority bring a new DeFi protocol under its regulatory wing, a huge step forward for the industry. There is even bigger news from the U.S., however. …