“The only thing we have to fear is fear itself.”

-FDR (March 4th, 1933)

In his landmark speech, almost exactly 87 years ago to the day, Franklin Delano Roosevelt called for “an end to speculation with other people’s money” and the “provisions for an adequate but sound currency.”

Watching the speech today, one can only marvel at the timelessness of his words and how much applies to our present situation. With the total number of Coronavirus cases surpassing 100,000 people as I write to you it’s difficult for me to see why people are freaking out of this. I mean, we’re talking about 0.001% of the world’s population.

Yet, the entire world economy has ground to a virtual halt. Global travel, theater, sports, education, commerce, shipping lines, financial markets, and virtually every industry on the planet have been massively disrupted. For me, this is far more concerning than the virus itself.

The potential affects of a supply shock being met with a demand shock on an economy that has been excessively stimulated for over a decade seems potentially more perilous to me than even the most dire of corona predictions.

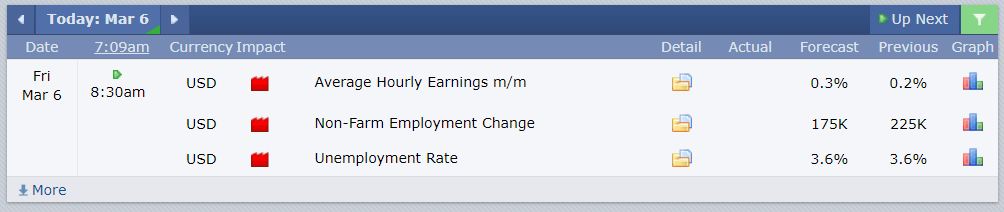

Jobs Day

The first Friday of every month has been a day of celebration for the last few years, when investors get together to talk about how great the economy is and analyze exactly how the numbers coming from the Beuru of Labor Statistics can be interpreted in the most bullish way possible. That won’t be the case today.

In the past, good news was always seen as bullish because it meant the economy is doing well wheras bad news was always met with buying because it meant the Fed is more likely to rain stimulus down upon us.

If the data comes out good, it can be easily dismissed as pre-corona statistics. If they’re bad, it still won’t give us any indication of just how bad things might get should the virus continue to grow. In any case, the Fed is already in full panic mode so there doesn’t seem to be much more they can do.

OPEC Minus

Crude Oils is down 4% as of this writing but according to some analysts it has the potential to drop another $6 a barrel between now and the opening on Monday.

The issue here is that Saudi Arabia has promised the market a huge production cut of approximately 1.5% of total global production. The issue is that they really can’t accomplish this without Russia’s help and Putin is yet to sign off on the emergency measures.

Should Russia end up agreeing to the cuts, it’s estimated that crude could see a nice pop of $2 or $3 a barrel. However, for the first time in years, crude’s problem at the moment is more on the demand side than supply.

As we can see, Texas Tea is now coming up on a historically important support level of $42 per barrel. Let’s see if she holds.

Viral Affect

In lieu of the comments above, I hope that you understand that my expertise lies in the markets and economics and I am in no way qualified to weigh in on the potential spread or decline of the Coronavirus. Given the current numbers, the level of fear we’re seeing does seem disproportionate to me but I also understand we’re dealing with a new kind of sickness and still many unanswered questions about how it spreads and how to treat it. Uncertainty is certainly a valid driver of fear.

Certainly we’ve seen times in the past when something seemed trivial before producing hockey-stick graphs. Like bitcoin for example, going from $1,000 to $20,000 in 2017 before reverting to the mean.

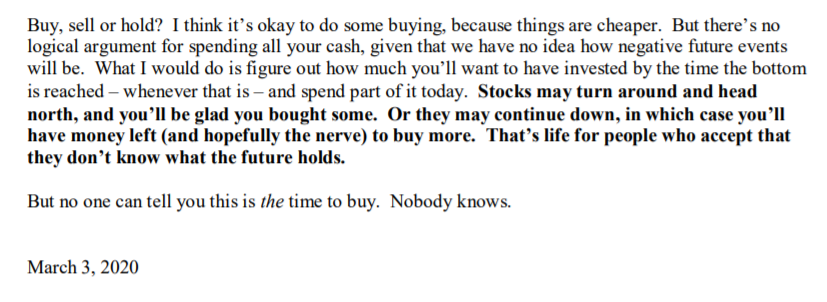

As Howard Marks points out in his latest note, because we don’t know how things will progress, we don’t really know how to trade it. Perhaps the best strategies might include buying a bit now and a bit later. Understand how much capital you want to deploy in total once the market reaches the bottom and that will give you a good indication of how much to spend at the moment.

For me, of course, this is more about short term volatility, which is a day trader’s dream.