Even though Bitcoin itself can’t catch Coronavirus, it seems that just like many things in our rapidly changing society we’re now seeing the affects of Covid-19 play out in Bitcoin’s network.

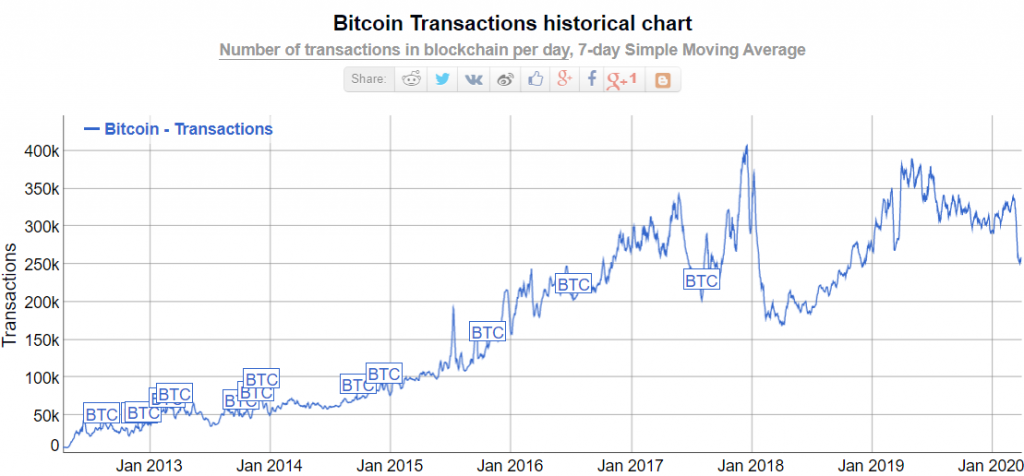

As far as on-chain transactions go, daily bitcoin volume is averaging just over $1 billion, which is sharply lower than it was a month ago but still pretty high compared to historical averages . The number of transactions however, has dropped to it’s lowest levels since the crypto winter of 2018.

Here we can see that through the course of March, we’ve dropped by about 100,000 transactions per day.

Now, some of that may have to do with the fact that Coinbase is now batching their transactions in order to reduce the load on the network. However, if this is the sole explanation, it would mean that Coinbase was processing approximately 26% of all BTC transactions before the upgrade. Not likely!

Of course, it doesn’t take too much of a stretch of the imagination to place this drastic reduction in usage of internet money to the current lockdowns and geographical quarantines in place over the last few weeks. After all, even Visa is now reporting that spending levels are way down this month, and that includes online spending as well.

See, this is where we start to see evidence of people using bitcoin as money. Speculative volumes on exchanges are way up on all the volatility. So it seems, that especially with the lower prices at this time and the lower propensity to transact due to the virus.

Good Bad News

The market spirits were lifted this morning by some good data out of China and stocks in the Asian and European sessions were quite positive in reaction to the PMI manufacturing data from China, which showed a reading of 52.

This is far greater than the reading of 44.9 that was forecasted by various analysts but for anyone who knows what these numbers mean, it’s clear there’s no real reason to celebrate.

The Purchasing Manager’s Index is basically a survey that asks people inside of companies who are in charge of purchasing things how they feel about the economy. A reading greater than 50 indicates that the purchasing managers feel that the economy will do better next month then it did this month and a reading below 50 means the opposite.

Of course, I’d be extremely worried if Chinese businesses thought that April would be even worse than March, one of the absolute worst months in recorded history. So though I’m glad to hear that the economy will likely do better than it did last month, it’s really little comfort at this point.

Quarter of a Decade

As the first quarter of 2020 draws to a close, I’m sure many people around the world have grown a few grey hairs. Several have pointed out that the first three months of this year have felt like an entire year. Those people obviously don’t have children on furlough. I can tell you quite pointedly that these past 19 days in family quarantine have felt like an entire decade.

Kidding aside, I’m grateful that we have a backyard where the kids can catch some sun and fresh air every day and I really am grateful for the extra time I’m getting to spend with them. Sure, I am a bit concerned about the school they’re missing but how much essential knowledge will they miss out on anyway? Just today I read how Sir Isaac Newton himself did a bit of self study time in quarantine during the Bubonic Plague.

I must say, that the more I think about the current situation, the more optimistic I’ve been getting about the potential for this whole ordeal to have an incredible impact on wealth distribution.

For far too long the economy has been held in place by the whip of excessive consumer spending. We’re made to think that we need to buy a new iPhone every few years and visit Starbucks several times weekly, even though most people can’t really afford these luxuries. All the while those at the top point to the high numbers of people literally becoming debt slaves in order to service these habits and say things like “the economy is strong right now, just look at the consumer data.”

Not only will the masses simply stop spending and going out to bars and restaurants thereby making a massive adjustment to their personal expenditures, but the wheels of the great machine are also now coming in their favor with new policies for UBI and more importantly in the United States the possibility to fix the health care system.

Never in my life have I seen such a huge bipartisan push in favor of the little guy. It seems that politicians are so afraid to repeat the mistakes of 2008 where they bailed out the rich and left the poor high and dry that they’re now finally cooperating to make things more even handed.

Sure, it’s still early days but I can easily see how this decade has the potential to be really great for everyone.

Many thanks for all your awesome questions, helpful insight, and amazing feedback that you all are sending on a regular basis. It is my main source of inspiration. Don’t forget to please share these updates in all your chat groups and social media, just send them to Bitcoin Market Journal to sign up. If this is your first time reading, welcome!! Make sure to subscribe now and keep washing your hands!!