This is further proof that technology is already immune to the virus, and unlike humans, tech and even markets don’t necessarily require any sort of vaccination.

Unfortunately, though, this dynamic is creating a bit of a lopsided economy. Tech may not be affected by the virus, but the humans who use it certainly are, and that is impacting the economy in a huge way.

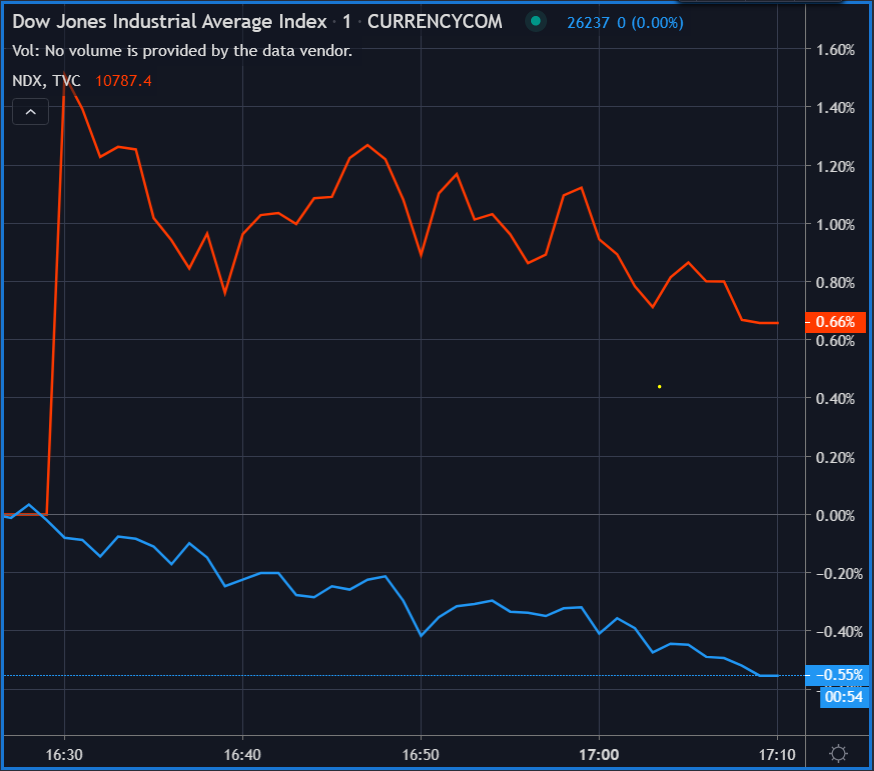

Shortly after the opening bell on Wall Street, we can see that most stocks are down, but the FAANG-M stocks are seeing huge gains.

It’s almost as if the fabulous four are draining all the wealth out of the markets and drawing it for themselves. This is hardly a new situation, but days like today make it all too blatant.

In this short-term graph, we can see the big pop in the opening bell for the tech-heavy NASDAQ index (red) Vs the Dow Jones Industrial Average stocks (blue).

Not shown here is the 7% rise in Facebook and a 5.5% pop in Amazon. Do you know how much money it takes to create such moves?

Dollar in danger

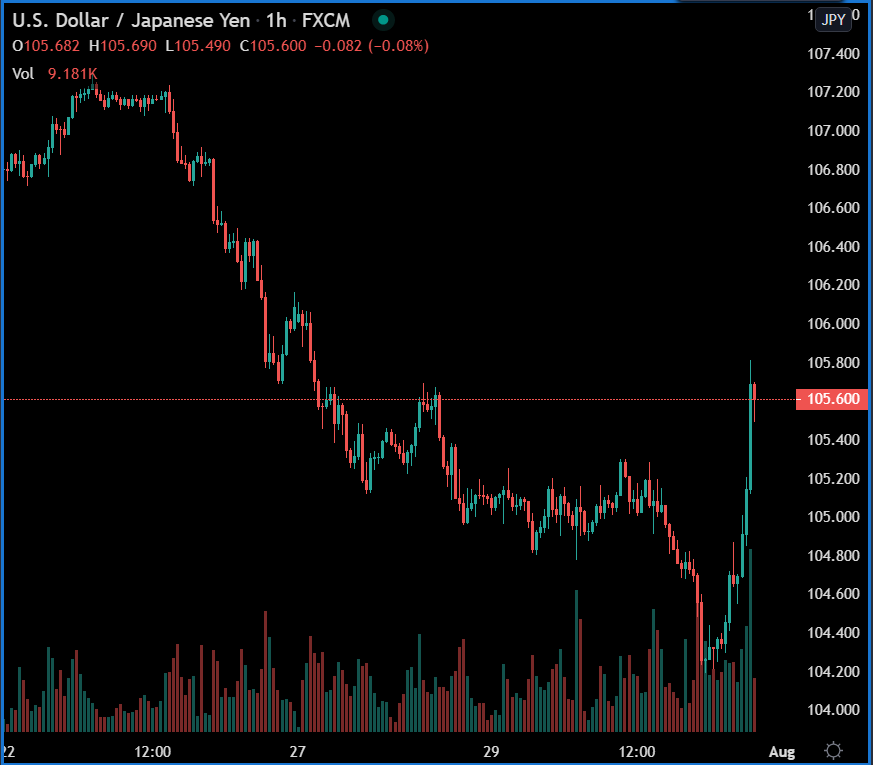

With the dip in the stocks as well as a bit of a pullback in gold and bitcoin, we can see that the U.S. dollar is now rising from the lows. Whether this is a bear market bounce, sell the rally scenario or the market looking for an actual bottom, it’s still too early to tell.

Here, check out this pop in the USDJPY, accompanied in full by a strong surge in volumes on FXCM, the largest volumes for this pair in about a month.

As might have been expected, this sudden move is also apparent in the bond markets, where it’s sorely needed. Unlike stocks, COVID-19 has not been kind to this particular market, nor has the Fed in the last decade of erosive policy. In the year 2007, it was normal to get a fixed return of 5% when lending your money to the U.S. government for 10 years. Today, you’ll be lucky to get 0.5%.

Of course, if we factor in inflation over the next 10 years, you’ll most likely be losing money on this trade, a phenomenon known as negative real yields. This is not good at all.

Markets tend to use the risk-free aspect in the bond market as a way to judge return on risk. Now that this return is nonexistent, it’s really impossible to tell how risky a given portfolio is.

Furthermore, traditional portfolio managers have grown accustomed over the last few decades to allocating more than half of their large portfolios to these Treasury bonds. But by now, even the biggest advocates of stable and safe investing are looking at portfolios that have no risk-free diversification at all.

So if investors are winding down their portfolios and not buying bonds right now, we can only assume that the only buyer in the market is the Fed, and all the money that was previously allocated by investors is now being pushed all in on the tech stocks.

I shudder to think what the end result of all this might be. The title of today’s newsletter might give us a clue though.