Of the many analysts who are making economic projections as if they can tell what’s going to happen in the future, we couldn’t possibly discount those at the International Monetary Fund.

The people of the IMF are quite experienced when it comes to forecasting growth figures, and we quite often see headlines about how they’re ‘revising’ their GDP expectations higher or lower, even in regular times, as they continuously make adjustments.

So, what are they thinking now? Well, here it is.

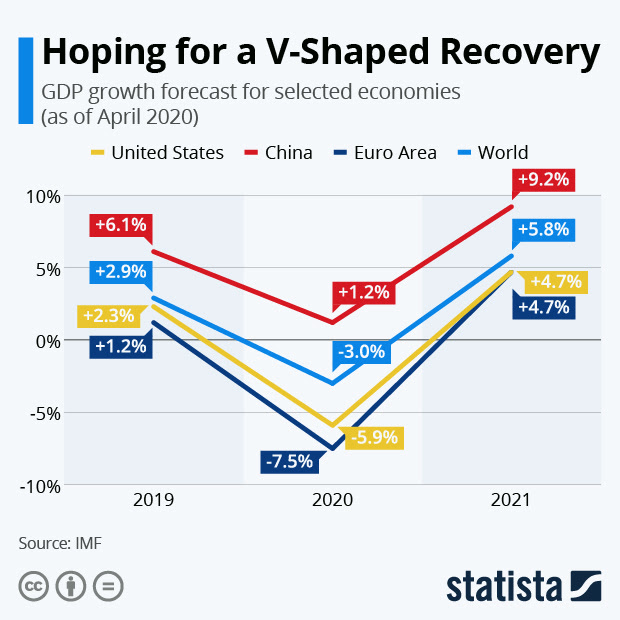

As we can see, they are expecting a pretty sour 2020, but 2021 will be a huge year for growth. Not sure if we can really label this as a V-shaped recovery as the title suggests, but I guess it kind of does look like a V when you have only three entries for three years.

To me, these projections seem incredibly optimistic. If they are indeed correct, then perhaps some of the optimism that we’ve seen reflected in stocks could actually be warranted as investors try to price in what might take place in five or 10 years. However, we still don’t know how much longer the stay at home orders will be in place, nor what the lasting effects of massive stimulus on a shuttered economy might be.

Oil Rollover

Now that the WTI crude oil contracts have been rolled over, it looks like the price is starting to roll over as well.

Here we can see the old contract that famously went negative yesterday, and the new contract that’s now looking ready to crash as well.

Note that as we mentioned in yesterday’s update, anybody who bought at $1 yesterday actually didn’t make any gains on the gap. They simply got reset to the higher price and watched their position continue to fall. For those on the short side however, it actually provided an opportunity to short again.

The simple matter is that the effects of the contract expiry have been greatly overstated by many analysts. Yes, it did cause some pressure, as a few traders were forced to realize their losses rather than take physical delivery. However, the price of paper crude has been unrealistically inflated for weeks.

If there wasn’t enough storage space in April, I’m not sure why anybody would think that May will be any different. Yes, eventually demand will gradually pick up again. However, until that happens, watching producers continue to pump oil out of the ground is ludicrous. They should be on lockdown like the rest of us, rather than continuing to destroy the planet. You reap what you sow.

Touch of Optimism

As you can imagine, the stock market is not so hot today. The action in crude oil yesterday was a harsh reality check for many investors and has presented a serious challenge for our collective perception of value.

After the closing bell today we’ll hear earnings reports from both Chipotle Restaurants and Netflix. One has been bitterly damaged by the lockdown, and the other has likely benefited. Getting both of these reports in rapid succession could cause some serious volatility in after-hours trading as the markets struggle to reconcile the extreme affects of COVID-19 for better or worse.

As far as I can see, there are not just two, but hundreds of different markets. They are all pulling in completely different and unrelated directions. This is why it’s so difficult to take any specific position on how things are going to end up, and we continue to trade short-term only.