You never really appreciate what you have until it’s taken away.

Not sure where this statement originated, but it seems especially true during a period of lockdown. The world is now brimming with excitement about a return to normal that has now gone live in many countries.

For myself, the moment of Nirvana came when I learned that the school system here is coming back online first thing next week. Suddenly, all the bad news in the world, and there still is plenty of extremely bad news, seems to fade into the background. If you’re in a country still affected, you’ll see what I mean soon enough.

I hope that our sacrifice until now has been worthwhile and that we’ve flattened the curve enough to give the authorities and health workers the time and resources needed to better deal with the threat. Because once this is over, getting everyone to go back into lockdown will not be an easy task.

U.S. Jobs Calamity

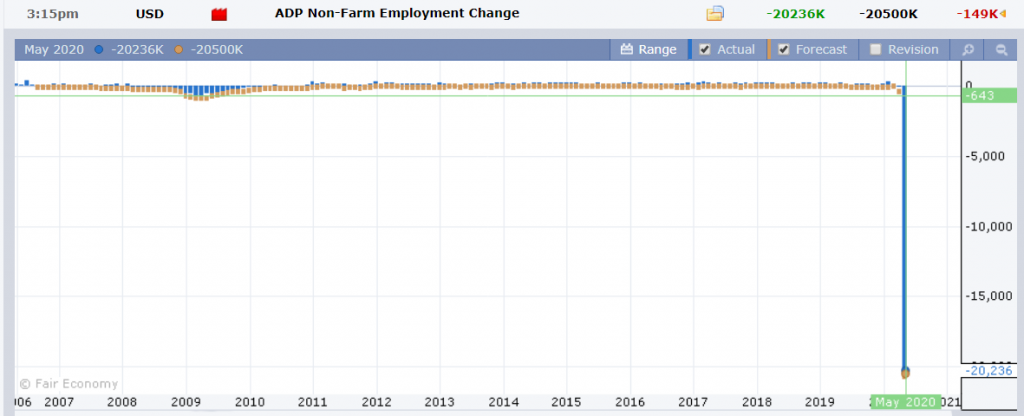

Perhaps the scariest story, aside from the virus itself and reports of triage in select locations, is the sheer level of unemployment, a story that’s becoming ever more vivid with the incoming data.

This Friday, we’ll get the monthly U.S. jobs report known as the NFP, which is now forecast to show a job loss of more than 21 million people in the month of April. Well, the numbers actually reflect the period from the middle of March to the middle of April, which is will give us a really accurate reflection of the overall picture.

Today, we got a little taste of that as the popular payroll firm ADP has published their forecast for Friday’s figure. Here we can easily see how those figures have far surpassed the entire job losses of 2008-2009.

With all the doom and gloom inherent in such figures, the stock market may not react much to Friday’s announcement, especially if the numbers are anything like what’s already expected. What might shake things up a little are the weekly unemployment numbers that come out tomorrow and are currently forecast at 3 million even.

Markets are pretty flat today, with everything down ever so slightly against the U.S. Dollar, with only one real exception….

Bitcoin

Even the square world is getting excited now, with Bloomberg’s Mike McGlone on the TV again today shilling BTC to the max. Mike has been increasingly bullish on this emerging asset and recently, he even published an entire report about it.

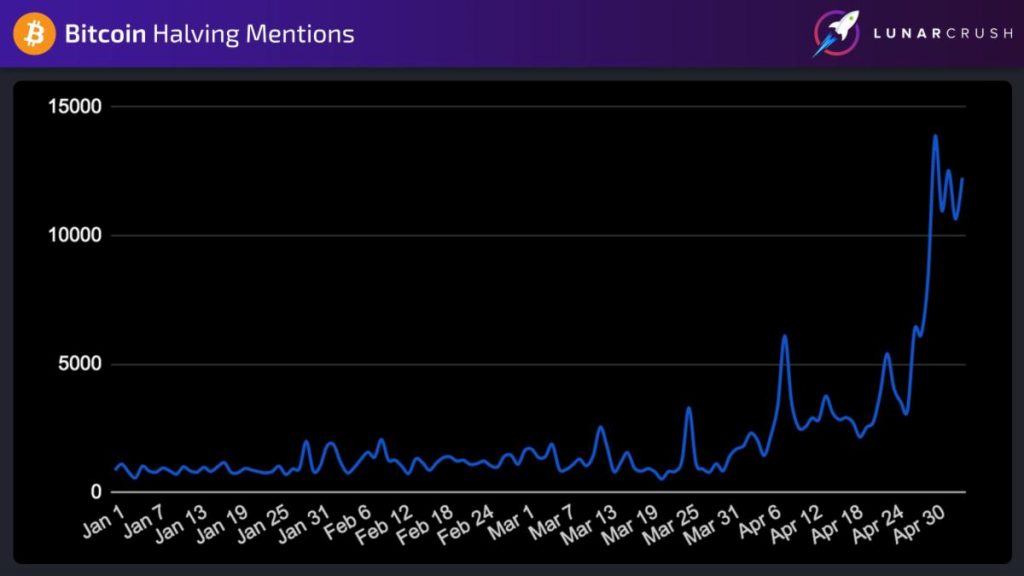

The closer we get, the more people are getting excited, here we can see some data from LunarCRUSH showing the total mentions of the halving event on social media.