Things are moving really fast these days, and there’s only so much information that our human brains can process.

Even yesterday as the Federal Reserve was speaking, we were also hearing concurrently from the CEOs of some of the largest companies on the planet, who were defending themselves in the world’s largest-ever antitrust investigation.

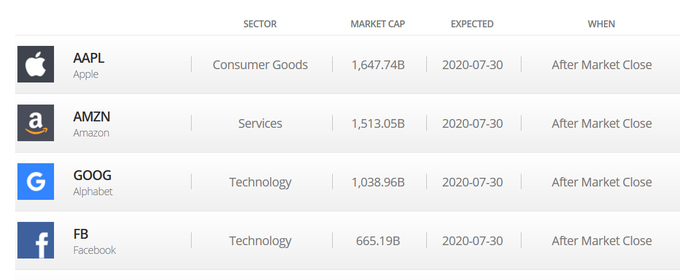

The U.S. government feels strongly that the likes of Google, Facebook, Amazon, and Apple have been playing capitalism to the max, and may have unfairly utilized their unique advantages.

In the year 1911, the U.S. government stepped in to break up a company called Standard Oil, which had built itself into a powerful monopoly. Capitalism has its limits, and every once in a while, governments do need to step in and shake things up in order to promote fair competition.

In the case of these tech companies, it seems quite clear that they are doing their best to ensure that no new competition comes up, but it isn’t very clear what the government can really do about it.

After all, unlike Standard Oil, we’re talking about companies that basically invented their respective lines of business and built them from thin air.

It is interesting to imagine for a moment a world where YouTube is separate from Gmail and Adwords, and where Instagram, WhatsApp, and Facebook are three separate companies, but it’s hard to really see that as being a realistic outcome of all this.

It’s more likely we’ll see some sort of slap on the wrist, and possibly some ineffective self-regulatory body.

Whatever happens, it’s more than likely to affect the price of these stocks, for better or for worse. Interestingly enough, they are all reporting their second quarter earnings after the bell today.

GDP Fast

Like any good roller coaster, the first drop is always the largest and most shocking. After that the momentum from the initial plunge carries us through the rest of the twists and turns and loop-de-loops.

The airline companies have by far been the most affected by the pandemic, but it seems there is a small section of the industry that is taking off. Demand for private jets has increased significantly in recent months. This could present opportunities for interested investors.