As we see strong signs of stabilization throughout Europe, the situation in the U.K. seems to be getting worse. Not only has the prime minister himself now been admitted to the hospital, but the number of confirmed cases has seen a significant spike to nearly 6,000 yesterday.

Last night, the queen herself addressed the nation in a brief but extremely moving speech.

Over in the U.S., the president has mentioned that the peak is near. Yet, even in Asia, leaders are finding it difficult to lift the lockdowns and travel restrictions. Perhaps now that the entire world understands how to mitigate the effects of the virus and flatten the curve, we can finally start thinking about an exit strategy.

The Shape of the Recovery

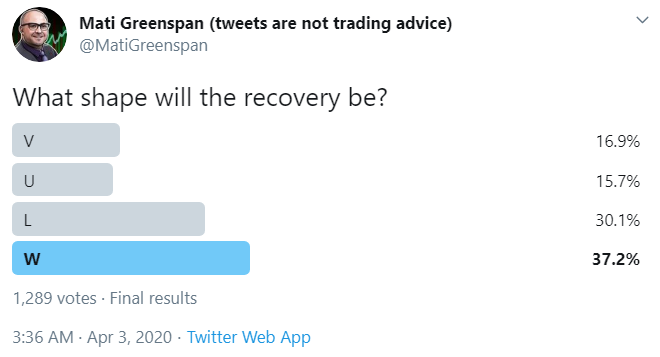

Economists have been weighing in on how the recovery will look, most often using letters to describe the shape.

Over the weekend, I took a quick poll on Twitter to see what my followers were thinking…

Although, with all the money injected lately, it would not surprise me to see the stock markets reach all-time highs again within a short time.

Either way, volatility is now way below peak levels and is dropping fast today. Here we can see the VIX index with a large gap down at the start of this week (last candle on the right).

This is an especially good time for beginning traders who are new in the markets to experiment with opening positions and different trading strategies. Volatility is not too high and not too low, it is in the Goldilocks region.

The Next Trade

After several sessions of very rapid flat action, gold and bitcoin are looking for a breakout to the upside this morning.

Here we can see both the physical stuff and the digital version testing resistance at $1645 and $7200 respectively.

Since the beginning of this crisis, cash has been the main benefactor in the markets as investors unloaded just about anything with value in order to avoid the rapid sell-offs. Now that the spread of the virus seems to be slowing and volatility is coming down, it’s time to look for the next trade.

In my own humble opinion, and of course this is just a theory, investors may well already be holding their fill of cash by now and will likely be looking to put it back to work.

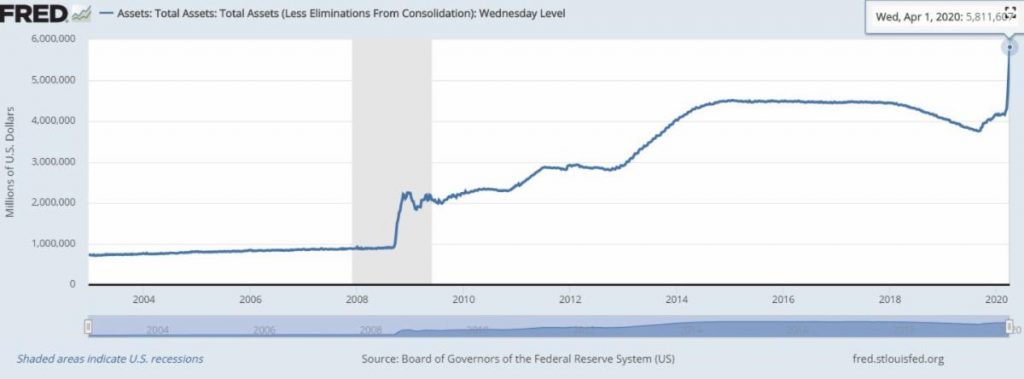

Today, several new swap lines will be deployed by the Fed in order to ensure that there are enough bucks to go around. In the meantime, the latest snapshot of the Fed’s balance sheet shows that as of April 1st, the total amount of assets they’re holding is now up to $5.8 trillion, and it’s very clear they’re just getting started.

The Japanese government is also out with their own stimulus measures this morning, which will be just shy of $1 trillion, which is an unprecedented 20% of the island nation’s GDP. Also, the Reserve Bank of Australia will be meeting this evening and though their rates are already on the floor at 0.25% and are not expected to go down from there, we’ll be watching closely for any further measures they’re thinking of taking.

So my friends, the stimulus injections continue to flow as cash saturates the system. Most analysts who are looking at a time-frame longer than it takes to dance the Macarena are looking to hedge inflation at this time.