What better way to celebrate Earth Day than with clean skies, carbon emission levels at multi-decade lows, and crude oil at $1 a barrel.

COVID-19 has had many unexpected repercussions. The most serendipitous by far is the positive impact on the environment. We can only hope that as we return to a new normal way of life, this will be a standard humans choose to preserve.

Netflix Flip-Flop

Yes, they’ve been making out like bandits, but what happened to the stock?

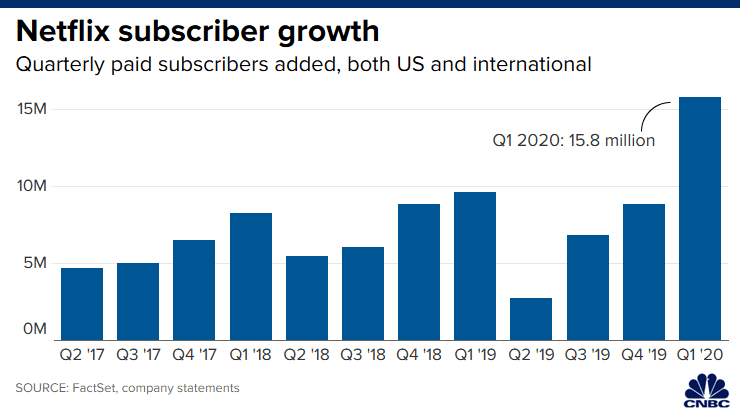

According to their earnings report last night, the streaming giant added more paid subscribers in Q1 then ever before, by a lot…

The initial impact of the stock in after-hours trading was an immediate surge of 10%, but as you can see, the move was quickly reversed and by now the N in FANG is now firmly in the down.

This could be due to the fact that they pulled their forecast for next quarter, saying that any guidance they could give would probably be “guesswork” given the current climate. It might be because they’ve stopped production on just about all new content, so it looks like we’ll be watching reruns for a while. It could also be due to the lavish praise that CEO Reed Hastings bestowed on their upcoming rival Disney+.

However, it is more likely that analysts were simply expecting more. As we’ve stated previously, it doesn’t matter what the actual number is, so much as how accurate the analysts’ predictions were. In this case, the forecast was for $1.65 earnings per share, but investors were let down with only $1.57 EPS.

In any case, it seems like this poor price performance on strong growth of one of Wall Street’s tech darlings could be quite telling about the current sentiment in the stock markets. A fresh round of fiscal stimulus for small businesses announced last night, worth $483 billion, is buoying the main indices at the moment. Let’s see how long that lasts.

Unspoken Countdown

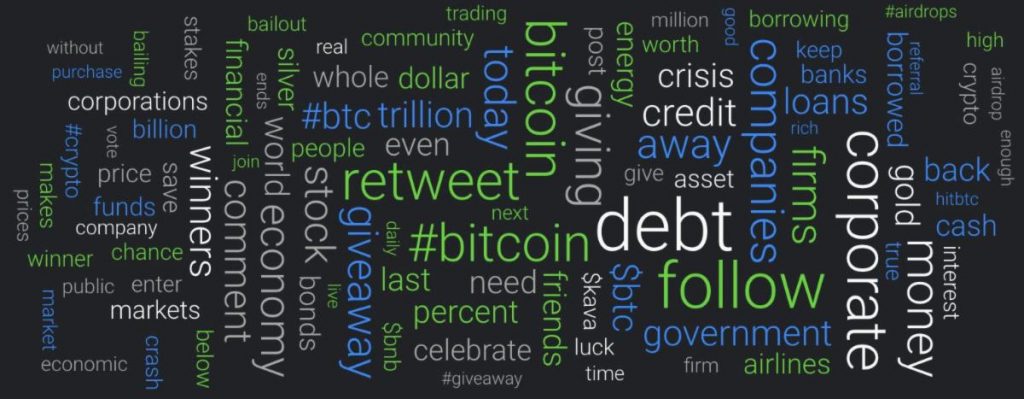

An amazing website called LunarCRUSH, who I have the privilege of being an advisor to, does a lot of visualizations of social data in the crypto market, and one of my favorite features is a word bubble that displays the most common words being spoken in the crypto community across Twitter, YouTube, Medium, and other sites.

What I find the most fascinating is that the themes reverberating throughout the crypto space at the moment are all about the current economy in the wake of the virus. Corporations, Bailouts, Government, Airlines, Borrowing, Interest, Loans, Bailout, Billions, Trillions, Economy, Gold, Silver, Dollar, Stocks, and Bonds, wow!!!

Although I’m very proud to see people discussing these very important issues, I am a bit disappointed by the absence of one word that should be on everyone’s lips and fingertips at this time… ‘halving’

It’s almost as if everyone is finally talking about the issues that bitcoin was designed to solve, and at this brief moment in time, barely anybody is talking about get rich quick schemes or their favorite altcoin. It’s just pure market factors with bitcoin at the very center.