The coronavirus recovery narrative has been broken wide open. If stocks were rallying based on lockdowns being eased and hopes of a quick rubber-band-like snap back, they can forget about it now.

As we showed yesterday, the number of confirmed cases continues to rise as we enter the dreaded second wave. Today the New York Marathon was cancelled, Disney delayed the opening of their theme parks, and Chuck E. Cheese’s parent company filed for bankruptcy.

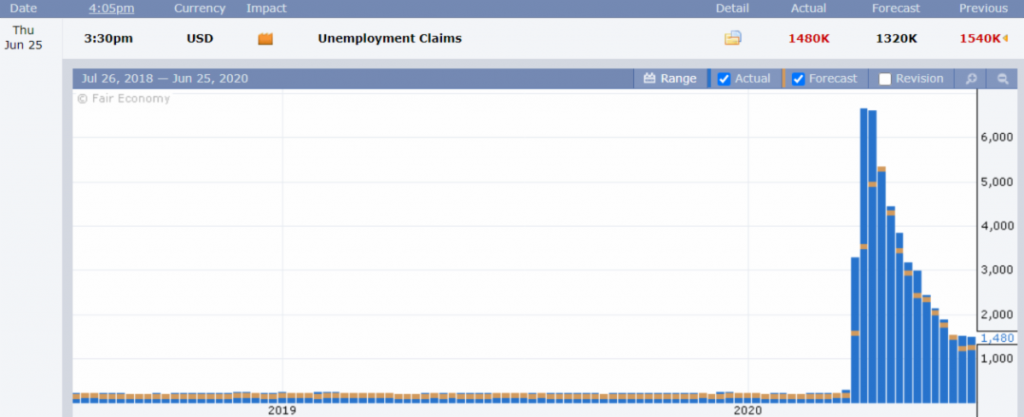

If that’s not bad enough, the weekly unemployment claims were announced, and the results were not only way worse than predicted, they’re almost as bad as last week and the week before. So much for a V-shaped economic recovery.

True to the character of his administration, White House economic advisor Larry Kudlow was on Fox Business saying that the V shaped recovery is still intact.

Well, as far as the stock market is concerned, it may well be. Sure, we’ve seen a bit of selling these last few days, but so far, there has been no real breakout to the downside.

Honestly, even though my money is for it to drop in the next couple months, it really could go either way from here. Here we can see the S&P 500 fighting valiantly to hold its 200-day moving average (blue).

Who’s In?

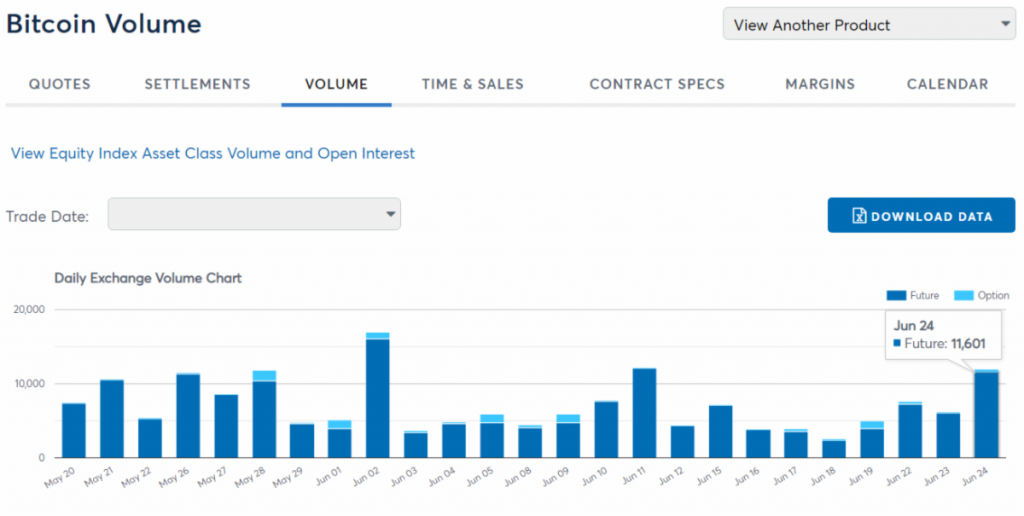

Along with the volatility, we are seeing an uptick in bitcoin trading volumes these last few days. This has been taking place less on digital currency exchanges, though, and more on the institutional side.

Looking at Messari’s data showing the volume on native digital asset exchanges, we don’t see anything too spectacular. There has been a bit of an uptick, but trading volume is still under $1.5 billion in the last 24 hours. By comparison, it was $4.35 billion at the beginning of the month.

The futures at Bakkt have been hot so far this week, and open interest at Deribit keeps rising. This is increasingly becoming a professional’s market.

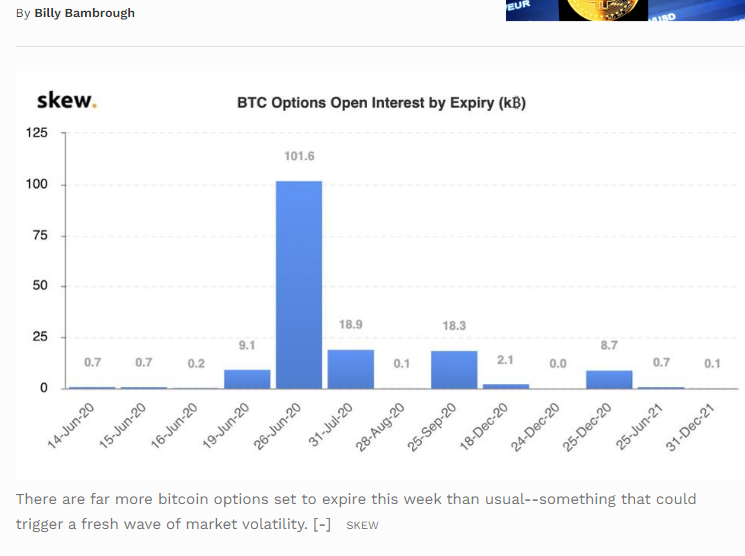

Speaking of which, several analysts have pointed to the bitcoin options market as a possible future choke point. When I say future, I actually mean tomorrow, where we have an abnormal amount of contracts expiring totaling more than $1 billion.

At this point though, it’s tough to tell exactly how that might affect pricing. It’s very possible that many of those positions will be rolled over seamlessly into the next period.

Also, there are many trying to pin the latest price slide on an outflow from bitcoin miners. The following chart has come up in my feed several times already.

Though I’ve tried, I’ve not been able to verify its authenticity. That sort of spike does seem a bit conspicuous, and it does almost seem like the provider got a hold of some erroneous data.

If you ask me, and if you’re reading this far down I’m assuming you are, the latest bitcoin and altcoin slide is nothing more than spillover from the traditional markets. We’re not uncoupled yet.