Last night, the U.S. National Debt reached $25,000,000,000,000 for the first time.

It’s now growing at its fastest level in history. I remember quite vividly when the number first passed $24 trillion. In fact, I remember it really well because it was less than a month ago on April 9th. So, if we do the math….

The U.S. government is borrowing a net amount of $35 billion per day, which comes out to roughly $24.8 million per minute.. Many people might like think that they’d be glad to be the U.S. government for just one solitary second and rake in $413,359.78, but please remember that this money is born directly in the form of debt.

Now, you might ask: How will they ever pay all this back?

The simple answer is, they won’t. In the coming years, policy makers will be faced with two options…

A. Tighten the belt. Raise taxes. Raise interest rates. And really watch what they are spending. This is known as austerity, and it is extremely unpopular.

B. Print even more. Keep interest rates low. And continue spending money like it’s going out of style. The lower the value of the Dollar, the lower the value of your monthly payments. This is a lot more harmful for your average citizen, but most voters are not quite savvy enough to understand this dynamic or realize that their money is being intentionally debased.

I’ll give you three guesses as to which path elected leaders will choose, though you might not need them.

So yeah, why not take half a million Dollars now, invest it wisely, then pay back half a million Dollars in 10 years. Now you know how financial firms are thinking at the moment.

Mother May I?

As expected, the weekly unemployment figures from the U.S. have been quite distressing, as 3.1 million people filed for benefits for the first time last week. The number came in just a hair above analyst estimates of 3 million even. So, at least the analysts are getting better at forecasting the data.

The stock market seems quite comfortable ignoring these horrid numbers. I actually heard someone say that “this is good news” because it’s the lowest figure since the crisis began.

Today we’re seeing the U.S. Dollar losing value across the board, as just about everything else gains. Stocks, Crude Oil, Precious metals, foreign currencies, and yes even bitcoin, especially bitcoin, are way up today and investor enthusiasm is palpable.

Frankly, it’s a bit difficult to understand where all the optimism is coming from. The CEO of Blackrock, who is one of the main dealers of U.S. treasuries, has just delivered an outlook that redefines the word ‘grim.’

4 Days

Not that there is anything particularly exciting about that, and it seems almost a bit funny that I, along with many others in the crypto community, keep obsessing about it.

After thinking briefly about writing a “how to trade the halving” article, or even “what to watch for during the halving” there just doesn’t seem to be anything really interesting to do, or say, or write, or trade, or take any action other than simply being present at the time. All we’ll really see on the front end is a counter resetting from ‘zero’ to ‘four years.’

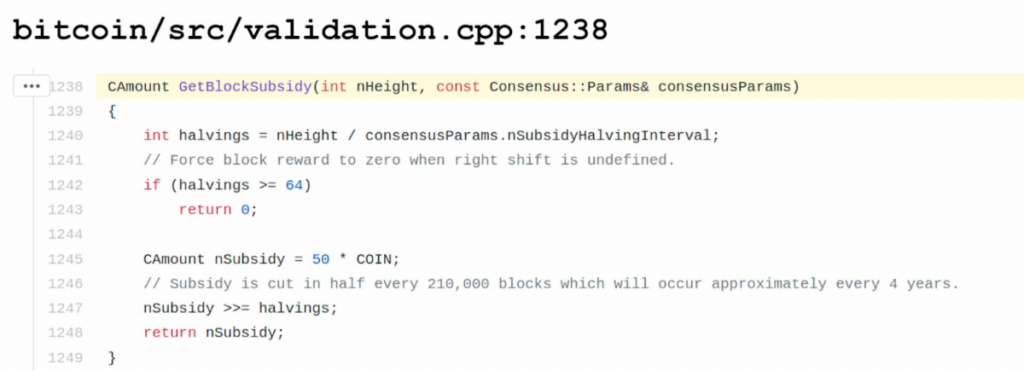

On the back end however, what won’t be visible to most people, is equally as unexciting as the front end. All that happens is the value of nSubsidy, which is currently set to 12.5, will be divided by two.

Yet, those few lines of code are basically what ensure that bitcoin will gain in value going forward while other currencies are designed to depreciate.