Over the weekend, we’ve added yet another hedge fund to the list of multibillion-dollar corporations and investors who have recently turned bullish on Bitcoin.

Their recent filing with the Securities and Exchange Commission (SEC) is an official request to invest up to 10% of the entire fund, or approximately $500 million, into bitcoin.

That’s about 25,000 BTC at today’s prices, or about 0.15% of the total supply ever minted. Of course, their request would need to be approved first, and doing so could be one final act of salvation for outgoing SEC Chair Jay Clayton, should he approve.

On a personal level, it’s really great to see them come to a decision at this time. I’ve been following the work of Guggenheim chief investment officer Scott Minerd for a very long time and often delight in his wisdom and knowledge of the markets. I’m glad to see he gets it.

It’s difficult to say whether Guggenheim is a contributing factor to bitcoin’s absolutely phenomenal price action today, as we continue to assault the all-time highest levels and key psychological resistance at $20,000.

In the meantime, the U.S. dollar is experiencing a bit of a meltdown, as the DXY Dollar Index has reached its lowest number since April 2018.

Stealing thunder

Normally, we would want to say that a declining dollar would be conducive to higher prices across the board, but that just isn’t the case today.

The stock markets have cooled way down and are currently experiencing a sour end to a fantastic month.

The Dow Jones Industrial Average, as of this writing, is down by 1.5%, despite some positive Monday vibes and some good news on the vaccine front.

What’s more, we have official confirmation that Wall Street’s damsel of QE, Janet Yellen, has been confirmed to be the next U.S. Treasury secretary, an event that’s apparently reason for her to open a Twitter account and send off her first-ever tweet.

For the time being, I still have more followers than her. 😛

Oddly enough, even commodities are having a bad day. Gold and crude oil are both off. Oil is down ahead of an important OPEC meeting today, and gold is lower as bitcoin steals her thunder.

Back it up

Yeah, that’s right.

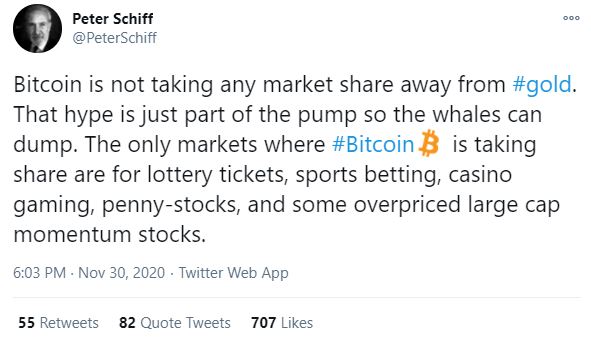

Well, it’s clear to all except one. …

Since Twitter hasn’t tagged this tweet as fake news, I’d like to put a disclaimer that this claim is widely disputed, and no evidence has been provided for the claims made.

As an advocate of gold myself, I kind of understand where he is coming from. It’s difficult and even a bit scary to imagine that the world is just about ready to toss a 5,000-year-old stable store of wealth for one that’s only 10 years old.

But then again, just because something is scary, that doesn’t mean it’s a bad thing. My children are extremely afraid of inoculations, but I still make sure they get them.

The world was very afraid when automobiles started encroaching on the horse business, but I guess that turned out alright.

Certainly, it would not be completely fair to post a graph comparing the two assets. It’s clear that over time, there is absolutely zero correlation between gold and bitcoin, positive or negative, and that their price movements have been completely different from one another.

The two did experience a brief spike during the mid-March multiasset COVID-19 sale. That was the highest level of correlation in history, which came out to 0.17 out of 1, or basically nothing.

So, drawing any conclusions about the long-term trend right now would be extremely premature.

For my part, I’m still eyeing an entry price for gold, I just haven’t found it yet, and in the meantime, I haven’t been very motivated to do so.