From the negative prices in oil just a few weeks ago, to the rising correlation between bitcoin and high-risk stocks, to people buying up bankrupt companies, to Tesla’s insane valuation.

None of it seems to make much sense to the casual observer, but if we take a step back, breath deeply and think about what really moves prices, we can find that there is a method to the madness.

The root cause of it all is clearly the coronavirus. COVID-19 has altered so many aspects of our daily lives in ways that would have been unimaginable to us going into the year.

From food and transportation, sports and music, the way we work and interact with other people and the world around us, to supply chains, international trade and geopolitics, everything is suddenly different.

Add to that copious amounts of fiscal and monetary stimulus and an extraordinary amount of new and unusual participants in the financial markets, and it’s really no wonder price action is so ridiculously crazy right now.

For what it’s worth, I would not recommend that newbies trade right now on anything more than throwaway money.

Long-term investors are also at an unfortunate disadvantage right now, as it’s extremely difficult to discern what the world might look like in the next five or 10 years post-COVID, which of our altered habits will be temporary, and which will be more permanent.

For those of us brave enough to weather some swing trading though, there are some really amazing opportunities right now. But be careful.

Rotation Time

Twitter has already recouped all the losses incurred following the hack the other day, yet it seems that verified blue-tick users still do not have access to post on the platform.

Netflix has suddenly fallen out of favor with investors, after reporting rather fantastic results in the second-quarter earnings.

It seems that the main issue here was that analysts were expecting a lot more from the company than record subscriber growth and outstanding profits. Their guidance for the third quarter wasn’t great either, as they’re expecting fierce competition in the video streaming industry from the likes of Amazon, Disney and the rest.

But there seems to be more at play here. …

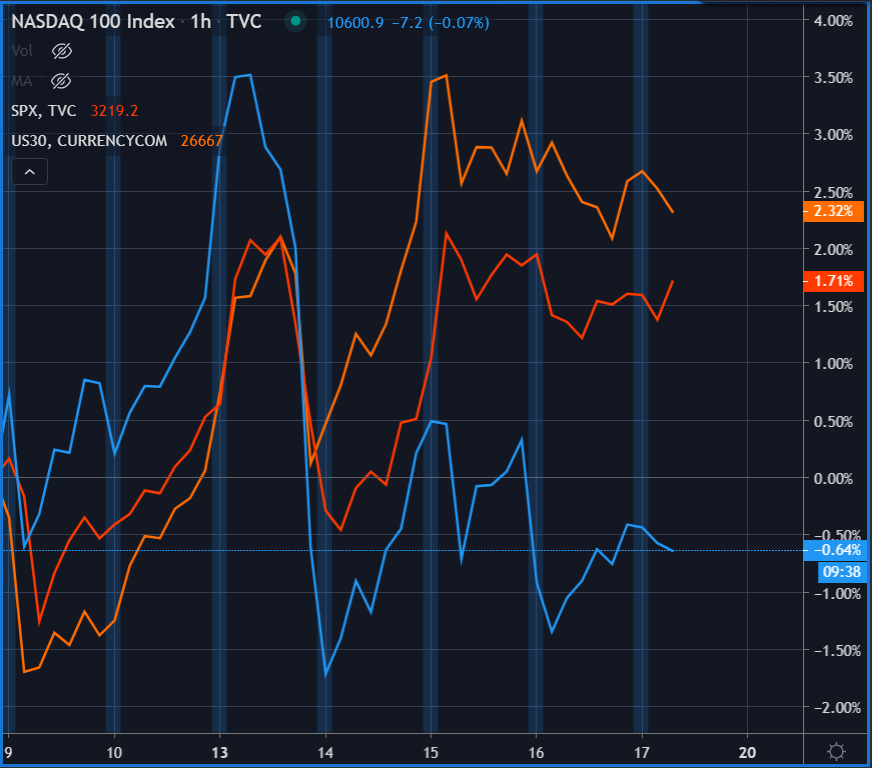

Technology stocks in general, one of the most powerful sectors of the market for the last few years and especially under COVID-19, seem to be underperforming lately.

Here we can see the tech-heavy Nasdaq composite index in blue, which has actually fallen over the last week by 0.6%, while the Dow Jones Industrial Average and the S&P 500 have risen 2.3% and 1.7% respectively.

As we mentioned the other day, investors are getting extremely selective these days.