Cryptocurrency was developed on the assumption of privacy. Satoshi Nakamoto’s whitepaper stressed the idea that bitcoin can both be transparent and private at the same time. Nakamoto wrote:

“The traditional banking model achieves a level of privacy by limiting access to information to the parties involved and the trusted third party. The necessity to announce all transactions publicly precludes this method, but privacy can still be maintained by breaking the flow of information in another place: by keeping public keys anonymous. The public can see that someone is sending an amount to someone else, but without information linking the transaction to anyone.”

Government intervention has turned user privacy into an arms race, with improved privacy-breaking techniques driving altcoin developers to make protocols that are stronger and with greater privacy insurance. However, news that the G20’s Financial Action Task Force (FATF) is preparing to issue new rules for Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter the Funding of Terrorism (CTF) that would require not only the recording of user information by crypto exchanges, but the passage of such information with any crypto transfer, threatens this sense of privacy.

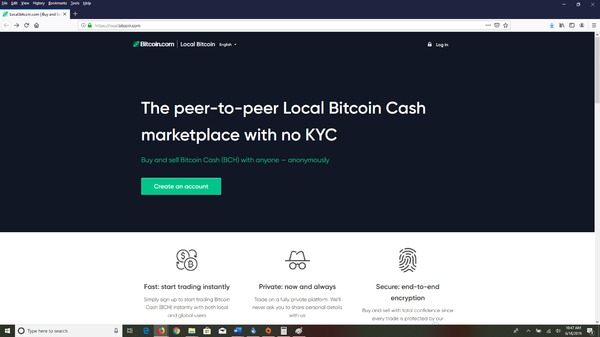

For some, the way around this is to simply avoid the exchanges. Peer-to-peer trading is basically bartering, where two people meet up and conduct a wallet-to-wallet transfer without the need of a third party. While this is generally considered risky as it does not offer the anonymity and protection of an exchange trade, peer-to-peer trading avoids the fees and requirements an exchange can demand. For Bitcoin Cash, one service offering matchmaking services for peer-to-peer trading is Local.Bitcoin.com.

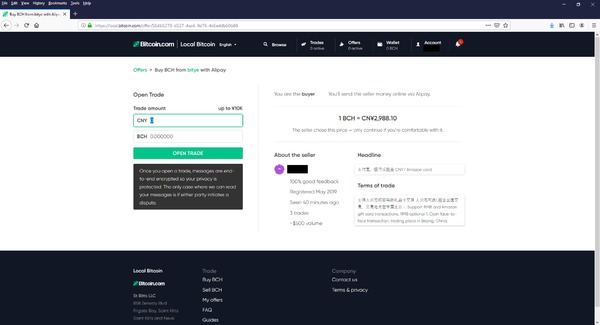

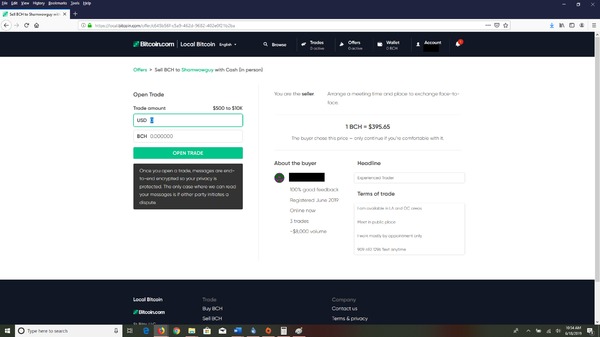

The service presents itself as a non-KYC alternative to exchange trading. The site offers a platform for Bitcoin Cash buyers and sellers to advertise themselves. A potential trading partner can choose his/her payment of choice and location to filter the choices. Once the trader has chosen a partner, he/she can negotiate the terms of the trade before arranging the in-person meeting or using the platform’s escrow service to conduct the trade.

How to Use LocalBitcoin

If you are interested in using Local.Bitcoin.com, the registration process is straightforward:

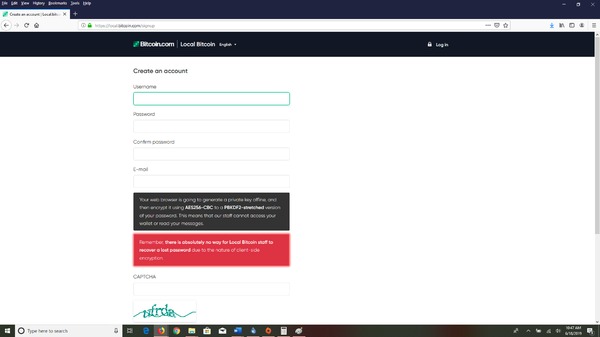

- Go to http://local.bitcoin.com. Click “Browse buy & sell listings.”

- Fill in your account password. As your password will be used to make a key for entry into the site, make sure that you securely record your password. You will need to confirm your email within one day of registration. Click “Create Account.”

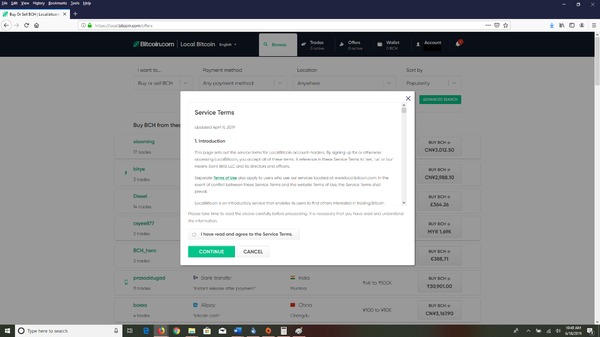

- Read the service terms. If you agree, click “I have read and agree to the Service Terms.” Click “Continue.”

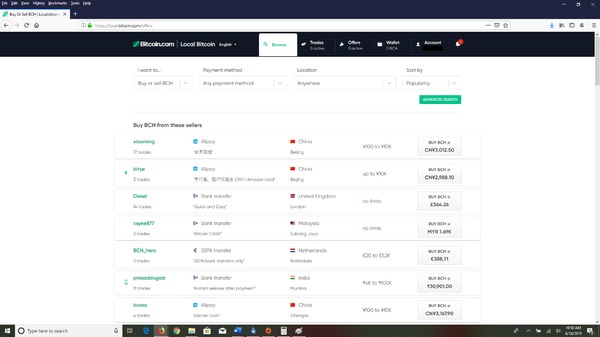

- The dashboard will show potential buyers to the top and potential sellers to the bottom. You can filter by preferred payment option, whether you wish to buy or sell, and your preferred country.

- If you wish to buy, press the buy button next to your selected seller’s name. This will bring you to an open trade window where you can start negotiations with the seller, as well as see the seller’s terms. A trade will not proceed until both parties agree on the purchasing price and amount of Bitcoin Cash to be sold.

- Likewise, to sell, you would click on the sell button by your preferred buyer. Just like buying, this will take you to the buyer’s page. You can set up an advertisement of your own where you can set the terms of the sale, but you will need to wait for a trading partner to choose you.

That’s it. Once the trade has been agreed upon, you would proceed to complete the sale.

While not everyone prefers peer-to-peer trading, it may be one of the last ways to ensure anonymity with altcoins. LocalBitcoin attempts to simplify this process in such a way that anonymity and trust are preserved.

Stay abreast of all the news in the altcoin world. Subscribe to the Bitcoin Market Journal newsletter today.