As digital asset markets mature, they attract more and more of the practices used in traditional financial markets. Thus, they give rise to new investment opportunities. The question is: how can you take advantage of these opportunities?

2019 has been the year of institutional adoption. In addition to the money, institutional investors have been injecting their tried-and-proven profit-making methods into crypto. HFT (High-Frequency Trading) and dark pools are examples of these methods.

What Is High-Frequency Trading?

High-frequency trading uses supercomputing and low-latency connections. Through such technology, trading algorithms of various degrees of sophistication place thousands of orders in fractions of a second. These algorithms analyze markets, pinpoint opportunities, and act on them, all according to a set of predetermined parameters.

Everything else being equal, speed is the variable that determines the edge the high-frequency trader enjoys. Thus, entities using high-frequency trading will do anything to gain the upper hand speed-wise.

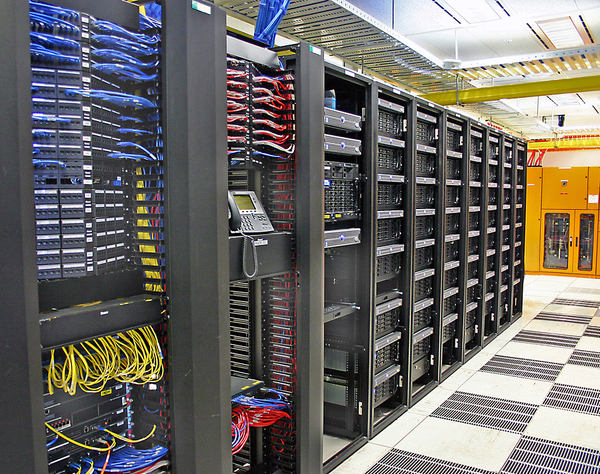

The best move they can make in this regard is to have their trading servers placed physically close to the servers of the exchange. This is called “colocation.”

There has been some hype about how a number of exchanges have effectively “invited” institutional actors to the trough by offering colocation services. Huobi, ErisX, and Gemini are exchanges which have taken steps to support HFT. However, the colocation issue is a bit more nuanced than just handing the big boys the keys to the vault.

The Ins and Outs of Colocation

Digital asset exchanges have the option of deploying their matching engines in a data center, or the cloud. As made clear by exchange insiders, deploying their operation in a top-tier data center is the technically soundest approach.

Such a solution gives the operator full control over every nook and cranny of the infrastructure. It makes possible the fine-tuning of the inner workings of the exchange, creating a predictable and seamless experience.

All of this is true for data center-hosted trading systems too. High-frequency traders who have their trading engines in the same data center as the exchange can cross-connect via a special API. Other users can connect as well, over the internet, through a Websocket API.

Cloud-based exchanges, on the other hand, have problems on all these fronts: latency, predictability, reliability, and uptime. In addition to that, clouds are hosted in data centers, meaning that unsanctioned colocation is possible in their case too.

The bottom line is that data center-hosted matching engines do not tilt the playing field toward institutional actors, any more than any other solution would.

A colocated and cross-connected HFT trading server will always have an advantage over manually trading retail traders.

The Benefits of High-Frequency Trading

HFT is a controversial practice. It drew flak in the past for causing flash-crashes in much bigger and better-established markets than the digital asset ones.

That considered, why would you, a retail investor, be interested in HFT? Here are some of the advantages of HFT, from the perspective of several different stakeholders in the digital assets market.

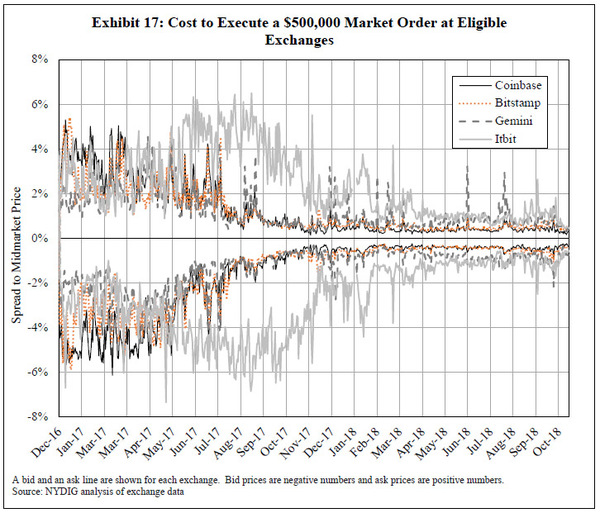

- For the digital asset space, HFT is beneficial for several reasons. It is a sign of maturity. It improves liquidity and price discovery, and it narrows bid/ask spreads. What HFT contributes to overall market quality clearly outweighs the damage certain sub-types of it can produce. It is the herald of institutional adoption.

- For the investor, it opens up a range of new profit opportunities. Properly tuned trading algorithms can make you money via market making, arbitrage, liquidity detection, latency arbitrage, etc. Because these are early days for crypto trading in general, HFT in this vertical is much more profitable than in any of the traditional markets.

- For exchanges, it ushers in stability, better liquidity, and an overall more attractive service package. The average exchange user has been enjoying HFT’s spread-related benefits for around 2.5 years now.

Various Types of HFT

As mentioned, some forms of high-frequency crypto trading are beneficial for the markets, while others are detrimental. As it happens, the beneficial forms of HFT are the least profitable. The detrimental ones are the most rewarding.

- Normal market making is aimed at making money on the buy/ask spread. It creates liquidity. Some exchanges reward market makers for the service they provide.

- Arbitrage takes aim at the price differences between various “coupled” assets. Cross-platform price differences are legitimate targets as well. Over time, arbitrage diminishes price differences.

- Statistical arbitrage identifies undervalued assets. Traders using this method buy these assets with the goal of selling them later at a better price. Pair-trading belongs in this category.

- News trading takes advantage of the power of supercomputing to react to news-induced asset price swings before other market participants. This is where HFT begins to veer away from being beneficial for the markets.

- Latency arbitrage is a form of cross-platform arbitrage, aimed at buying an asset at one exchange for a certain price and selling it at another for a higher price. Latency arbitrage adds nothing positive to the markets.

- Pinging is a barely legal practice which consists in the placing of a small “immediate or cancel” order, to detect willingness to buy or sell.

- Flash orders allow high-frequency trading systems to see certain orders a fraction of a second earlier than other market participants. Needless to say, the practice is hardly beneficial for anyone but the trader engaging in it.

Some of these practices are clearly detrimental. There are a number of others, however, which are downright illegal.

- Front running takes advantage of non-public knowledge of a major upcoming transaction.

- Spoofing is, in effect, price manipulation. It involves the placing of large orders at artificial prices to produce a swing in the price of the targeted asset. The perpetrator then profits off the price movement.

- Layering artificially inflates the trading volume of an asset. It thus creates the impression that there is a great deal of investor interest in the said asset.

How to Get into Beneficial High-Frequency Crypto Trading

The recipe is similar to successful HFT trading in traditional markets – up to a certain point.

If you are so inclined, you can build your own trading system, grabbing code off GitHub and using the API provided by your exchange.

Past that point you will have to:

- Locate an exchange which offers low-latency capabilities and adaptable trading platforms. Special institutional account types and sliding fee scales do not hurt either.

- Bear in mind that you need an API from the exchange to plug in your high-frequency trading system.

- Make sure your exchange is a data center-based one.

- Go for colocation if possible. Be aware that it is not the exchange that offers you this option, but rather the data center which hosts the exchange. Find out which data center hosts your exchange and buy server space there.

- Use the cross-connect API offered by the exchange. Make sure such an API is available and that your exchange supports such a matching engine.

The Bottom Line

HFT, together with its benefits, drawbacks, variants, and connected services, is part and parcel of the institutional adoption of digital assets. Like it or not, it is coming.

Given the highly volatile nature of the digital asset markets, its profitability is higher than in more conventional markets. It is up to you to take advantage of this profitability.

Will HFT hurt or help the digital asset industry as a whole? Only time will tell.

Subscribe to the Bitcoin Market Journal newsletter for more in-depth looks at investment opportunities brought about by institutional adoption of digital assets.