Welcome to earnings season! The first earnings reports are out. Much like the first few drops when you squeeze a lemon, the results cause observers to salivate, but you know that it’s gonna be sour later on.

Wells Fargo took the biggest hit with a loss of $2.4 billion, while Citibank and JPMorgan Chase both beat their estimated earnings. However, neither really put out a very optimistic outlook. JPMorgan CEO Jamie Dimon said it best. …

I’m glad that we have people like Dimon to tell us that there’s uncertainty in the markets. Honestly, I could not have said it better myself.

Anticipating a huge package

Trading is choppy today. After Tesla’s huge rally reversed itself, causing the stock to close lower yesterday, volatility is up sharply. The fact that TSLA is an indicator seems a bit silly to me, but I digress.

Help is expected in the form of money printing later this week, but not from the central banks. European leaders will be meeting in person this Friday for the first time since the outbreak to thrash out a half-trillion-euro stimulus package.

Rumor has it that it may take a second summit to figure out all the details, but I have a feeling that in the unlikely event the market turns sour between then and now, we might see some peace and harmony among lawmakers.

The same goes for the United States, only the stakes are much bigger. Firmly into the unrealistic world of Modern Monetary Theory, the number some market participants are expecting to hear from Congress has reached as high as $3.5 trillion for the next package.

I’m not entirely sure that it will play out that way, especially with all the tension over the Black Lives Matter protests and a deeply divided country, but negotiations are tense right now, and markets are moving on the optimism that a deal will get through sooner rather than later.

DeFi blastoff

Following the stocks, the market for digital currencies is choppy as well. We’ve seen some tremendous gains recently, and now they’re consolidating. It will be most interesting to see if we can see a few breakouts. I’ve mostly been trading cardano and tezos lately, and feel that a fresh high could go a long way right now.

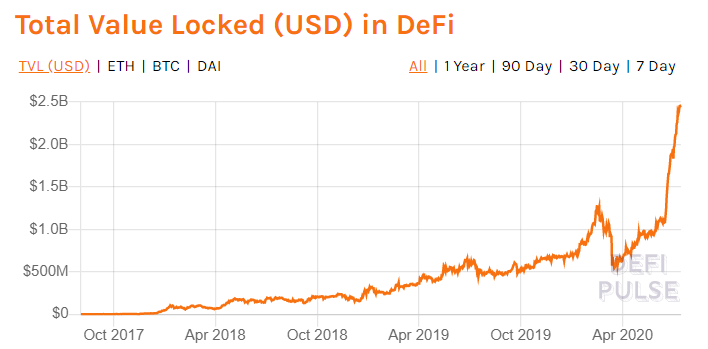

In addition, it’s worth keeping an eye on the world of DeFi.

All I can say is … gosh, I hope not. Just looking at the totals though, it does sort of look like a bubble. The entire market has gone from crossing $1 billion for the first time at the start of the year to nearly $2.5 billion today.

In large part, this is due to the compound effect that we discussed a few weeks ago, where traders are leveraging money that they’ve borrowed and lending it back to the same platform. So it’s unclear how much of this money is being counted twice or thrice, or maybe even more. …

It doesn’t matter. Even though this chart does look like a bubble, there’s no real reason that it needs to pop right at this moment, and it certainly has the potential to grow several times over before this phase of the cycle is through.

We’ve seen it happen before in this market. Even though there may be pain down the road, things are looking pretty good right now.