To read the news, you would think the sky is falling.

Crypto companies are freezing investor funds. Others are filing for bankruptcy. As the price of bitcoin has crashed, so has the rest of the market, causing a domino effect that has spread through much of the crypto ecosystem.

I have two good pieces of news for you.

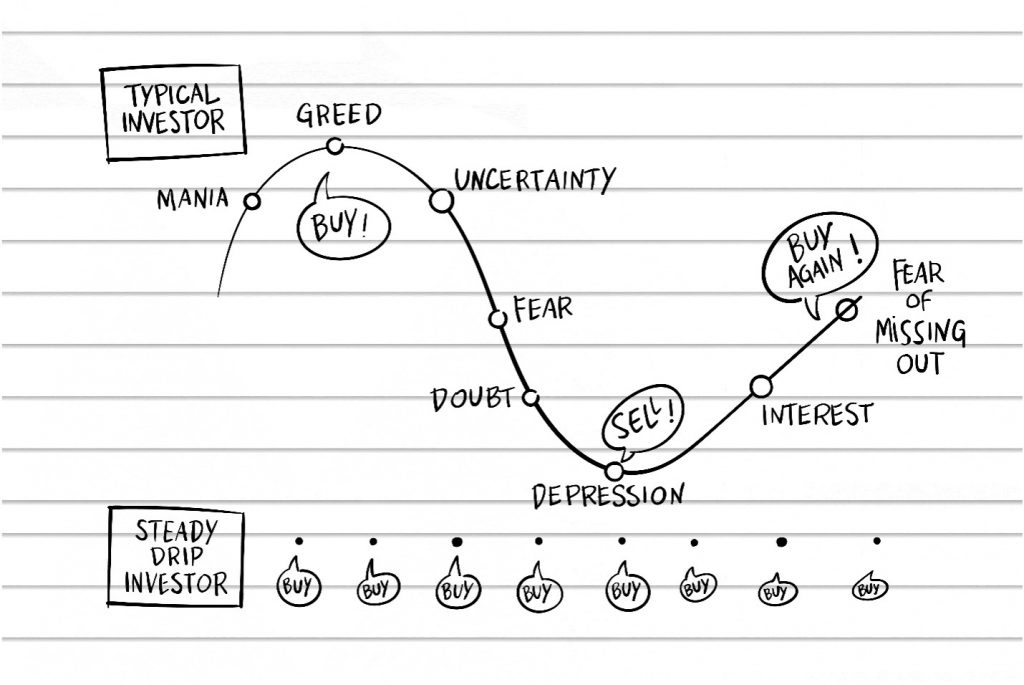

The first is that investors who have followed our simple investing plan -- a steady-drip monthly investment using set-it-and-forget-it tools like Coinbase and Betterment – are doing just fine. These services have stood the test of time, which is why we recommend them.

The second is that long-term investors in our plan are still beating the stock market. The Blockchain Believers, as we call ourselves, are beating the Non-Believers.

Rome wasn’t built in a day, and great fortunes aren’t built overnight. If you got into crypto investing during the last year, it may have been dazzling to see your instant wealth, then dizzying to see it vanish in a matter of weeks. Stay the course.

In my book Blockchain for Everyone, I tell my own rags-to-riches-to-rags story of going “all in” on the first big bitcoin boom, then losing it all over the next few months. I’m so glad I stayed the course, because in time it became rags-to-riches all over again.

Today, in fact, I have a Zen attitude about the market. The fact that bitcoin has lost 2/3 its value in less than a year bothers me not at all, because I’ve diversified (the great lesson that I hope my book will teach you).

Of course, I am concerned for those first-time investors who have lost great amounts of money, but that’s why we continuously preach this simple plan, through both good times and bad:

- Buy bitcoin, plus a small number of high-quality digital assets

- Set them up on a steady-drip plan, investing the same amount each month

- Make them part of an overall portfolio (stocks, bonds, up to 10% crypto)

- Think long-term (5+ years)

- Full instructions here.

This strategy seems foolish in the boom times, when crypto services are offering 120% interest rates, 10x leverage, and free tokens. But in the tough times, everyone wishes they had followed it. Stay the course.

Some of you will have to sell your crypto to stay afloat during these lean times, and many of you will swear it off altogether. In my view, a better approach is to learn from your mistakes, sell what you must, then put the rest into this long-term investing plan.

I recently showed you that our simple “Big Believers Portfolio” has even beat the crypto hedge fund industry, at a fraction of the cost. The crypto hedgies themselves would do better to just follow this plan, but then they couldn’t charge their exorbitant fees.

The Blockchain Believers Plan has one drawback: it’s boring. But good investing usually is. (Warren Buffett, remember, made most of his money on insurance.) If you want to gamble, go to Vegas. If you want to build long-term wealth to share with the world, stay the course.

Brain Hacks for the Investor Mindset

When the market is down, it’s difficult to think rationally. “Why buy now, when the market may go even lower?” your brain will tell you. “I’m not going to fall for that one again.”

Here are a few techniques you can use to keep the Investor Mindset.

Think of crypto as software companies. If bitcoin was a software company, do you see it going out of business anytime soon? Or is there enough demand, and enough brand, to carry it through the tough times? (Remember: tech companies like Netflix and Amazon are staying the course, and even ramping up hiring, during this downturn.)

Think of crypto like money. We may not like how money markets are behaving, but few of us question the validity of money itself. If you think of the move toward crypto as a continued step in the evolution of money -- from coins and paper, to ones and zeroes -- that makes it easier to stay the course. It's hard to see us going back to paper.

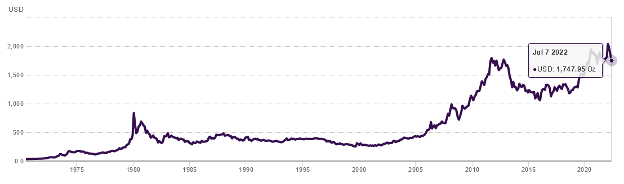

Think of crypto like gold. Think of this time like the California Gold Rush, during which fortunes were made – both in gold mining, and in the “picks and shovels” – that changed the character of the United States. (The price of gold was set by the government until 1968: this chart is an argument for HODLing if ever there was one.)

George Hearst: The OG Miner

One of my favorite rags-to-riches stories is that of George Hearst, a miner who left a legacy.

Hearst grew up during the early 1800s on a small farm in Missouri, with little access to formal education, but he didn’t let that stop him. He cultivated an interest in mining, and began to teach himself about gems and minerals, learning everything he could by visiting local mines.

After several years of learning the mining business, he heard the news of gold in California (the crypto boom of its day). He did his homework, researching to see if the rumors were true, then pulled together a party of 16 prospectors to make the long, arduous journey to California, along with thousands of others seeking fortune.

At first, they tried Sutter’s Mill, where gold was first discovered, but they found it had been picked clean, and the company almost didn’t make it through their first winter. Undaunted, they moved to another site the following year, but that also came up empty.

Hearst pivoted his mining strategy from gold to quartz, drawing on his extensive knowledge of minerals. He also diversified into prospecting (i.e., buying and leasing parcels of land that potentially contained valuable mines). He opened a general store to sell the “picks and shovels.” He raised livestock. These additional revenue streams helped him ride out the tough times.

It was nearly ten years before his patience paid off. He got a tip on a silver mine in present-day Nevada. Again, he did careful research to confirm the opportunity was a good one, then hurried down to buy a 16% interest in the mine.

It was nearly ten years before his patience paid off. He got a tip on a silver mine in present-day Nevada. Again, he did careful research to confirm the opportunity was a good one, then hurried down to buy a 16% interest in the mine.

That winter, Hearst and his partners mined 38 tons of high-grade silver ore.

From there, he had enough capital to repeat the formula, buying partnerships in high-potential mines, investing in the infrastructure to keep them profitable and secure, and directing his newfound wealth into enterprises to benefit his shareholders and society.

The lessons we can take away from the George Hearst story are:

- Do your research; learn everything you can.

- Diversify your revenue streams, and your investments.

- Patience and persistence pay off.

By reading this, you’re doing your research. By following the Blockchain Believers plan, you’re diversifying your investments. The final step is simple: just stay the course.

We’re in this for the long haul. Get rich slowly. And during down times, you might even consider doubling down. The mine is ready and waiting.