Key Investor Takeaways:

- A simple buy-and-hold strategy of 50% bitcoin and 50% Ethereum has outperformed the crypto hedge fund industry.

- Crypto hedge funds also charge extremely high fees that eat into investor profits.

- Instead of hiring a crypto hedge firm, investors can set up steady-drip investing, with a 50/50 mix of BTC and ETH, and let it build over the long term.

One of my heroes is the famous investor John Bogle, who founded Vanguard Investments, which today has over $7 trillion in assets. But it wasn’t always that way.

Bogle’s key insight was that mutual funds didn’t work for the majority of investors. Even though they were popular, the mutual fund industry did not beat the stock market over the long term. (If you’re skeptical: here’s proof, proof, and more proof.)

It’s still hard to believe, because mutual funds are run by smart financial professionals with access to excellent research. Why would so many people invest in them, if they didn’t work?

I’m currently reading Bogle on Investing, a 500-page collection of his essays and talks, and it’s astounding how he found so many ways to come back to one simple idea: most investors will do best by investing in the overall stock market, not by trusting the so-called “experts.”

He was firmly, squarely on the side of investors.

This is why Bogle founded Vanguard, along with its Total Stock Market Index Fund (VTSAX). Investing in VTSAX is like buying the entire stock market. Since the stock market has averaged a 10% return over the last 100 years, its performance has been better than the majority of mutual funds. (Lower fees, too.)

It took some time for investors to understand that Bogle’s “simple” strategy was right. In crypto, we’re learning this all over again. But instead of mutual funds, it’s crypto hedge funds.

How Crypto Hedge Funds Work

Crypto hedge funds are run by money managers who pool money from investors, then put it to work into various crypto investments. Their goal, of course, is to make money: to outperform the “simple” DIY method of just buying and holding crypto yourself.

A new report from PricewaterhouseCoopers surveyed hundreds of crypto hedge funds, illuminating their secret inner workings:

- On average, crypto hedge funds attract about 30 investors, who each put in about $500K.

- About half of crypto hedge funds are legally incorporated in the Cayman Islands, though the managers are located all over the world.

- Most crypto hedge fund teams are small, just 6 or 7 people. I think of them as “crypto bros gone pro.”

These hedge funds charge outrageous fees: typically an annual 2% on all your money, plus 20% above a certain benchmark return.

These funds appeal to high net worth individuals (HNWIs) who can’t or won’t buy and hold crypto themselves. But as the report shows, the rich are paying dearly for putting their money into these hedge funds.

You’re Better Off HODLing

While strategies vary, hedge funds generally try to make money like traders: buying and selling, borrowing and lending, and yield farming. (Meanwhile, the fees on every one of their trades is eating into your profits, but that’s another story.)

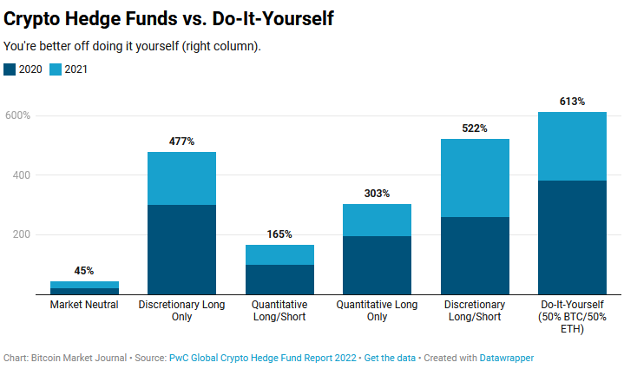

The PwC report classifies the hedge funds by various technical names, but it really doesn’t matter because you’d be better off holding a 50/50 mix of bitcoin and Ethereum:

A 50/50 mix, of course, is exactly the strategy we use in our Blockchain Believers Portfolio, along with a healthy dose of Vanguard’s total stock index fund.

It’s so simple that most people don’t believe it works, just like most people didn’t believe Jack Bogle. Surely the professionals, with their massive supercomputers and giant brains, can outperform the stock market! Over the long run, most of them can’t.

Their real results are likely even worse. First, the returns above don’t account for the 2-and-20 fees. And many crypto firms from their 2021 survey either closed up shop, or didn’t answer the 2022 survey (nobody likes to admit poor performance).

True, we have only a few years of data on crypto hedge funds, but this is still a very young industry. It could be that over the next ten years, a few of them will do well. But which ones? You’re back to picking individual crypto bets, and hoping you get lucky.

It’s tempting to “trust the professionals,” until you realize the professionals, as a whole, are not beating the simple do-it-yourself strategy. That’s true in the stock market, and now we’re seeing it’s true in the crypto markets as well.

But there’s one more reason to avoid crypto hedge funds: they’re risky.

Crypto Hedge Funds are Risky

Take a look at the top crypto assets held by these hedge funds in April 2022 (when the survey was conducted).

Aged like milk.

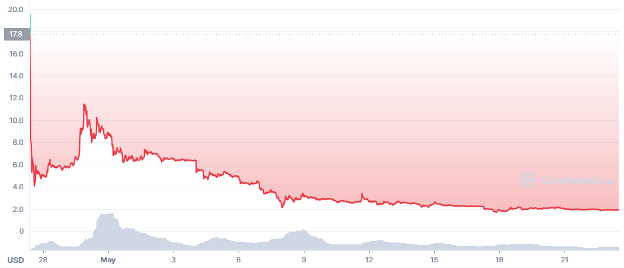

Note the first two assets held are BTC and ETH (thus showing the hedge fund managers intuitively know the real money-makers), followed by SOL (which is flirting with disaster) and LUNA (which of course famously collapsed).

When you trust your money with a hedge fund, they’re not just going to let it sit there. They want to do something to justify their sky-high fees, so many put it into LUNA (which at the time, remember, was paying 30% interest). What could go wrong?

Plenty.

Their desire to show short-term profits — most of them do not require long-term lockups — leads them to take bigger risks. Imagine if you entrusted your money to a crypto hedge fund, and they sunk it into LUNA. Today you’d own the sad LUNA 2.0:

This is a situation where you can make better financial decisions than the wealthy: just don’t hire a crypto hedge fund. Instead, you can set up steady-drip investing, with a 50/50 mix of BTC and ETH, and let it build over the long term.

The rich can afford to lose money. Let them.

Simple Becomes Sensible

For years, Jack Bogle was mocked for his “simple” strategy. When he launched his first index fund, it raised only $11 million and was nicknamed “Bogle’s Folly.” Today the Vanguard 500 holds over $750 billion in assets.

At first, the simple strategy often seems too simple. A crypto hedge fund might hit a hot streak for a year or two. A crypto staking platform might offer 30% yield. When everyone else is getting rich, why sit on the sidelines?

But over the long term, the smart money eventually realizes that simpler can be better. Later in his life, Bogle warned that simple, low-cost index funds were growing so big that they might be able to sway the entire stock market.

What was once “simple” had become “sensible.”

We can see the parallel in crypto investing. People spend so much energy on finding the next hot token, chasing yield, or stacking DeFi strategies, that they forget to measure their performance against just buying and holding a mix of 50% bitcoin, 50% Ethereum.

We Serve Investors

The beauty of Bitcoin Market Journal is that we don’t accept advertising, so we have one audience to serve: investors. Like Bogle, we are firmly, squarely on the side of investors.

Crypto hedge funds may also be on the side of their investors, but remember they’re earning a living on the 2-and-20 fees. That makes them antsy to do stuff, and that stuff might lead to more risk, and certainly leads to higher fees.

Fortunately, you don’t need an MIT-trained Ph.D. in quantitative finance. The simple strategy of just buying and holding 50% bitcoin and 50% Ethereum is beating the crypto hedgies.