“What’s the price of bitcoin going to be next year?”

I get this question All. The. Time.

I have a few stock answers. “I promised Satoshi I wouldn’t tell anyone.” Or, “My prediction is there will definitely be a price.”

I don’t know of anyone who predicted all that would happen in 2020 (with the possible exception of Bill Gates back in 2015). The future is hard to predict, which is why fortune tellers live in trailer parks. It’s also why good financial writers don’t give investing predictions, they talk about investing principles.

Principles are better than predictions, because principles are the laws that run the universe. We can “predict” that an acorn will grow into an oak. Weather forecasters do this every day: a drop in barometric pressure “predicts” bad weather.

Principles aren’t perfect, but they’re pretty good predictors.

So by understanding the principles behind blockchain, we can make excellent long-term profits in blockchain. Even though bitcoin and cryptocurrencies are still new, the principles are already there, timeless and eternal, waiting to be discovered.

It’s like math: it was always there, it just took us a while to figure it out.

When we “figure out” the laws behind blockchain markets, we can make better predictions about the future. This doesn’t mean we get it right 100% of the time, but we can greatly improve our skill as long-term investors.

Before we talk about 2021, let’s look at how these principles predicted what would happen in 2020.

2020: A Look Back

In my column one year ago, I said that John McAfee’s prediction of $1 million per bitcoin by the end of 2020 was unlikely. I thought Florian Glatz’s prediction was less sexy but more likely: we’d continue the march toward digitization of national currencies.

I said China would be the first major country to roll out a digital currency – most likely in 2020 (ding). Other nations would be quick to follow suit (ding). This acceleration of digital currencies would accelerate the tokenization of other assets (ding, ding, ding).

Principles: Nature loves liquidity; paper goes digital; over-centralization leads to decentralization

March: Our SEC Safe Harbor Proposal

In March, we issued a proposal outlining how the Securities and Exchange Commission can create a “Safe Harbor” for blockchain projects (download it here). While not law yet, SEC “Crypto Commissioner” Hester Peirce signed on for a second term, and the SEC recently spun out FinHub as a standalone office. Government moves slowly, but things are moving in our direction.

Principles: Eggs must be protected; good seeds and good soil lead to rich gardens

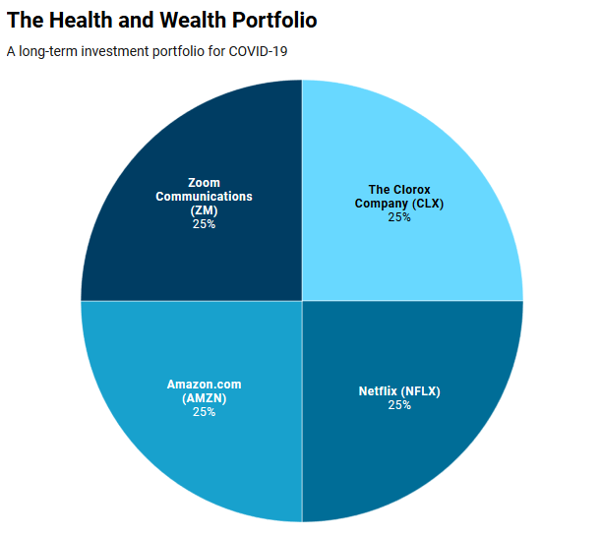

Also March: The Health and Wealth Portfolio

On March 13 (!), we unveiled our Coronavirus Stock Portfolio, which predicted four companies that would likely do well during Covid-19: Amazon, Clorox, Netflix, and Zoom. This seems like common sense now, but things looked much different back then (who used Zoom?).

Those who invested in our “Health and Wealth” portfolio back in March have literally doubled their money:

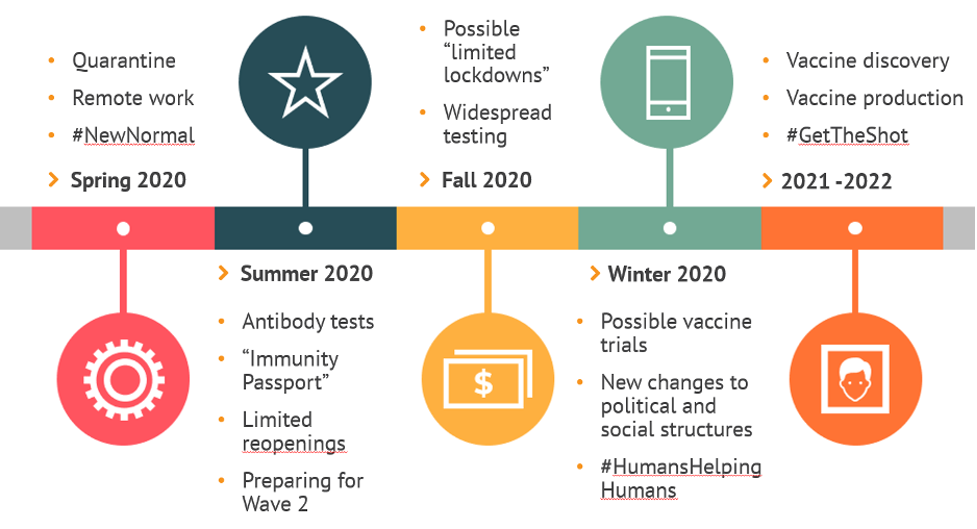

We quickly sketched out a timeline for the pandemic, saying that Wave 2, financial turmoil, and civil unrest were all likely. It was all eerily accurate, though the vaccine may have arrived a few months earlier than expected (depending on where you live):

Principles: Invest in great products at times of great need; everything that can go digital, will

Spring: Covid-19 Blockchain Solutions

We spent the early days of the pandemic proposing three blockchain-based solutions that could help humankind: an immunity passport, supply chain solution, and blockchain bonds. Again, governments are slow to move, but we have seen significant progress on all three.

Principles: Great problems lead to great innovations; the best way to predict the future is to build it

Summer: Our Digital Asset Rankings

In June, we rolled out our new Digital Asset Rankings. Investors who put their valuable money to work in our top-rated digital assets have been handsomely rewarded:

Fall: Making Sense of Decentralized Finance (DeFi)

I spent the summer and fall explaining the new world of DeFi investments, letting you know that I had invested in COMP, LINK, REN, AAVE, BAL, and UNI. All these have performed well, except that I expected the “Uniswap Unicorn” to hit a billion-dollar valuation this year (it’s currently at about $750,000,000).

Principles: Think of DeFi tokens like investing in companies, and approach them as a value investor

And There’s One More Thing…

We also launched a new book.

Principles: See Chapter 14.

So, What Will the Bitcoin Price Be in 2021?

I’ll ask at the next Illuminati meeting. We get together on Thursdays.

In summary, I am extremely proud of our work here at Bitcoin Market Journal in 2020. These are sensible, positive, growth-focused ideas that performed very well for our investors in 2020 — if you had the courage and the capital to act on them.

I’m also proud of all the recommendations we’ve made this year to the highest levels of government. We’re using our money to move the world in a positive direction. We’re using the global crisis as an opportunity to move to a world that is greener, smarter, and fairer. We’re moving the world forward.

Finally, I’m proud of our bedrock investing principles, which stand out like a tropical island in a sea of crypto noise. Principles are a kind of prediction: they show the way the universe is wired, the natural laws that govern our reality. And principles predict that if we act a certain way, a certain result – sooner or later – is likely to happen.

The tricky part is the timing. I often call things too early: sometimes it takes reality a while to catch up with my imagination. (Remember, I was investing in VR in 1995.) That makes my column an excellent resource for long-term investors, who can patiently wait. (It’s not so good for short-term traders, but that’s why you have the brilliant Mati Greenspan.)

In my next column, I will finally answer the question of how these principles are likely to play out in 2021 – and beyond. It’s going to be an exciting year.

John Hargrave is the co-author of Blockchain Success Stories: Case Studies from the Leading Edge of Business.