1. Bitcoin Daily Active Addresses

Our thesis: Cryptocurrencies are like companies and active addresses are like customers, similar to active users of Facebook or active subscribers of Netflix.

We can measure the price (black line) relative to the active addresses (green line) to see if bitcoin is currently underpriced or overpriced.

Investor takeaway: Active addresses (green line) have risen over the past week despite a slip in the bitcoin price (black line). BTC is again at $20K, possibly due to higher-than-expected inflation after trading nearly $3K higher over the weekend.

With activity increasing as the price falls, long-term investors are likely agreeing with us that crypto crashes present good buying opportunities. Buying low can often mean selling high once the market returns to form.

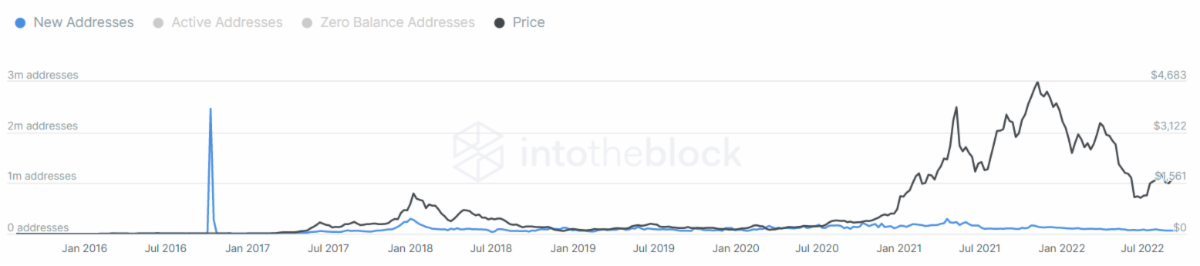

2. Ethereum Daily Active Addresses

Investor takeaway: This week began with the price (black line) moving past $1700, though by Tuesday, the bears brought the asset back into the $1500 range. The number of active addresses (green line) has also slightly thinned over the past seven days.

With the long-awaited Merge now in place, the results are surprising, especially as many have predicted ETH would jump as the event moved closer, though it may be too early to tell. We recommend allowing a “wait and see” approach before reaching any conclusions about ETH’s present valuation.

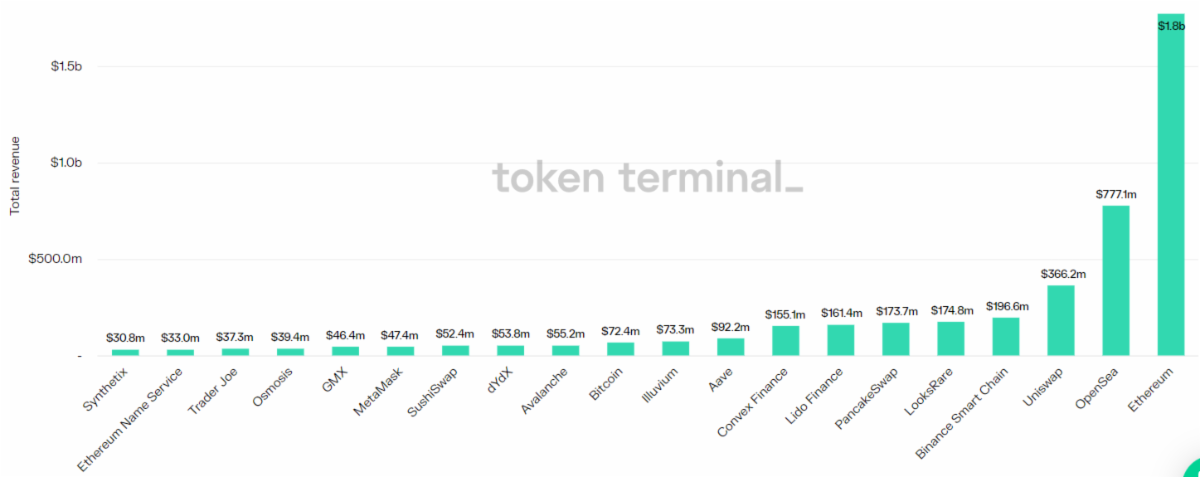

3. Top Crypto “Companies” by Total Revenue

Our thesis: Crypto revenue like transaction fees is how a crypto “business” makes money. Smart investors look for the projects generating the most cash.

Investor takeaway: We’re about buying and holding shares (or tokens) of crypto’s main players. The chart above continues to show the top four revenue-producing projects as:

- Ethereum (the top blockchain network)

- OpenSea (the top NFT marketplace)

- Uniswap (the top decentralized exchange)

- Binance Smart Chain (the top centralized exchange)

The most noticeable difference this week comes with OpenSea, which has dropped by more than $200 million in total revenue over the past seven days. As the world’s largest NFT marketplace, perhaps the trend of buying digitized art laden with copyright issues is beginning to dissipate.

4. Top Crypto Companies by Protocol Revenue

Protocol revenue is money paid back to token holders or company treasuries (vs. being paid out to liquidity providers as with Uniswap or NFT holders as with OpenSea). You might roughly think of this like stock dividends.

Investor takeaway: dYdX has been hit hard this week, falling from 3rd place to 6th after losing more than $120 million. This has given LooksRare (last week’s #4) the chance to move to #3, while newcomer Illuvium rounded things out.

Despite these changes, Ethereum and OpenSea remain our choices for long-term investments as the others are exhibiting harsher volatility by comparison.

5. Total Value Locked

TVL represents how much is held or “locked” in a company’s smart contracts. It is roughly equivalent to the deposits held by a bank and can signal a crypto company’s strength.

Investor takeaway: The top three entities remain Curve, MakerDAO, and Lido, though the #1 position is virtually anyone’s game. Only a few million dollars separate the three as TVL continues to sink, and with The Merge now in full swing, Lido could soon become the dominant force on this list thanks to its status as a top ETH staking service.

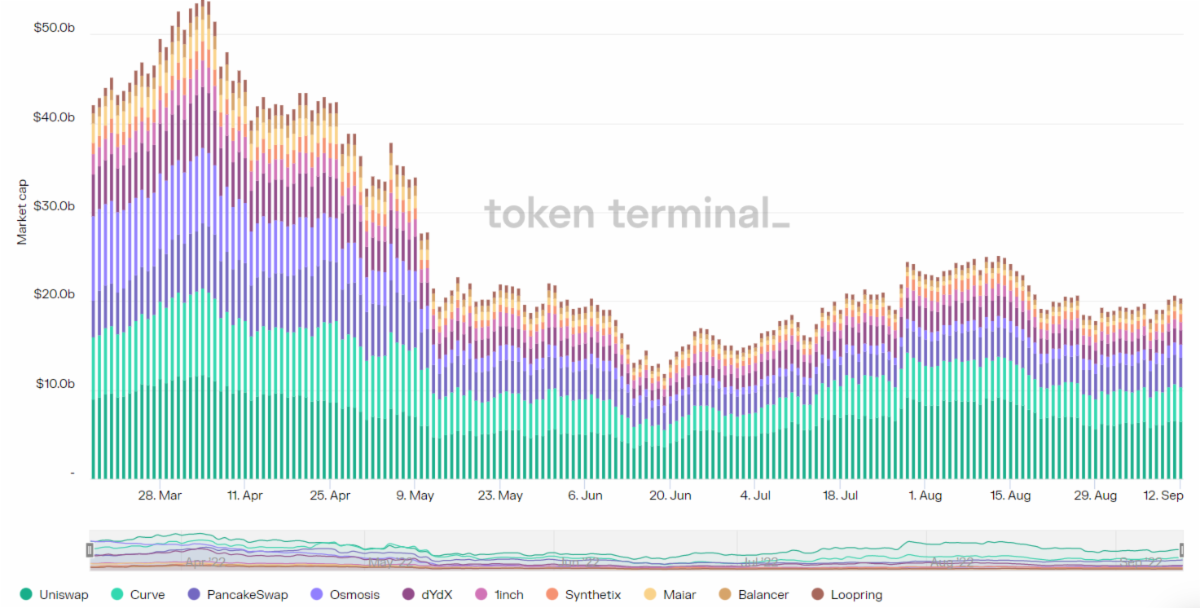

6. Top Crypto Exchanges

Our thesis: Crypto exchanges, both centralized and decentralized, are arguably the most important applications in blockchain. Savvy investors look for which will be the #1 and #2 exchanges over the long term.

Investor takeaway: Again, we have Uniswap leading the exchanges, while Curve and PancakeSwap complete the top three. dYdX, despite its revenue problems discussed earlier, remains in 4th place, though Osmosis is lessening the gap with only $2 million separating its market cap from dYdX.

This is a huge shrink from the $400 million difference exhibited last week, suggesting dYdX is still suffering from its unpopular user promotion.

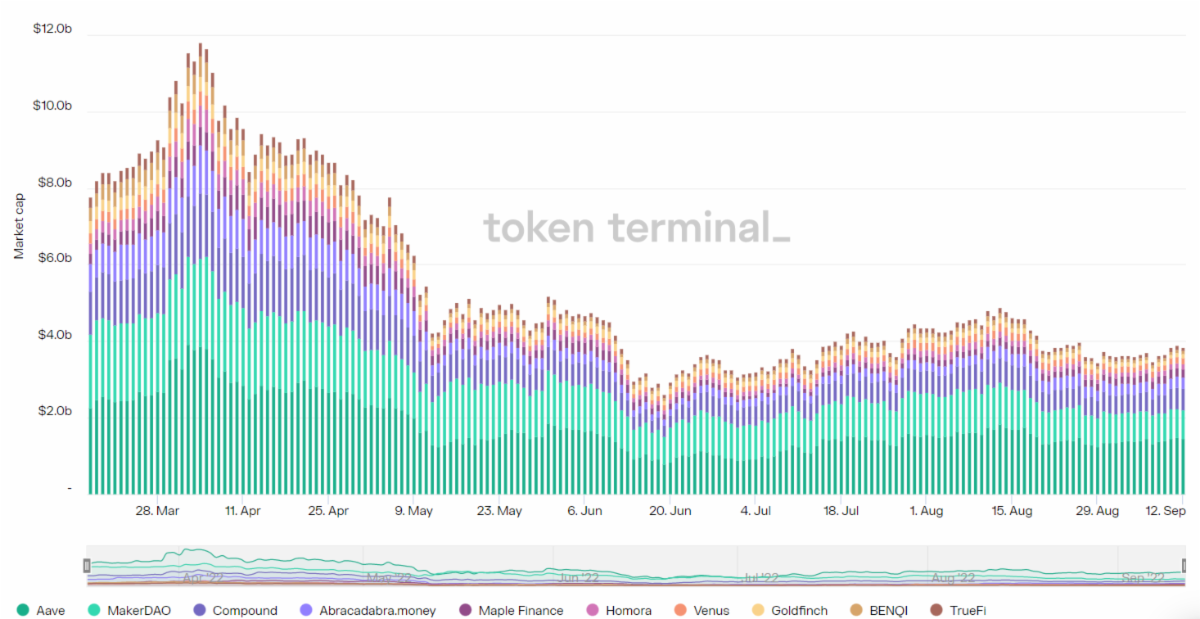

7. Top Lending Protocols

Our thesis: Lending and borrowing is another proven use case of blockchain. Savvy investors look for the companies that will dominate the lending market long term.

Investor takeaway: This week’s chart remains unchanged with Aave, MakerDAO, Compound, and Abracadabra.money making up the top four. Abracadabra has held this position for the last seven days after overtaking Maple Finance, suggesting it’s not just another lending platform, but rather a growing enterprise that’s worth taking seriously. We’ll keep a close eye on the project to see if its magical powers remain intact.

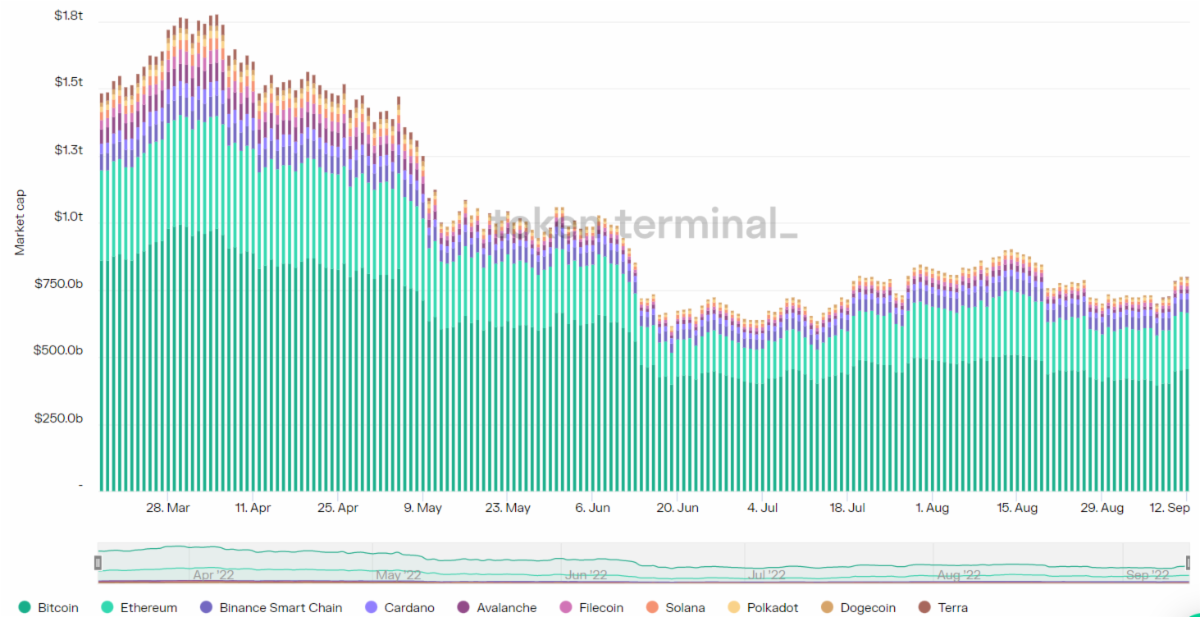

8. Top Layer 1s

Our thesis: Foundational blockchains, also known as L1s, are like the operating systems for Web3. We predict there will be two or three big winners that will go on to dominate the internet of tomorrow.

Investor takeaway: Bitcoin, Ethereum, and Binance Smart Chain are still the #1, #2, and #3 blockchain networks out there. No doubt they’re strong, but the world of blockchain is anything but predictable.

For instance, the #4 blockchain is the Cardano network. Not long ago, we discussed its growing popularity and stability, so perhaps an L1 like Binance Smart Chain (which has less than $30 billion separating it from Cardano) should start feeling a little nervous.

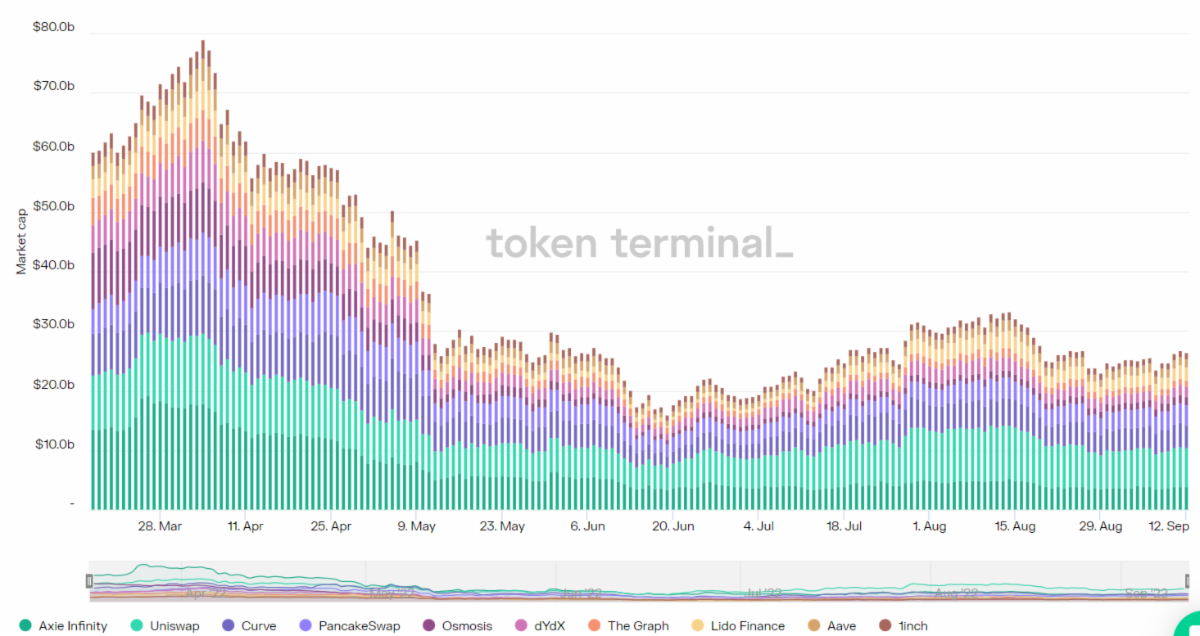

9. Top DeFi Protocols

Our thesis: DeFi companies are the future giants of fintech, disrupting or replacing all the legacy payment and banking systems of today.

Investor takeaway: Uniswap remains the #1 player in DeFi. Axie Infinity and Curve are still neck and neck, with Axie leading the market cap race by only $1 million. PancakeSwap has proven to be a subtle player and has made its way into the top four by crossing the $3 billion line. Only $500 and $600 million separate it from Axie and Curve, respectively.

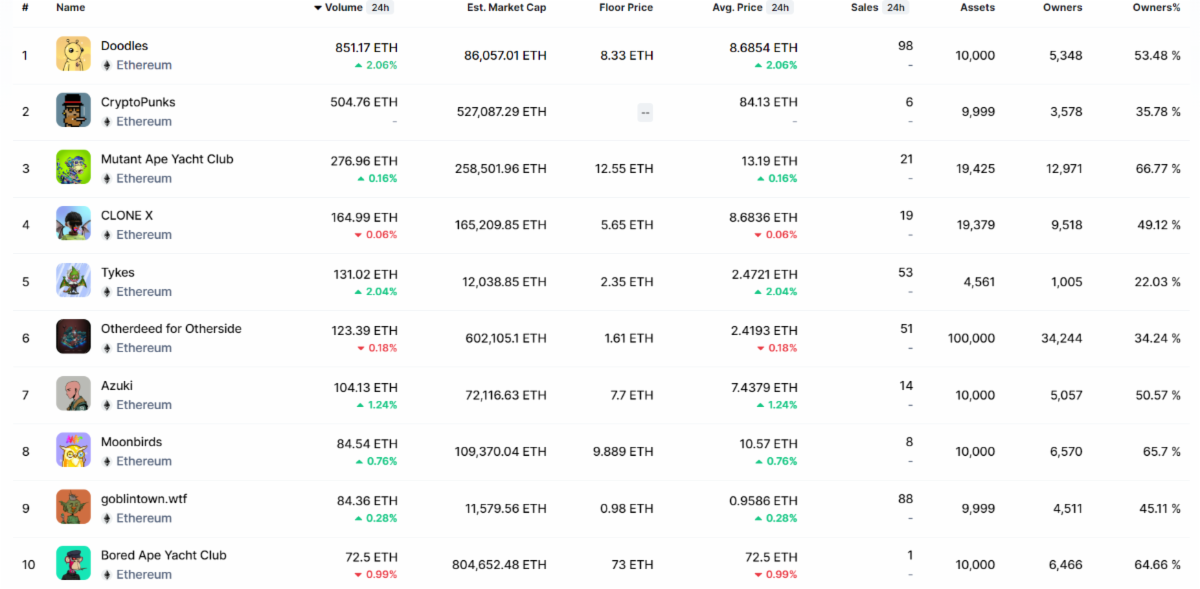

10. Top NFT Collections

Our thesis: NFTs make up a specialty area of crypto. They’re only appropriate if you really love collecting. Even then, they should not compose more than 1% of your portfolio.

Investor takeaway: Doodles, which now has a valuation exceeding $700 million, is this week’s #1 while last week’s top ranker is missing from this edition’s top ten, proving the NFT space remains as speculative as ever. CryptoPunks is at #2, while Bored Ape Yacht Club has experienced a fall from grace to round out this week’s top ten. The token is being outdone by its sibling, as Mutant Ape Yacht Club stands tall as this week’s #3 (four positions higher than where it sat seven days ago).