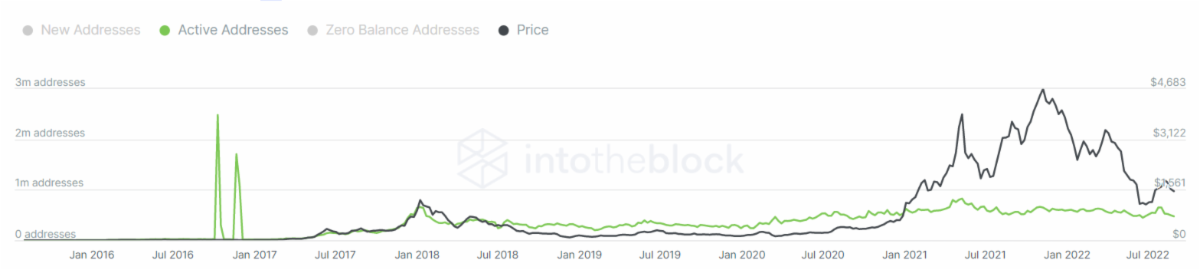

1. Bitcoin Daily Active Addresses

Our thesis: cryptocurrencies are like companies and active addresses are like customers, similar to active users of Facebook or active subscribers of Netflix.

We can measure the price (black line) relative to the active addresses (green line) to see if things are currently underpriced or overpriced.

Investor takeaway: While BTC has incurred a slight jump from its recent decline following Jerome Powell’s speech, the asset is still selling at bargain basement prices (70% less than its November 2021 high).

Our thesis: buying low (now) and selling high (after market recovery) is still the stronger technique for those looking to achieve lasting wealth.

2. Ethereum Daily Active Addresses

Investor takeaway: Ethereum has also seen a slight price uptick (black line), though the number of active addresses for ETH has remained relatively constant over the past few years (green line).

This could change with The Merge, which is scheduled for September 14. Crypto can be an unsteady game, but with so many predicting the expansion of ETH’s price soon, perhaps the number of addresses will receive a boost as well.

3. Top Crypto “Companies” by Total Revenue

Our thesis: Crypto revenue like transaction fees is how a crypto “business” makes money. Smart investors look for the projects generating the most cash.

Investor takeaway: We believe it’s best to purchase and hold shares (or coins) of crypto’s biggest players. The chart above lists the top four revenue-producing projects:

Ethereum (the top blockchain network)

OpenSea (the top NFT marketplace)

Uniswap (the top decentralized exchange)

Binance Smart Chain (the top centralized exchange)

The revenue produced and earned by these four entities solidifies their positions as long-term investments.

4. Top Crypto Companies by Protocol Revenue

Protocol revenue is money paid back to token holders or company treasuries (vs. being paid out to liquidity providers as with Uniswap or NFT holders as with OpenSea). You might roughly think of this like stock dividends.

Investor takeaway: The chart shows few changes from last week, with the top four companies (Ethereum, OpenSea, dYdX, and LooksRare) still holding their positions. However, revenue figures appear to have gone down somewhat, suggesting the bear market remains in effect. At this time, we can only recommend Ethereum and OpenSea as long-term investments, though we’ll continue to monitor upcoming competitors.

5. Total Value Locked

TVL represents how much is held or “locked” in a company’s smart contracts. It is roughly equivalent to the deposits held by a bank and can signal a crypto company’s strength.

Investor takeaway: The top three entities (Curve, MakerDAO, and Lido) have experienced slight dips over the past week. This puts MakerDAO and Lido neck-and-neck for second place … and even then, Curve is only slightly ahead in the #1 spot, so it’s anybody’s game.

As an ETH staking service, Lido could overtake MakerDAO in the coming weeks as we get closer to The Merge.

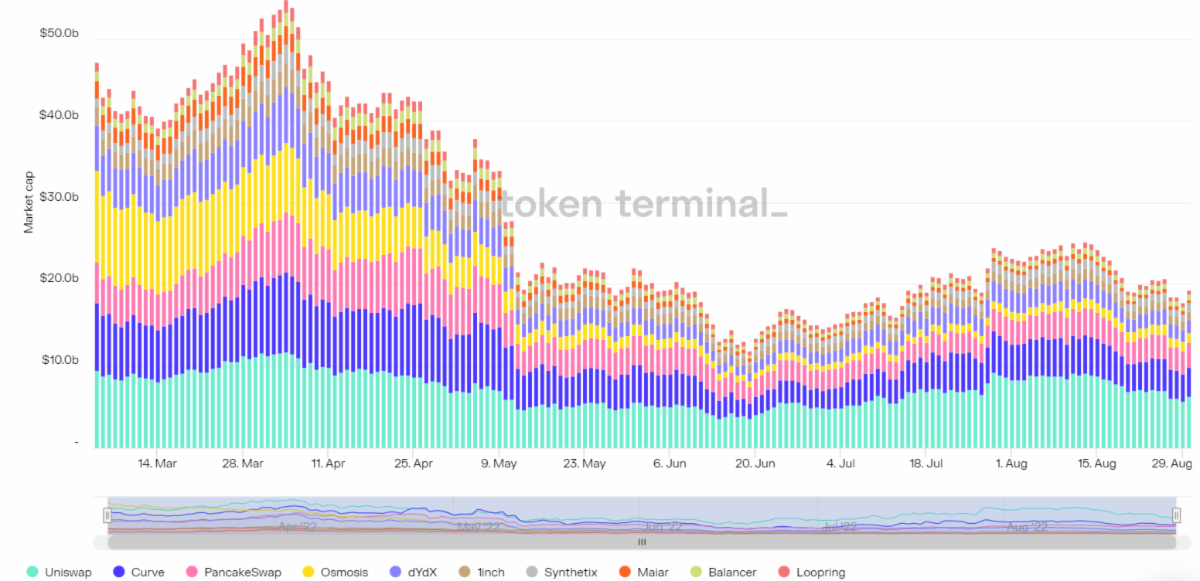

6. Top Crypto Exchanges

Our thesis: Crypto exchanges, both centralized and decentralized, are arguably the most important applications in blockchain. Savvy investors look for which will be the #1 and #2 exchanges over the long term.

Investor takeaway: Uniswap is retaining its #1 spot, though its market cap has dropped about $3 billion in the past six months. Curve, PancakeSwap, and dYdX follow in 2nd, 3rd, and 4th place, respectively, with PancakeSwap having lost the least in terms of market cap.

As we covered in our Top Projects Building on Binance Smart Chain, PancakeSwap has stayed a true winner (and a potential long-term investment) during the current bear market.

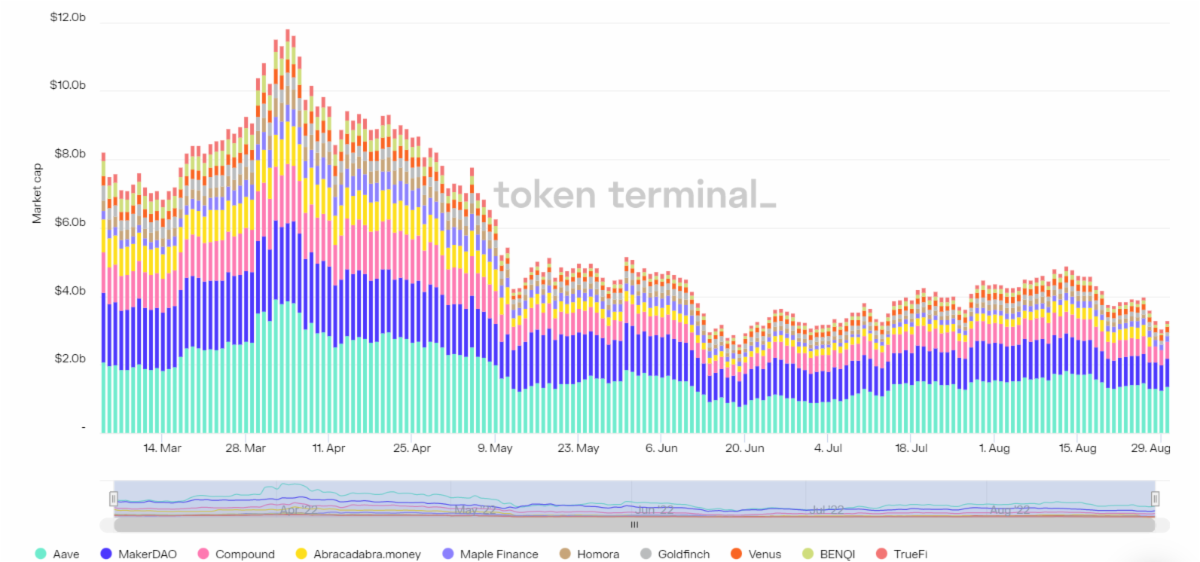

7. Top Lending Protocols

Our thesis: Lending and borrowing is another proven use case of blockchain. Savvy investors look for the companies that will dominate the lending market long term.

Investor takeaway: Aave continues to dominate the lending space, with MakerDAO, Compound, and Maple Finance rounding out the top four.

Aave lending has remained relatively consistent over the past few months, giving credence to the idea that its platform should be taken seriously (at least more so than lending platforms like Celsius).

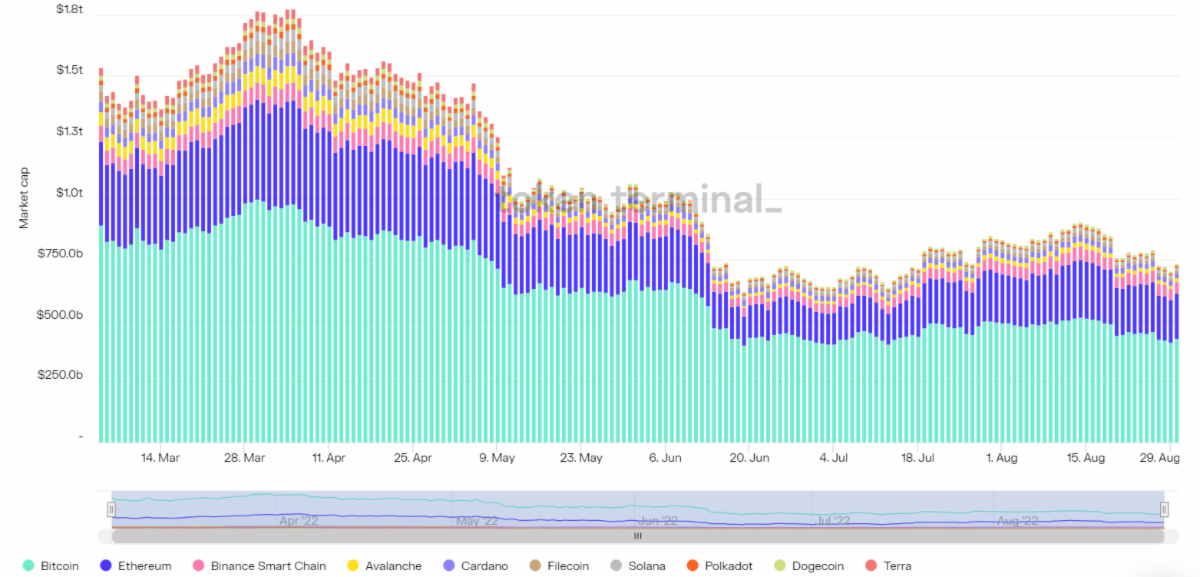

8. Top Layer 1s

Our thesis: Foundational blockchains, also known as L1s, are like the operating systems for Web3. We predict there will be two or three big winners that will go on to dominate the internet of tomorrow.

Investor takeaway: Surprise, surprise. Bitcoin, Ethereum, and Binance Smart Chain are still the top three L1 chains. It’s easy to assume both developers and users will continue to flock to these networks, but the world of blockchain has shown us time and time again that nothing is set in stone.

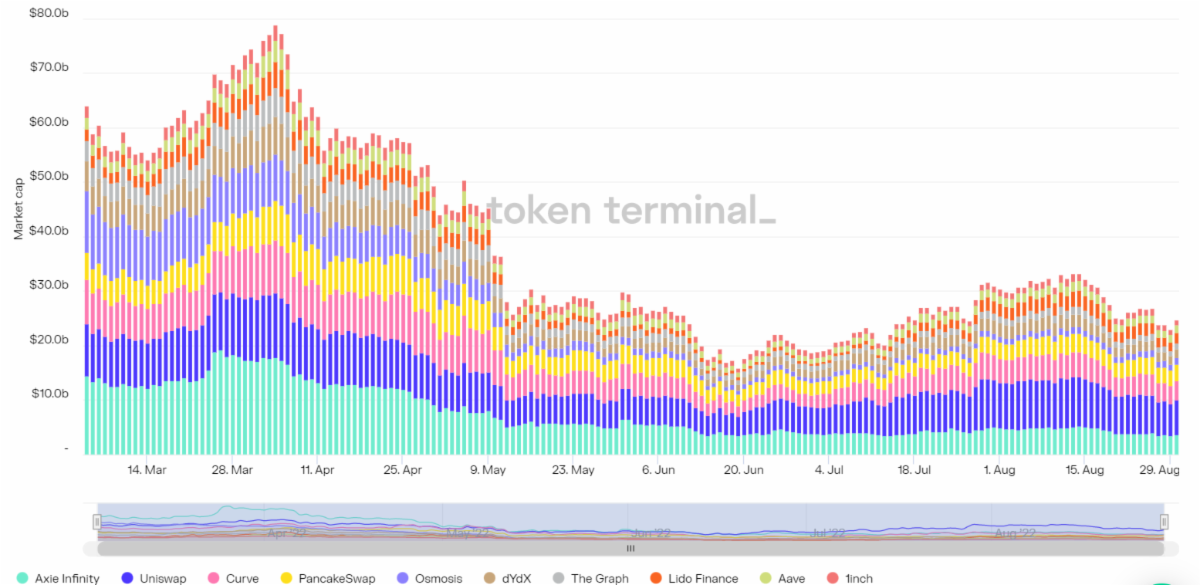

9. Top DeFi Protocols

Our thesis: DeFi companies are the future giants of fintech, disrupting or replacing all the legacy payment and banking systems of today.

Investor takeaway: Uniswap continues to hold the #1 spot. Axie Infinity remains at #2, though no doubt its market cap dips can be attributed to the $600 million Lazarus attack that occurred in March. Curve is hot on its heels in 3rd place, with a market cap of only $2 million separating the two, making it a solid crypto player that long-term holders may want to stay focused on.

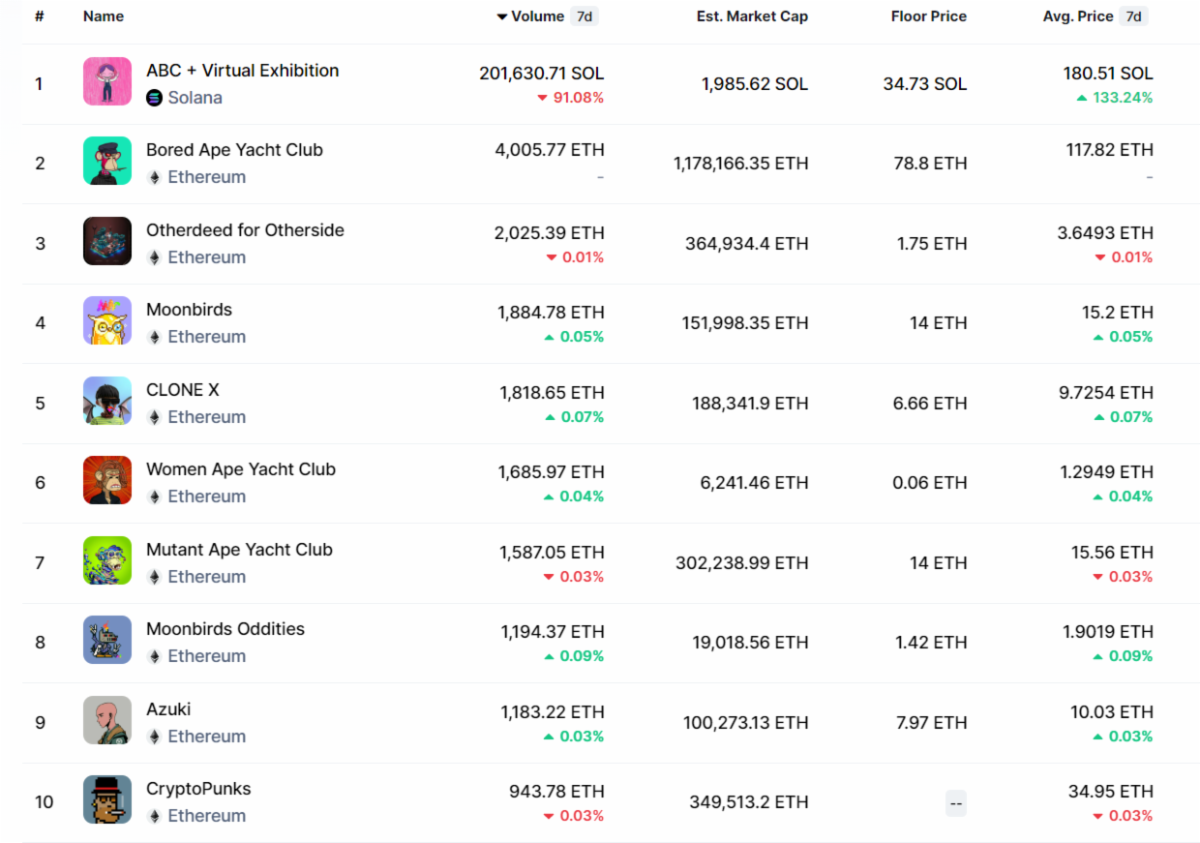

10. Top NFT Collections

Our thesis: NFTs make up a specialty area of crypto. They’re only appropriate if you really love collecting. Even then, they should not compose more than 1% of your portfolio.

Investor takeaway: CryptoPunks experienced a serious fall from grace, from #1 last week to landing at the bottom of the top 10. Despite its lack of affiliation with the official Bored Ape Yacht Club, Women Ape Yacht Club has risen through the ranks and jumped into 6th place, a full two places higher than last week. (Apparently, copyright issues aren’t a concern for those joining the NFT craze.)

In Case You Missed It

Modern Portfolio Theory and the Crypto Portfolio

The Nobel Prize-winning investing strategy, explained.

Premium Members: Bitcoin Backwardation

Our crypto market outlook for 8/30/22.

Top Projects Building on Binance Smart Chain in 2022

Should you invest in BNB? Not before reading this.

Start Here

Begin again… at the beginning.

Unwrapping the New Coinbase Token (Premium Members)

How cbETH works and how to make it work for you.

Share This Meme