1. Bitcoin Daily Active Addresses

Our thesis: Cryptocurrencies are like companies and active addresses are like customers, similar to active users of Facebook or active subscribers of Netflix.

We can measure the price (black line) relative to the active addresses (green line) to see if bitcoin is currently underpriced or overpriced.

Investor takeaway: Active addresses (green line) have fallen to about 971K. This is surprising given the price (black line) has surged another $4K to hit $21,000 this week, though it’s likely traders are taking their time before jumping into “rally mode.”

The explanations behind bitcoin’s sudden rise are varied, a big one being that rate hikes are expected to fall in 2023. Inflation is also cooling off, while several large purchases amongst whales have been documented in recent weeks.

In any case, while a significant spike has occurred, bitcoin is nowhere near its November 2021 all-time high, and opportunities still exist for investors to purchase low-priced BTC.

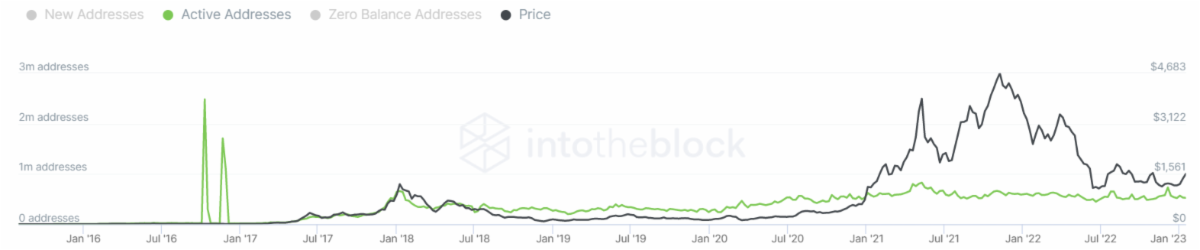

2. Ethereum Daily Active Addresses

Investor takeaway: Like BTC, the Ethereum price (black line) surged and entered the $1,500 range (a $200 jump from last week), while active addresses (green line) fell to about 523K.

Ethereum’s next upgrade (called Shanghai) is set to occur in March, and the community is swiftly gearing up. The ETH network now boasts 500K validators, while popular digital wallet MetaMask (which powers our BMJ reward token) has paved the way for users to stake Ethereum through platforms like Rocket Pool and Lido Finance.

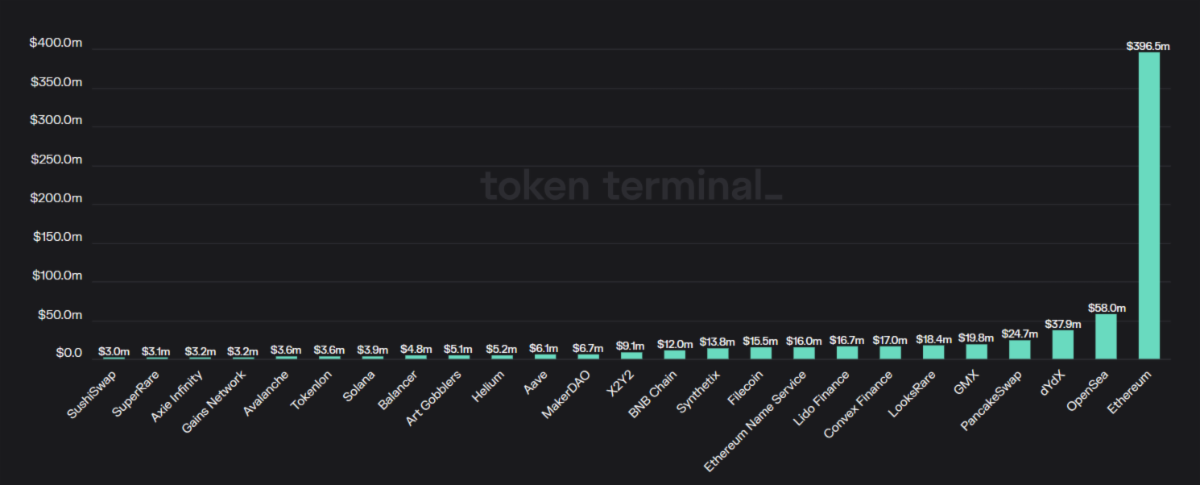

3. Top Crypto “Companies” by Total Revenue

Our thesis: Crypto revenue like transaction fees is how a crypto “business” makes money. Smart investors look for the projects generating the most cash.

Investor takeaway: We suggest buying and holding shares (or tokens) in crypto’s biggest revenue producers. The chart above shows the top money makers as:

- Ethereum (the top blockchain network)

- Uniswap (the top decentralized exchange)

- OpenSea (the top NFT marketplace)

- Lido Finance (the top staking service)

OpenSea has been in a tough spot since losing 2nd place on this list several weeks ago, though it appears to be closing in on this position once again as only $17 million separates it from rival Uniswap.

This could be attributed to the near 40% increase in daily activity it’s experienced over the past month as we mentioned in Tuesday’s Premium newsletter.

4. Top Crypto Companies by Protocol Revenue

Protocol revenue is money paid back to token holders or company treasuries (vs. being paid out to liquidity providers as with Uniswap, or NFT holders as with OpenSea). You might roughly think of this like stock dividends.

Investor takeaway: Our top four are still Ethereum (#1), OpenSea (#2), dYdX (#3), and PancakeSwap (#4). Little change has been recorded over the past seven days, though PancakeSwap is now dangerously close to falling into 5th place as it holds only a $5 million lead over competitor GMX.

While another drop of $1 million has occurred, Ethereum’s position is still considerably higher than the remaining firms, and given all the change that’s set to occur following the Shanghai upgrade, we believe ETH is likely to remain the leader for the foreseeable future.

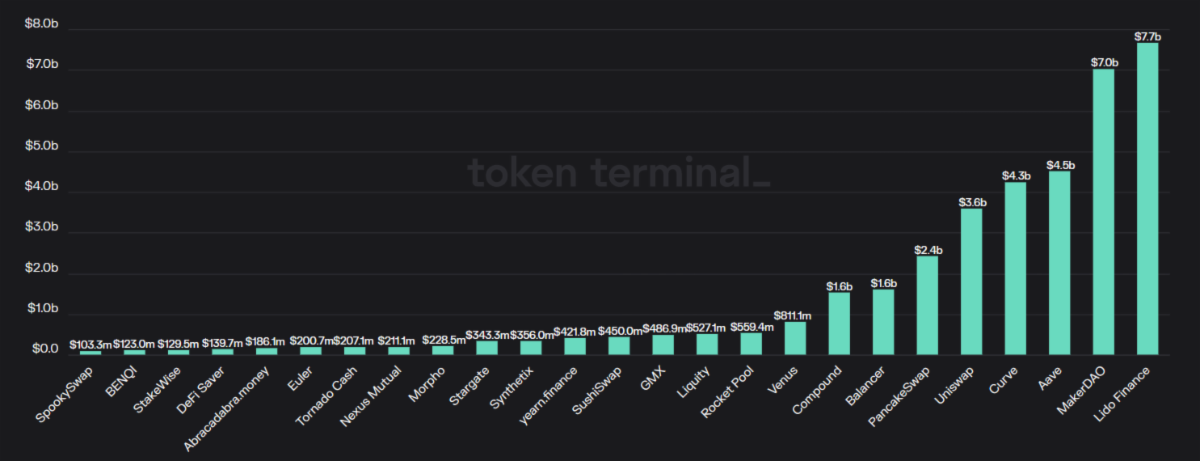

5. Total Value Locked

TVL represents how much is held or “locked” in a company’s smart contracts. It is roughly equivalent to the deposits held by a bank and can signal a crypto company’s strength.

Investor takeaway: Since jumping into 1st place last week, Lido Finance has maintained its #1 position in Total Value Locked and holds a $700 million lead over its nearest competitor MakerDAO. Rounding out the top four are Aave (#3) and Curve (#4).

As mentioned above, new staking opportunities now exist through Lido for MetaMask users. With activity slated to increase further as we near the next ETH upgrade, Lido is likely to hold its newfound spot in this category for some time.

Meanwhile, Curve and Aave remain neck and neck, with only $200 million separating the two. Could these firms switch places in the coming weeks? Stay tuned to find out.

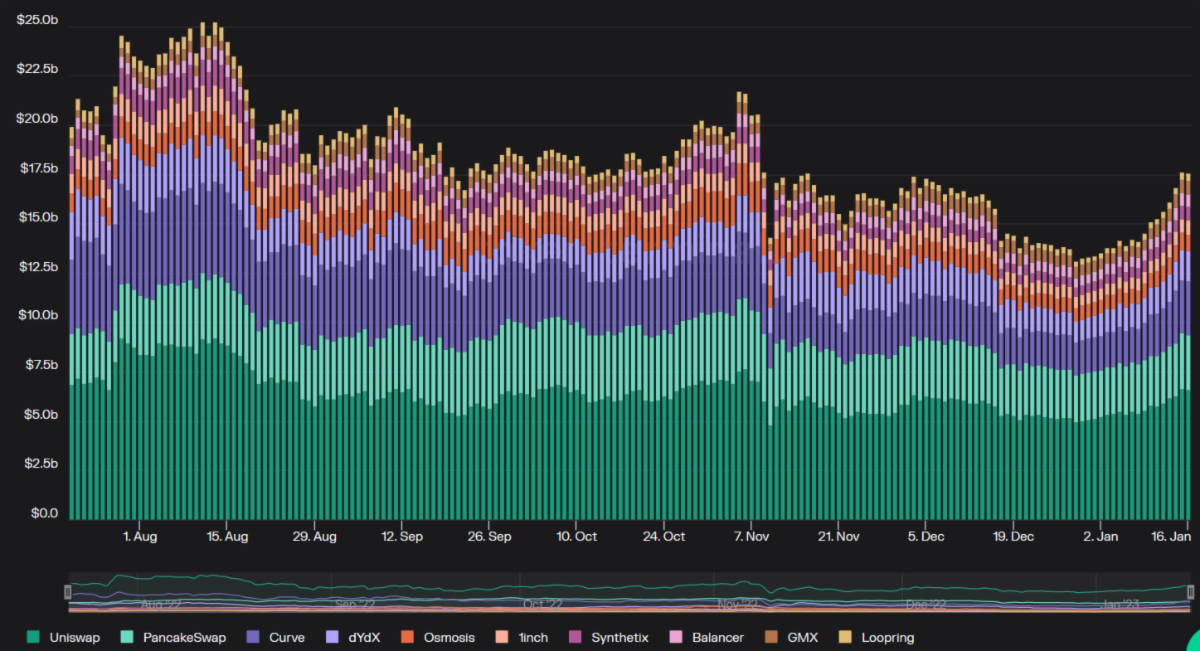

6. Top Crypto Exchanges

Our thesis: Crypto exchanges, both centralized and decentralized, are arguably the most important applications in blockchain. Savvy investors look for which will be the #1 and #2 exchanges over the long term.

Investor takeaway: This week’s top four are still Uniswap, PancakeSwap, Curve, and dYdX, though large gains have been recorded. Uniswap has jumped beyond $6.5 billion, while PancakeSwap — still #2 — could lose its position as it now only holds a $50 million lead over Curve, and things are close enough that they may find themselves switching positions.

As the FTX drama begins to subside, traders are likely preparing to shift from centralized to decentralized exchanges per The Motley Fool. This could explain the sudden gains recorded for Uniswap. While trading platforms seem to be making a comeback, holding at least some of your assets in cold wallets is still recommended.

7. Top Lending Protocols

Our thesis: Lending and borrowing is another proven use case of blockchain. Savvy investors look for the companies that will dominate the lending market long term.

Investor takeaway: This week sees a change to our top four as Abracadabra.money has fallen off the list to be replaced with a platform called Venus. Aave, MakerDAO, and Compound continue to hold their #1, #2, and #3 positions respectively and have experienced strong gains. Aave, for example, recently stepped beyond the $1.2 billion line.

Venus is a decentralized platform that allows users to lend and borrow crypto. The enterprise runs on its own synthetic stablecoin called VAI, though customers are not limited to this asset and can lend and borrow multiple currencies supported by the firm. To learn more, click here.

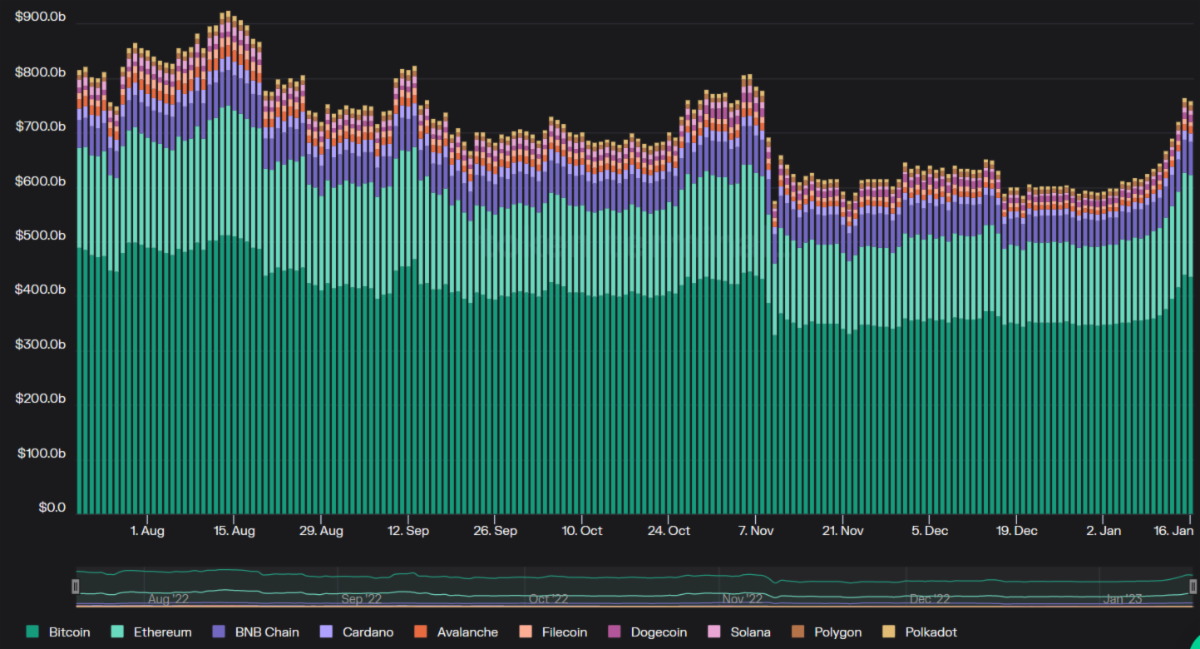

8. Top Layer 1s

Our thesis: Foundational blockchains, also known as L1s, are like the operating systems for Web3. We predict there will be two or three big winners that will go on to dominate the internet of tomorrow.

Investor takeaway: Bitcoin is #1 and Ethereum is #2. BNB Chain, which is still at #3, has increased its cap to $60 billion. This could be attributed to a recent token burn of more than $550 million in BNB units, thus causing remaining tokens to solidify their value further.

In any case, BNB is now considerably stronger than its competition, and these three networks are likely to remain unchallenged for some time.

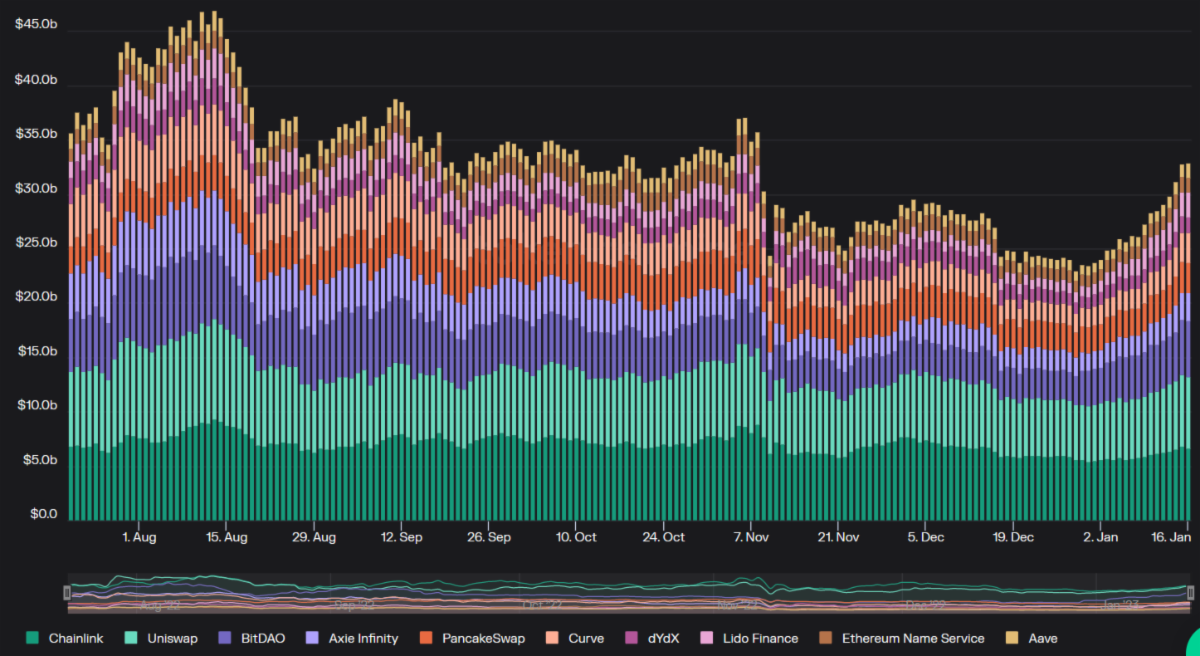

9. Top DeFi Protocols

Our thesis: DeFi companies are the future giants of fintech, disrupting or replacing all the legacy payment and banking systems of today.

Investor takeaway: The top three are still Chainlink, Uniswap, and BitDAO. As in our previous categories, these entities have recorded solid gains for the week, with Chainlink just shy of $7 billion. Uniswap has edged beyond $6.6 billion, while BitDAO is just under $5 billion.

Once the #1 contender in this section, BitDAO could see itself rise through the ranks again given the recent praise it received from The Motley Fool. The publication cites its “unique blockchain” structure and “long-term growth prospects” as gamechangers for the industry. We’ll keep an eye on BitDAO to see if it indeed becomes a force to be reckoned with.

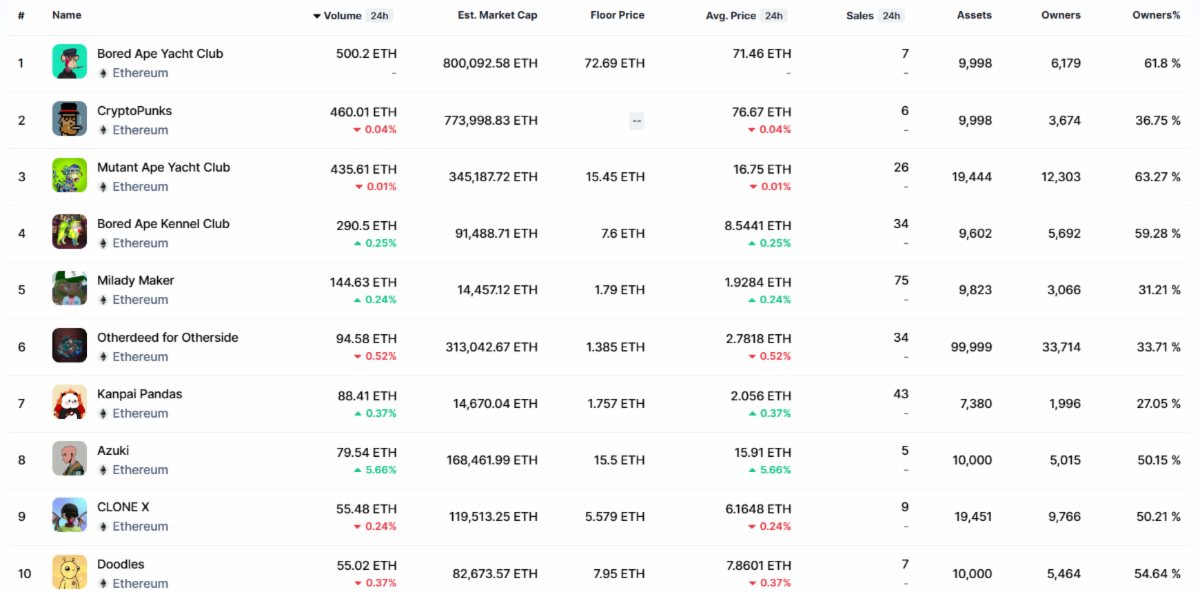

10. Top NFT Collections

Our thesis: NFTs are a specialized niche of crypto. They’re only appropriate if you really love collecting. Even then, they should not compose more than 1% of your portfolio.

Investor takeaway: BAYC remains in the #1 position, and while CryptoPunks has maintained its #2 spot, BAYC’s cousins are dominating this edition’s top ten. MAYC is up a rung from last week, having moved to #3, while Bored Ape Kennel Club (BAKC) is #4.

If you still think art tokens are worth mulling over, check out our NFT guide and list of Top NFT Projects for 2023 to see which ones bear significance.