This week we launched our new Bitcoin Market Journal Reward Token, kickstarting the next wave of growth for the crypto industry.

Here’s how it works: our Premium members now get 10 BMJ tokens deposited to their crypto wallets each month, which they can redeem for real-world rewards you can’t get anywhere else. (Check out the rewards here.)

On Monday I explained our mission at BMJ: to onboard the next 100 million crypto investors. The BMJ Reward Token is not an investment — it’s a loyalty program — but it does get people introduced to crypto in the easiest possible way, and encourages long-term loyalty.

On Tuesday I explained how BMJ is different from other tokens: it’s only minted when real revenue is earned from our Premium membership. We’ve developed a new metric – Real Revenue Earned (RRE) – which gives the crypto industry a new level of transparency and trust.

On Wednesday I explained the journey to launch the BMJ token, including why we chose to build directly on Ethereum – not another blockchain or L2 solution – even paying the gas fees for members, so you can have the joy of discovering new tokens in your wallet each month.

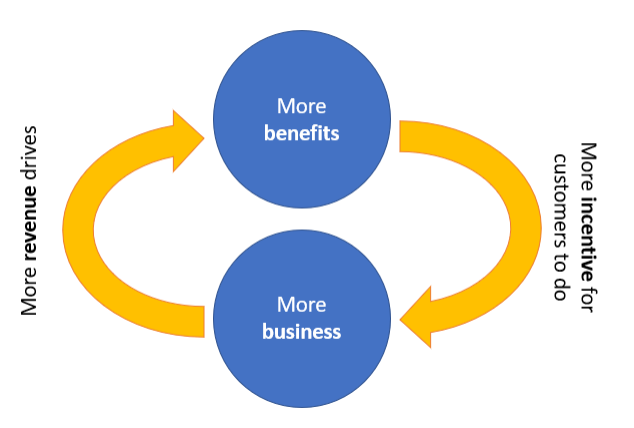

On Thursday I talked about the qualities of good loyalty programs, and how we can adapt these to the crypto industry. We talked about the “Loyalty Flywheel,” and how re-investing in more benefits leads to more business — building a crypto community along the way.

Today I’ll talk about why this is the start of the next great crypto cycle, and why the BMJ Reward Token is uniquely positioned to lead the way. If you’re a Premium subscriber, hold on: you’re part of something really good.

The Collapse of Trust and the Rise of Loyalty

It’s no secret that many view the crypto industry with suspicion.

2022 didn’t help. Meltdowns. Implosions. Bankruptcies. And the ongoing trial of Sam Bankman-Fried, which will consume the news media for 2023 and beyond. (Prediction: there will be a Netflix documentary.)

How do we, as an industry, regain trust?

The first way is to tie tokens to real value. Apart from stablecoins, most tokens are backed by nothing but people’s belief. During market panics, we’ve seen that belief is the first thing to go, soon followed by token price.

Stablecoins were a real innovation, because they’re backed by real dollars — at least, the good ones. Stablecoins have flourished as a result, and will likely be the first crypto asset to be regulated and properly integrated into the traditional financial system. (Another prediction.)

The BMJ token (and, we hope, other crypto loyalty programs to follow) are only minted when real revenue is received. This is different from stablecoins — we’re not holding the money in reserve — but it mirrors loyalty programs today, like frequent flyer programs or Starbucks Rewards.

The second way to regain trust is to give tokens real utility. Make them do something. Investors are fixated on tokens that just sit in a wallet, hoping that “price go up.” The BMJ Reward Token is something different: you can redeem it for real-world rewards.

This gives reward tokens an enormous advantage over other crypto tokens. If designed correctly, you don’t live under a black cloud of fear that they may be an “unregistered security.” Loyalty tokens are digital loyalty points, period. Just like Delta SkyMiles. Just like Starbucks Rewards.

The difference is utility: they’re not just tokens that you buy, hoping that the price will increase, based on the efforts of others. They’re tokens you are awarded as a paying customer, which you can collect and redeem for valuable real-world rewards.

Peace out, Howey.

Real Rewards Cost Money

Let’s take a typical credit card reward program: you earn one reward point for every dollar spent. Then you can redeem these reward points for free flights, hotel stays, or even — gasp! — cash back.

These rewards, of course, cost real money.

Again, with crypto loyalty programs, we’re building real businesses that take in real revenue to make real products and services. This means all the beautiful, high-quality merch on our rewards page costs real money … just like credit card rewards for the credit card company.

So where does this money come from?

For credit card companies, it’s hidden in the interest and fees. The foolish consumers who don’t pay off their credit card bills in full each month pay interest, and their interest pays for your credit card rewards.

For your local coffee shop, they have enough profit margin built in that they can afford to give you a free coffee after you’ve bought ten (you probably bought ten pastries or muffins, too).

For those who are building their own crypto reward programs, you can solve the “real rewards cost real money” problem in a few ways:

- You can mark up the initial product, or (more likely) the reward product, so you still make a profit;

- You can offer digital downloads, which are essentially free to fulfill;

- You can allocate some of the cost as a marketing expense (good loyalty programs will reduce customer churn and increase customer stickiness);

- You can figure out what percentage of reward tokens will go unredeemed, and price accordingly.

On the topic of unredeemed tokens, here’s a valuable data point. When we did our initial token mint for the BMJ token, we found there were a number of users who never hooked up their MetaMask wallets. They paid real money for a Premium membership (RRE), but never claimed the tokens.

We’ve minted these tokens — some 17,680 — back into the master wallet, which we’re calling “BMJ Reserves.” The idea is that these can potentially be awarded to Premium members in the future. It’s a war chest that lets us invest back into the program, to make the loyalty flywheel go even faster.

Remember: the point of reward programs is to increase customer loyalty. Companies must view them like marketing or community-building efforts: the long-term benefits are increased customer happiness, decreased churn, and more sales. (More benefits = more business.)

The Great Crypto Cycles

When you’ve been in this industry a while, you see that it goes through cycles.

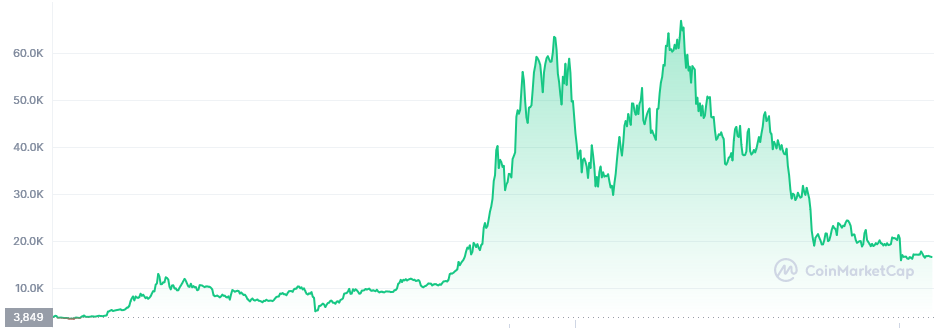

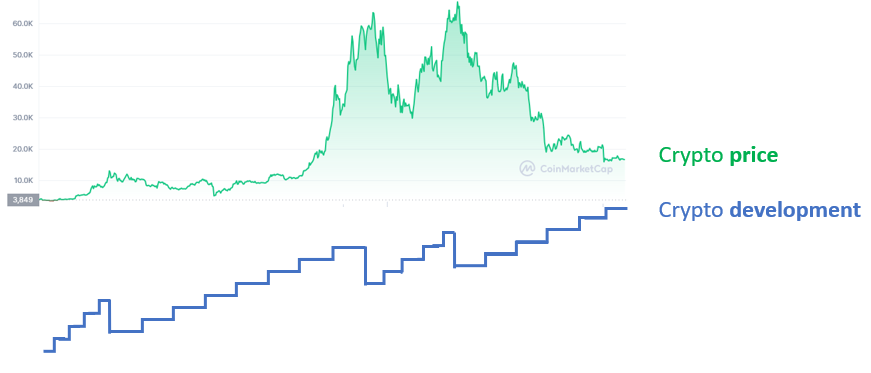

The easiest way to see these cycles is to look at the price of bitcoin:

But what’s happening behind the scenes looks something more like this:

That’s because each downturn in the cycle washes out the weakness. It gets rid of the gamblers and the degens, and it opens the doors for fresh building.

The downturns are not fun, but they’re valuable because they force us to pay attention to what really matters. To innovate. To hustle. To find new solutions.

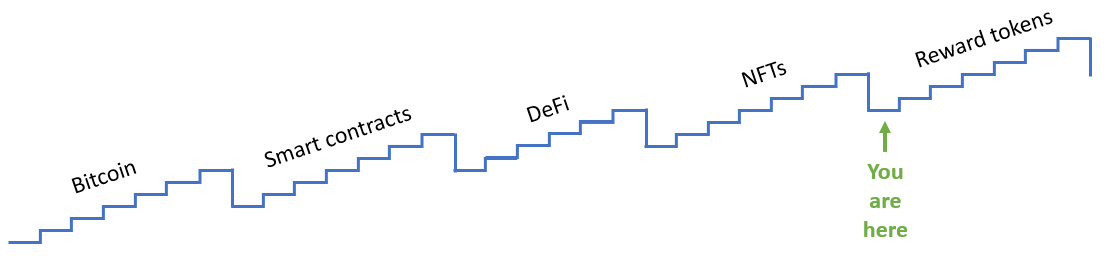

Up markets are for speculators, but down markets are for builders. To simplify the crypto market cycles, it would look something like this:

Every down market in crypto gave birth to some new innovation that fueled the next up market, whether that was smart contract platforms, DeFi, or NFTs. The next wave of growth, we believe, will be fueled by reward tokens.

I’ve laid down the principles we’ve used to create our BMJ Reward Token, with the hope it will provide a model for future projects to follow. Principles like transparency and trust. Real revenue earned. Real-world rewards. And above all, thinking of blockchains like businesses.

Thanks to all our Premium subscribers, especially those who have been with us since Day 1. The future is going to be more rewarding than any of us can imagine.